US stock markets got some support near the end of the past week, with the US employment report for June easing market expectations for a hawkish Fed, given the drop of the NFP figure. Yet a more holistic view of the report would also identify that the unemployment rate dropped implying that the US employment market remained rather tight, while the earnings growth rate accelerated, implying that the US employment market may continue feeding inflationary pressures in the US economy. On the other hand last Monday, we had a number of Fed policymakers that tended to ease market expectations for a hawkish Fed further as their statements were interpreted as a signal that the end of the hiking cycle may not be here yet, possibly another two rate hikes in the pipeline, yet is nearing. For the record, as these lines are written as the US CPI rates for June are still to be released and could alter the direction of US stockmarkets. Furthermore, we expect wider volatility to hit US stock markets as the earnings season is beginning and on Friday we note the release of the earnings reports of JP Morgan, Wells Fargo and City, three major banks, that may shape the market’s perception for the health of the US banking sector. In this report, we aim to present news that we singled out and could affect various shares as well as have a small comment about fundamentals surrounding the course of US stock markets and for a more rounded view we are to close with a technical analysis of a US stock market index.

Apple launches WeChat store

Media headlines highlighted in the past few days that Apple launched on Tuesday an online store in the Chinese WeChat messaging app. Given the wide use of the platform in China and the size of the Chinese population, we highlight the opening of another retail channel of Apple in the land of the Red Dragon, which in turn may help boosting Apple’s retail sales. Please note WeChat is also categorized as a super app as it has various functions incorporated in one application, from social media and messaging to stores and paying various bills. The users are considered to be over 1.2 billion providing additional access to Apple and could lift its share price.

Bank of America’s deception?

Bank of America is reported to have been fined $150 million by the US Consumer Financial Protection Bureau and also has to pay $80.4 million to customers which have been unfairly charged inappropriate fees. The bank has been charged to engage in deceptive practices which hurt hundreds of thousands of its customers. The issue gains on importance as the bank is to release its earnings report next Tuesday, a bit later than the banks prementioned on Friday. Not only the financial damage from the fine but also the practice as such could cause a reputational issue for the bank and may weigh on its share price.

Microsoft gains ruling

Reports surfaced that a US federal judge ruled in favor of Microsoft’s $69 billion takeover of Activision Blizzard Inc. It should be noted that the takeover may allow Microsoft to enjoy substantial market power in the gaming industry as it gets control of the well-known and profitable Call of Duty franchise. The issue was tantalising for competitor Sony which includes the game on its PlayStation platform, yet for the time being Microsoft stated that it will keep the game there. We note that the US Federal Trade Commission is planning to appeal the case, it seems that Microsoft gets a competitive advantage in the sector which may provide some support for its share price.

Threads takes off

Last but not least we would like to make a small comment on Threads the microblogging app, launched by Meta, an issue that we discussed in our last report. Headlines highlight that the application has hit a 100 million users in a matter of five days and is considered currently as the fastest growing consumer app currently. We repeat that the synergies that could be developed by threads with Instagram, could provide additional support for the new application. Should the good news continue to reel in, we may see Meta’s share price getting additional support in the coming days.

テクニカル分析

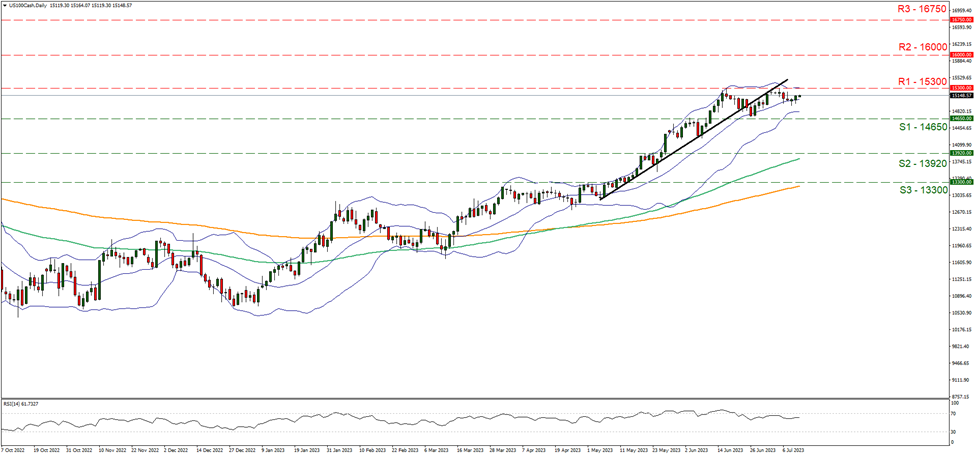

US100 (Nasdaq) Daily Chart

Support: 14650 (S1), 13920 (S2), 13300 (S3)

Resistance: 15300 (R1), 16000 (R2), 16750 (R3)

Nasdaq maintained its sideways motion just below the 15300 (R1) resistance line in the past few days. We tend to maintain our bias for the sideways motion to continue, and the narrowing of the Bollinger bands highlights the lower volatility for the index that may allow the sideways motion to continue. Yet we also note that the RSI indicator seems to remain below yet near the reading of 70, implying a residue of a bullish sentiment in the market which should not be underestimated. Should the bulls take control over the index, we may see Nasdaq breaking the 15300 (R1) resistance line clearly and aim for the 16000 (R2) resistance base. Should the bears take over, we may see the index, dropping, breaking the 14650 (S1) support line and aim for the 13920 (S2) support level.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。