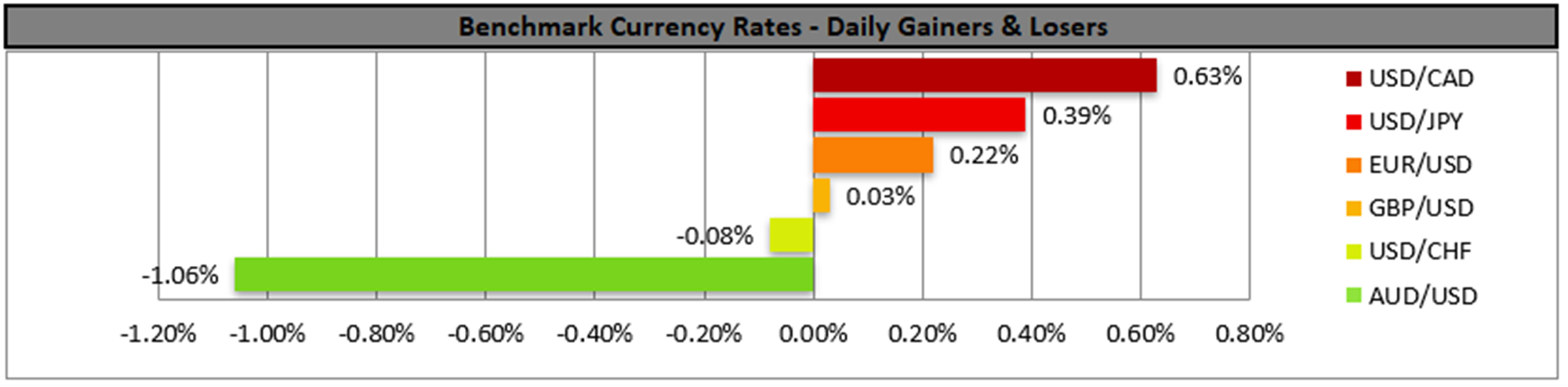

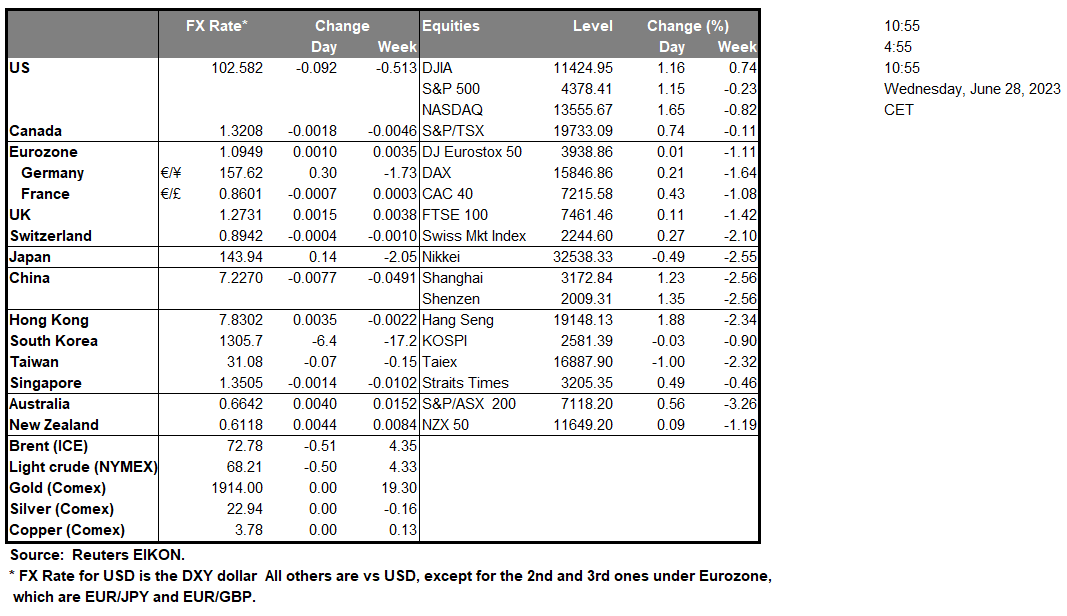

The USD edged a bit lower against its counterparts yesterday yet overall, the picture of a sideways movement seems to remain for now, as market sentiment seemed to be rather mixed yesterday. Better than expected data from the US showed that consumer sentiment for June is more optimistic than expected, while at the same time, the number of new home sales for May was higher than expected, both pointing towards a more robust US economy and an appetite for more spending. On the other hand these readings, among others, may also imply that consumption could continue to feed inflationary pressures in the US economy, prompting the Fed to continue with its monetary policy tightening.

North of the US border the slowdown of Canada’s May CPI rates weighed on the Loonie. At the same time we note that the drop of oil prices yesterday may have been another factor weighing on the CAD given that Canada is a major oil-producing economy. Across the world, we note that inflationary pressures in Australia eased for the month of May as the headline CPI rate slowed down to 5.8% yoy and thus may also ease RBA’s hawkishness, an assumption that tended to weaken the Aussie during today’s Asian session.

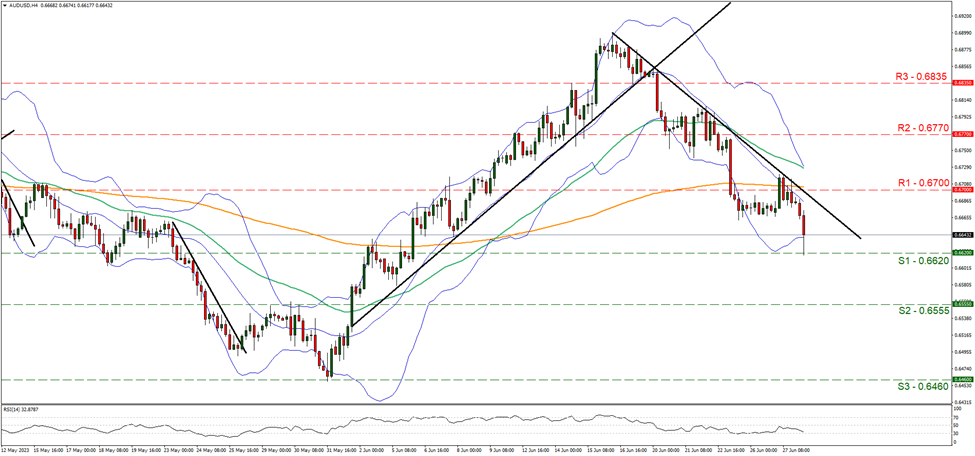

AUD/USD continued to drop yesterday and during today’s Asian session tested the 0.6620 (S1) support line. We tend to maintain a bearish outlook for the pair as long as the downward trendline guiding it remains intact and given that the RSI indicator is nearing the reading of 30 implying a more bearish sentiment on behalf of the market for the pair. Should the bears maintain control over AUD/USD we may see the pair breaking the 0.6620 (S1) support line and aim for the 0.6555 (S2) support level. Should the bulls take over, we may see the pair reversing course breaking the prementioned downward trendline, in a first signal that the downward movement has been interrupted, break the 0.6700 (R1) resistance line and aim for the 0.6770 (R2) resistance level.

In the European monetary policy theatre, we highlight ECB President Lagarde’s statement yesterday, where she stated that inflation is still too high in the Eurozone and that foreshadowed more monetary policy tightening to come from the ECB. We highlight ECB’s annual forum at Sintra, Portugal, and statements from heads of central banks are expected to be hawkish, maybe with the exception of BoJ Governor Ueda. Should that be the case we may see market worries for a possible economic slowdown on a global level intensifying.

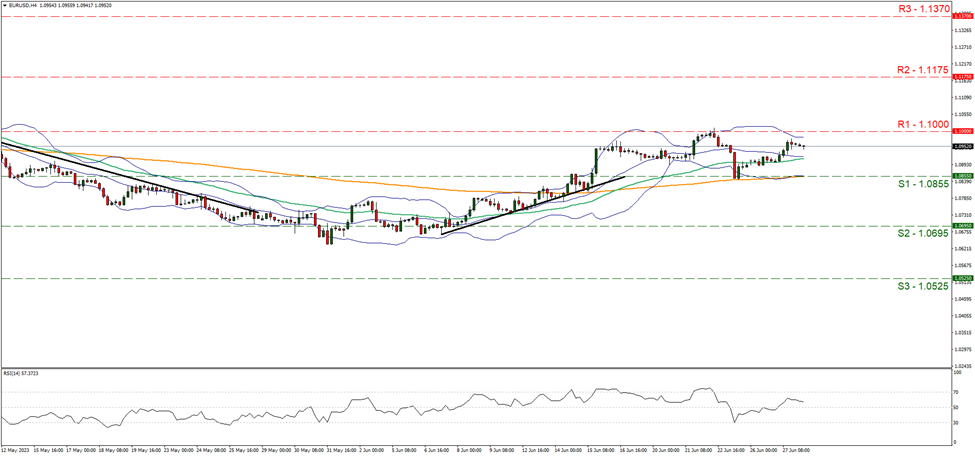

EUR/USD edged a bit higher yesterday yet the overall sideways motion between the 1.1000 (R1) resistance line and the 1.0855 (S1) support line. We tend to maintain our bias for the sideways motion to continue given also that the RSI indicator is dropping, nearing the reading of 50. Should the bulls take over, we may see EUR/USD breaking the 1.1000 (R1) resistance line and aiming for the 1.1175 (R2) resistance level. Should the bears take over we may see the pair’s price action breaking the 1.0855 (S1) support line and aiming if not breaching the 1.0695 (S2) support base.

On a more exotic note the Turkish Lira seems to have halted its drop against the USD at least for now, at around 26 TRY per USD, as the market ponders what the next move of the Turkish Government will be, yet the bearish sentiment seems to be still present for the Lira.

その他の注目材料

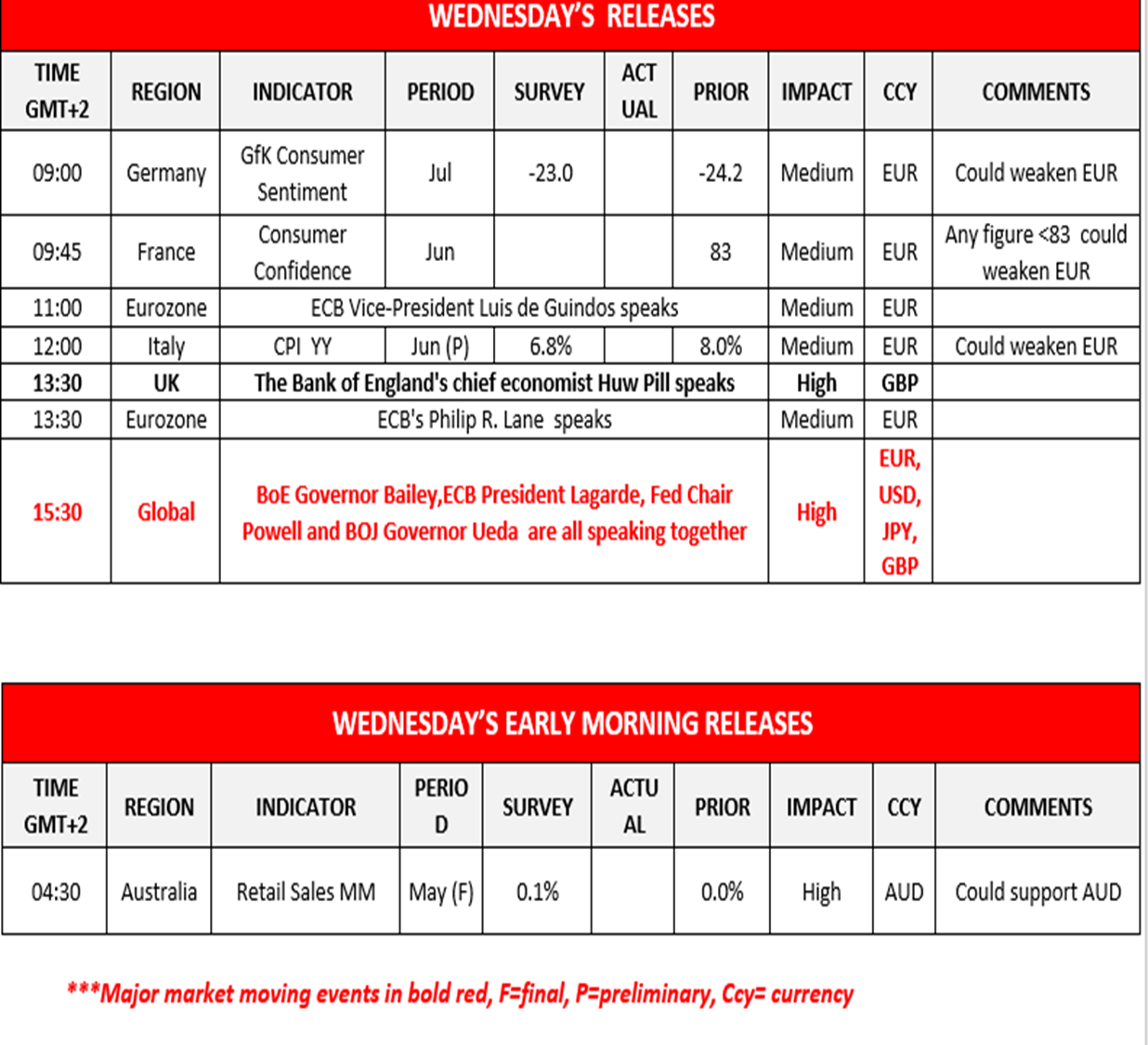

Today in the European session, we get Germany’s GfK consumer sentiment figure for July, France’s Consumer confidence figure for June and Italy’s Preliminary CPI rates for June. During tomorrow’s Asian session, we note Australia’s final retail sales rate for May. On a monetary level, we note ECB’s De Guindos, BoE’s Pill and ECB’s Lane are all due to speak during today’s European session. However, we place a heavy emphasis on BoE‘s Governor Bailey, ECB’s President Lagarde, Fed Chair Powell and BoJ Governor Ueda who are all speaking together.

AUD/USD 4時間チャート

Support: 0.6620 (S1), 0.6555 (S2), 0.6460 (S3)

Resistance: 0.6700 (R1), 0.6770 (R2), 0.6835 (R3)

EUR/USD 4時間チャート

Support: 1.0855 (S1), 1.0695 (S2), 1.0525 (S3)

Resistance: 1.1000 (R1), 1.1175 (R2), 1.1370 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。