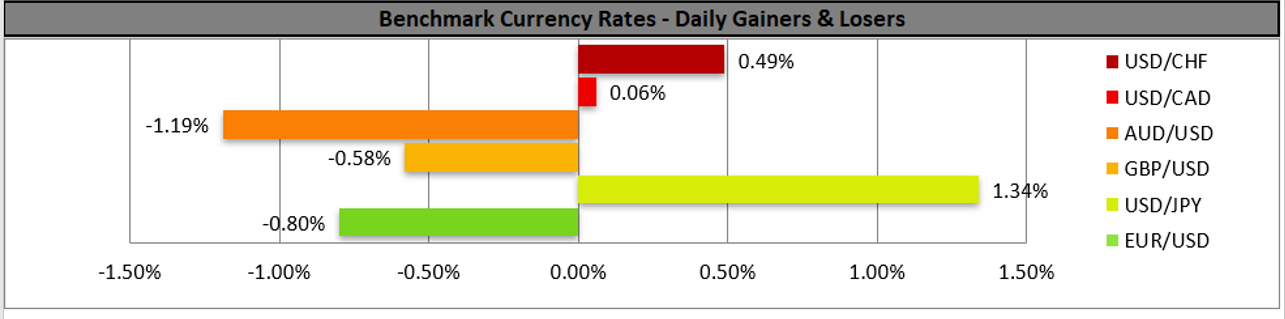

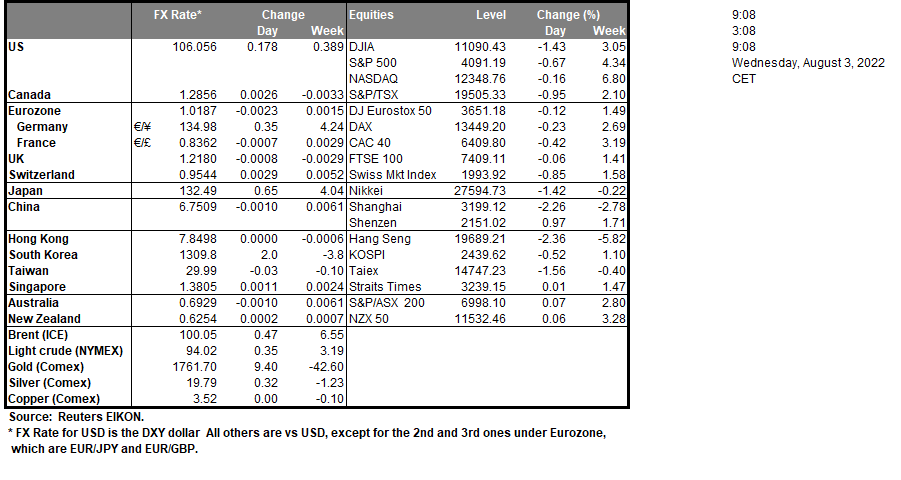

Yesterday, the US dollar rose against its counterparts, rebounding from a four-day losing stream following the Federal Reserve’s rate hike decision during last week. The rebound of the greenback was aided by the Chicago Fed President Evans and San Francisco Fed President Daly where they signalled that they and their colleagues remain resolute and united in regard to raising rates to a level where inflationary pressures will be curbed, yet that could also slow down, if not contract economic activity. Also the greenback’s rise yesterday was favoured by the US treasury yields, which were rebounding after the announcement of Pelosi’s arrival in Taiwan. US House of Representatives Speaker Pelosi landed in Taiwan yesterday, to meet with the country’s president, defying Chinese warnings for retaliatory actions and as a consequence escalated the US-China tensions. This visit marks the first time a high-ranking US official visited the island in the past 25 years and market participants brace themselves for turmoil. Should tensions in the US-Sino relationships intensify we may see the USD enjoying some safe haven inflows. In regards to US stock markets, we note the mixed signals sent and highlight today’s and would like to highlight the release of the earnings reports for EBAY, Booking and Moderna among others. Oil closed the day flat yesterday, as oil traders wait in anticipation for the upcoming OPEC meeting, scheduled later today. Even though major exporters such as Saudi Arabia reported capacity constraints last month its it worthwhile keeping an eye on the remarks made by the oil cartel. Also of interest to oil traders is the US EIA Weekly Crude oil inventories figure released later today, which will shed light on the demand side of WTI. Gold finished in the reds yesterday as the US dollar recovered, yet the precious metal seems to be regaining the lost ground in today’s Asian’s session and we consider the next big test for gold to be the release of the US employment report for July on Friday.

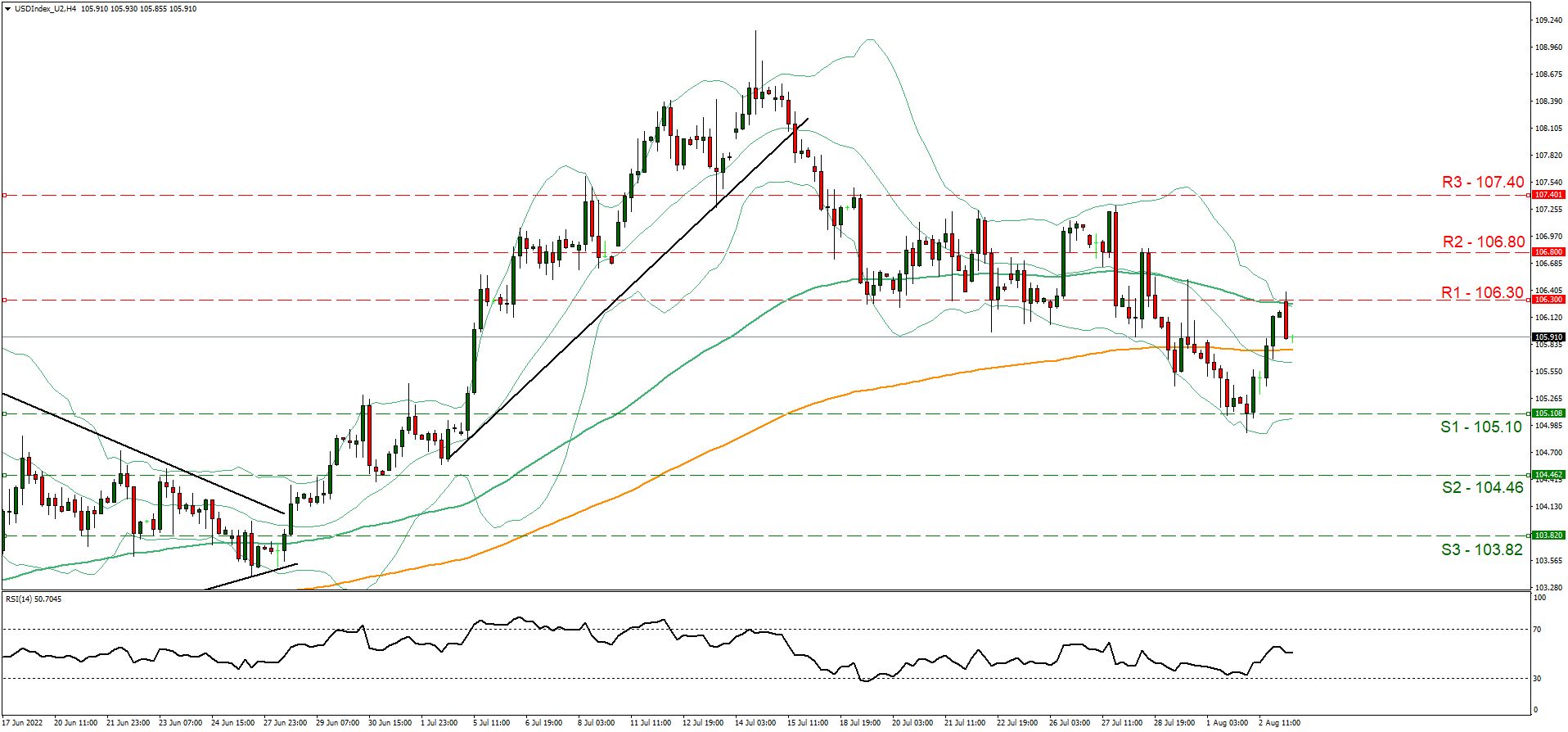

USDIndex rebounded during yesterday’s session and challenged the 106.30 (R1) resistance line. We hold a bullish outlook bias for the pair as the RSI indicator rests in above the 50 level and points to the upside. Should the bulls reign over, we may see the break of the 106.30 (S1) and move towards the 106.80 (R2) level. Should the bears take over, and for us to change our view, we might need see the break below the 105.10 (S1) support level, heading definitively towards the 104.46 (S2) barrier.

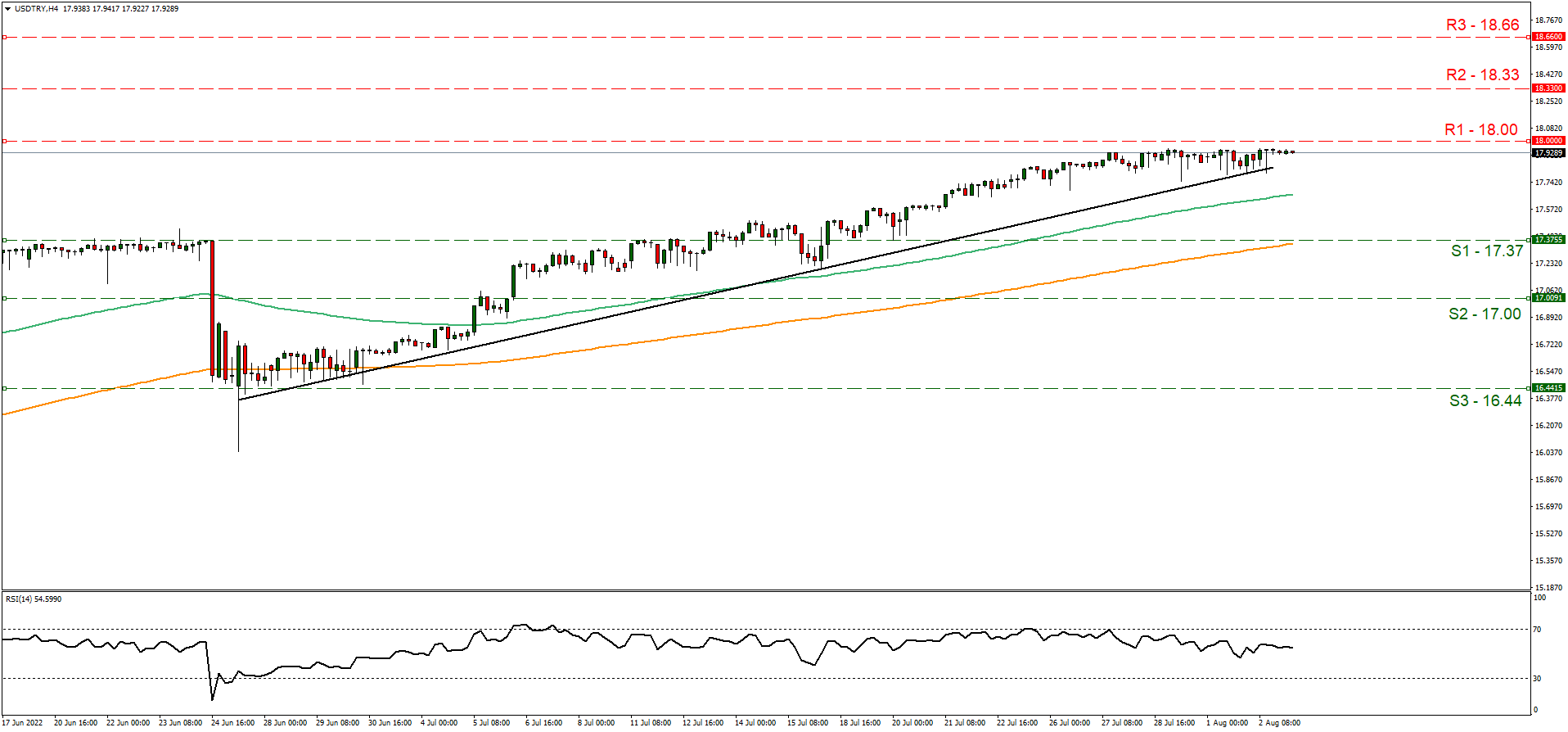

USD/TRY extends its uptrend, closing in the 18.00 (R1) resistance level. We hold a bullish outlook bias for the continuation of its uptrend as long as the price action remains above the ascending trendline incepted since the 24 of June. Should the pair maintain its extend buying orders along its path, we may see the break above the 18.00 (R1) and then the 18.33 (R2) resistance lines. Should the bears take over and for us to alter our assessment, we would require seeing the clear break below the ascending trendline and the subsequent break of the 17.37 (S1) support level, with the pair moving closer to the 17.00 (S2) hurdle.

その他の注目材料

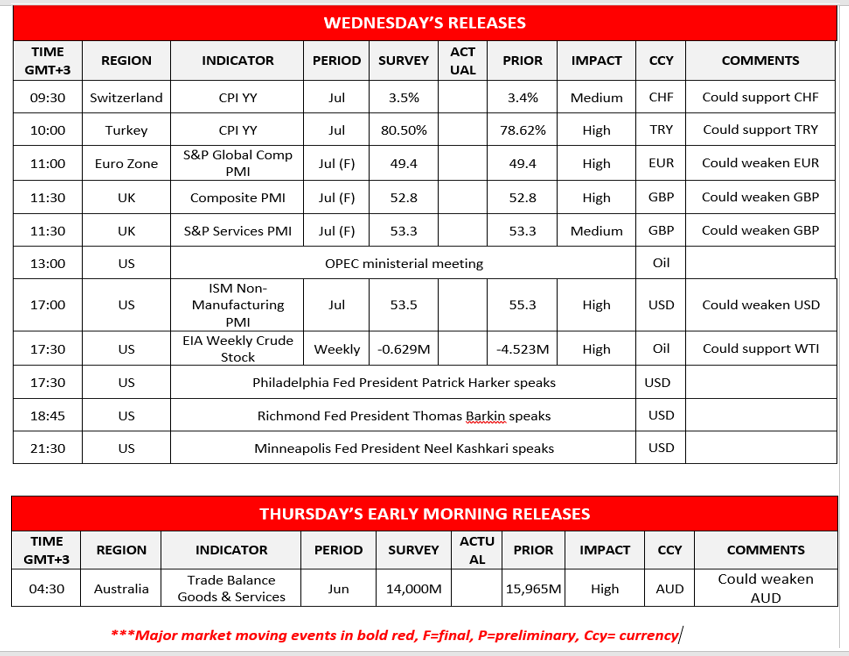

Today, we also highlight the release of Switzerland’s and Turkey’s CPI YoY figure, from Eurozone the final S&P Global Composite PMI and for the UK we await for the final Composite PMI as well as the final S&P Services PMI figures, all releases being for July. The main event for the day during the American session is expected to be the release of the US’s ISM Non-Manufacturing PMI figure, which is expected to drop and if actually so could weaken the US dollar. We would also like to note the scheduled press releases by Fed’s presidents of Philadelphia Patrick Harker, Richmond’s Thomas Barking and Minneapolis Neel Kashkari.

USDIndex 4時間チャート

Support: 105.10 (S1), 104.48 (S2), 103.82 (S3)

Resistance: 106.30 (R1), 106.80 (R2), 107.40 (R3)

USD/TRY 4時間チャート

Support: 17.37 (S1), 17.00 (S2), 16.44 (S3)

Resistance: 18.00 (R1), 18.33 (R2), 18.66 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。