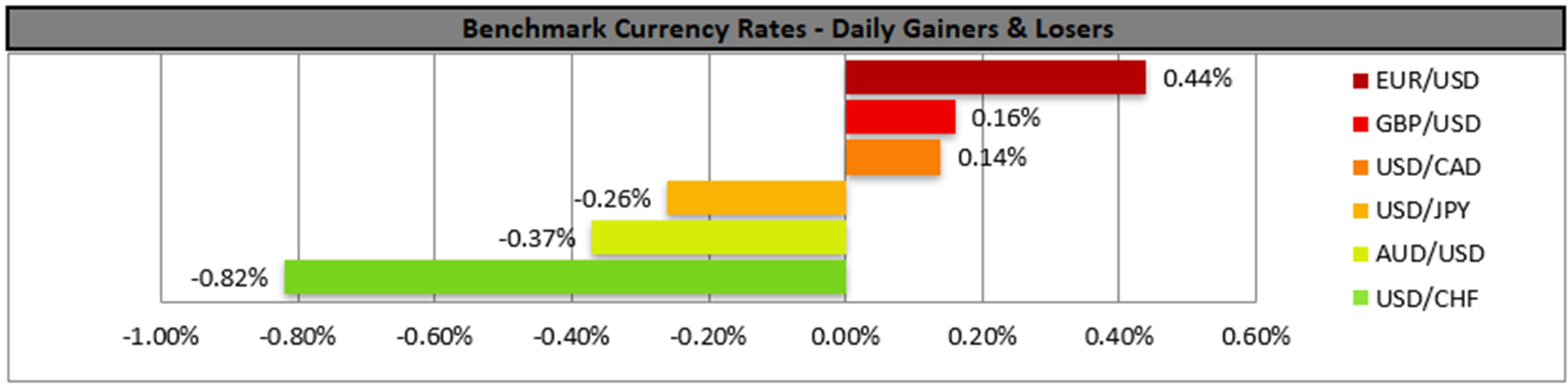

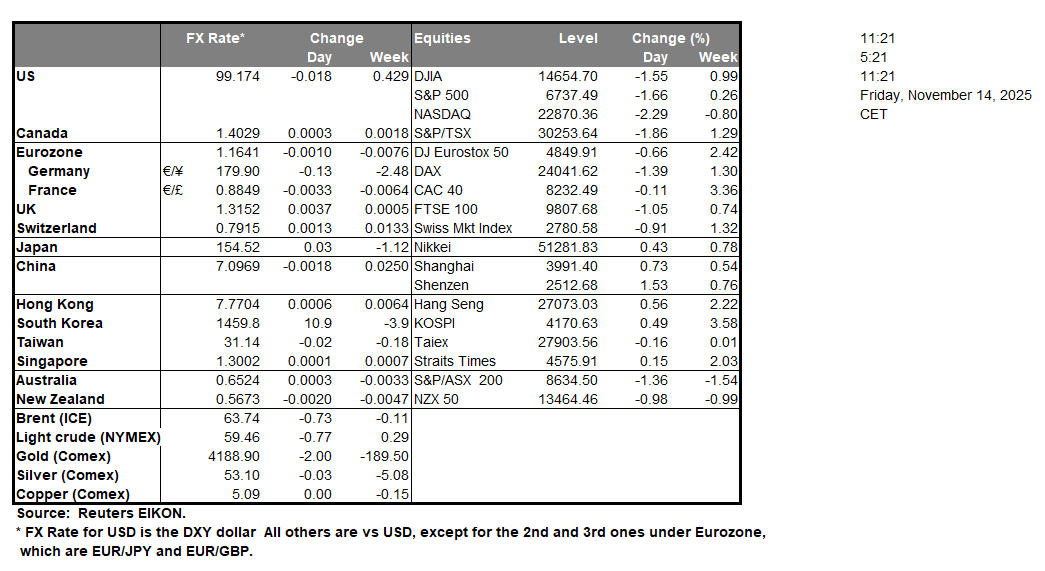

The USD is about to end the week in the reds against its counterparts after 6 day losing streak of the USD Index. Market participants seem to closing long positions in anticipation of the publication of high impact financial data in the coming week, which were not released given the US Government shutdown, while some may never be released. For example, the White House shed doubt on the scenario of the October employment data being released as the relevant survey may not have been completed. It should be noted that the USD was sold by the markets yesterday despite US yields being on the rise, of both shorter and longer term bonds, while also the market’s expectations for the Fed to cut rates in December are being set into doubt. It’s characteristic that now Fed Fund Futures imply a 50.5% probability for the bank to remain on hold. It should be noted that a substantial number of Fed policymakers have signalled substantial hesitation for the necessity of further rate cuts among which a number of policymakers that had been characterised as doves. Just to name a few who in the past few days have expressed remarks advising caution we note San Francisco Fed President Daly, Minneapolis Fed President Kashkari, St Louis Fed President Musalem, Atlanta Fed President Bostic, Cleveland Fed President Hammack and Boston Fed President Collins who was particularly blunt. Overall, the balance of power among Fed policymakers who are voting seems to be shifting increasingly towards a more hawkish, cautious approach, thus forcing the markets to readjust their expectations and reposition themselves. The US fundamentals tended to weigh on gold’s price and US stock markets, particularly the tech sector, while at the same time failed to provide the necessary support for the greenback, as market worries for the US macroeconomic outlook linger on.

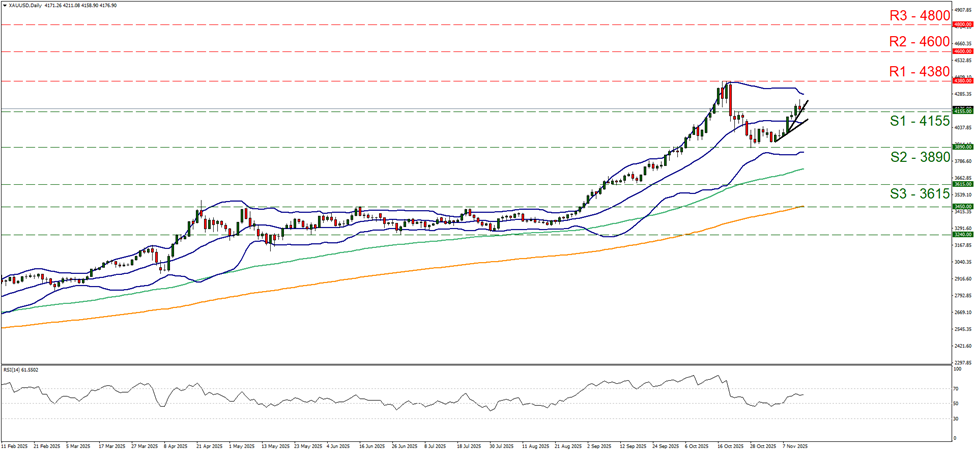

We note that gold’s price edged lower yet failed to break the 4155 (S1) support line. Gold’s price seems to be testing the upward trendline guiding it setting into doubt the bullish outlook for the precious metal’s price. The RSI indicator despite the drop of gold’s price remained well between the readings of 50 and 70 implying a bullish predisposition of the market. Should the bulls maintain control over the precious metal’s direction, we set the next possible stop for buyers at the (R1) resistance level, which marks an All Time High for the precious metal’s price. For a bearish outlook to be adopted we would require gold’s price to break the prementioned upward trendline and continue to also break the 4155 (S1) support line and continue to break also the 3890 (S2) support level.

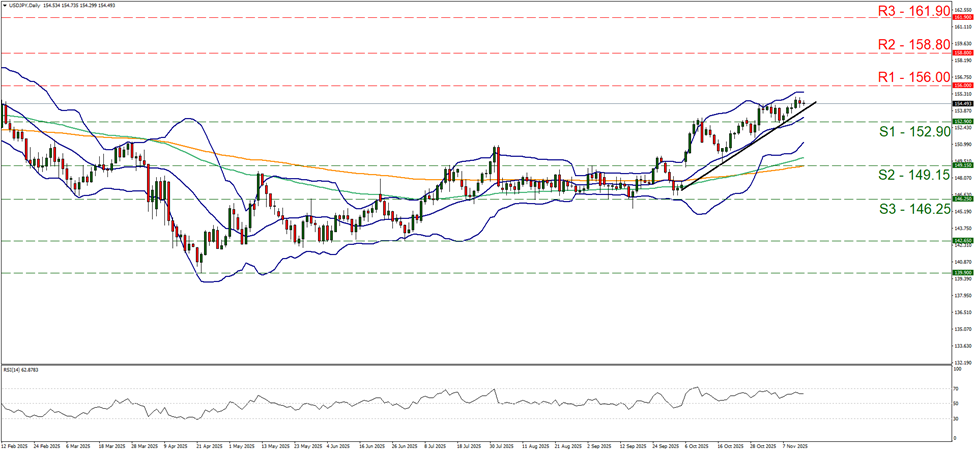

Also on a technical level, we note that USD/JPY edged lower yesterday yet remains well between the 156.00 (R1) resistance lien and the 152.90 (S1) support level. We maintain a bullish outlook for the pair and intend to keep it as long as the upward trendline guiding remains intact. Also the RSI indicator remains between the reading of 50 and 70 implying that the market sentiment is still bullish for the pair. Should the bulls continue to lead the pair higher we may see it breaking the 156.00 (S1) support line clearly and starting to aim for the 158.80 (R2) resistance level. For a bearish outlook to prevail we would require the pair’s price action to break the prementioned upward trendline in a first signal that the upward motion has been interrupted, continue to also break the 152.90 (S1) support line clearly as a sign of the pair’s price action not merely stabilising but actually dropping and start actively aiming for the 149.15 (S2) support level.

その他の注目材料

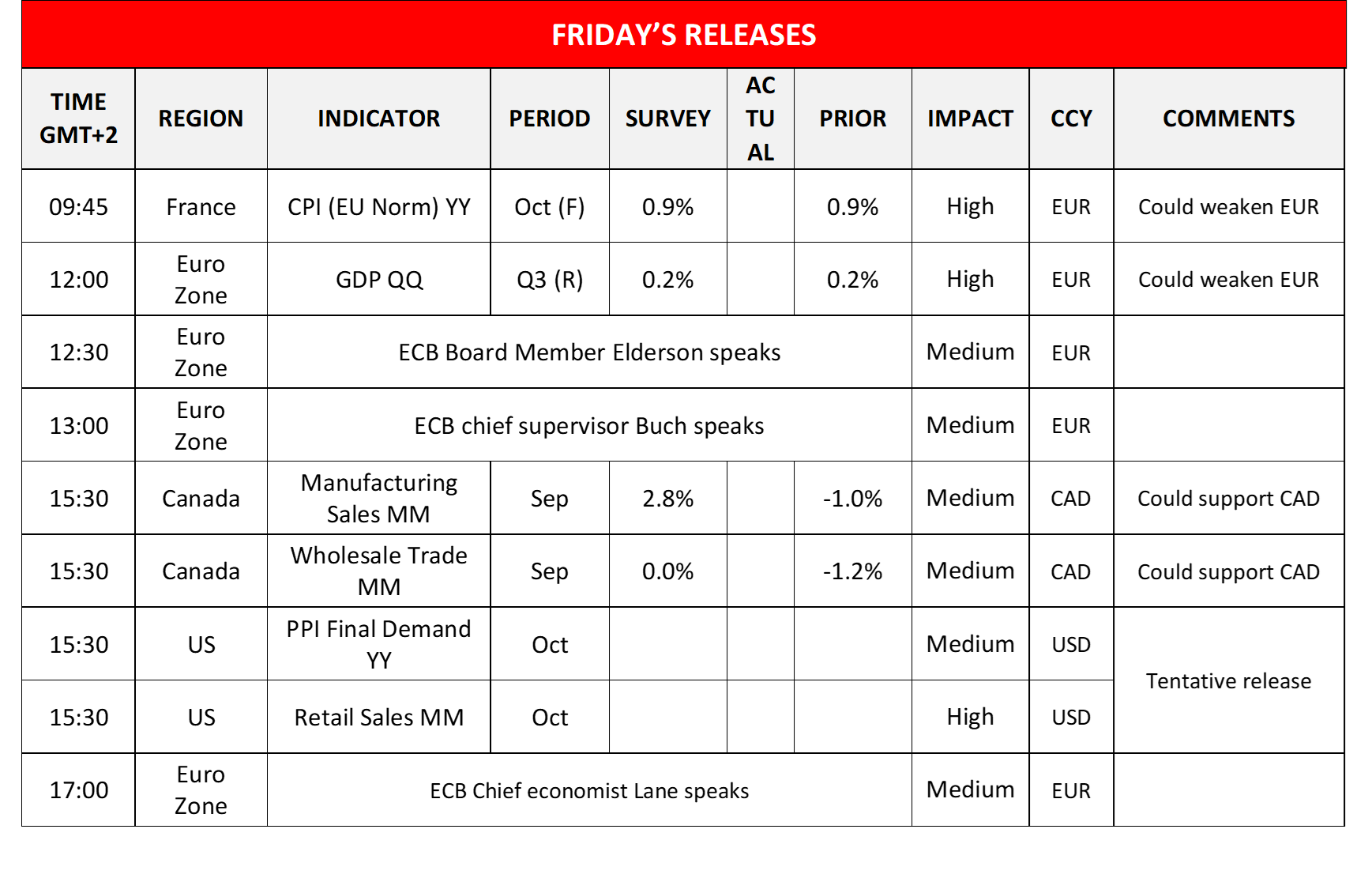

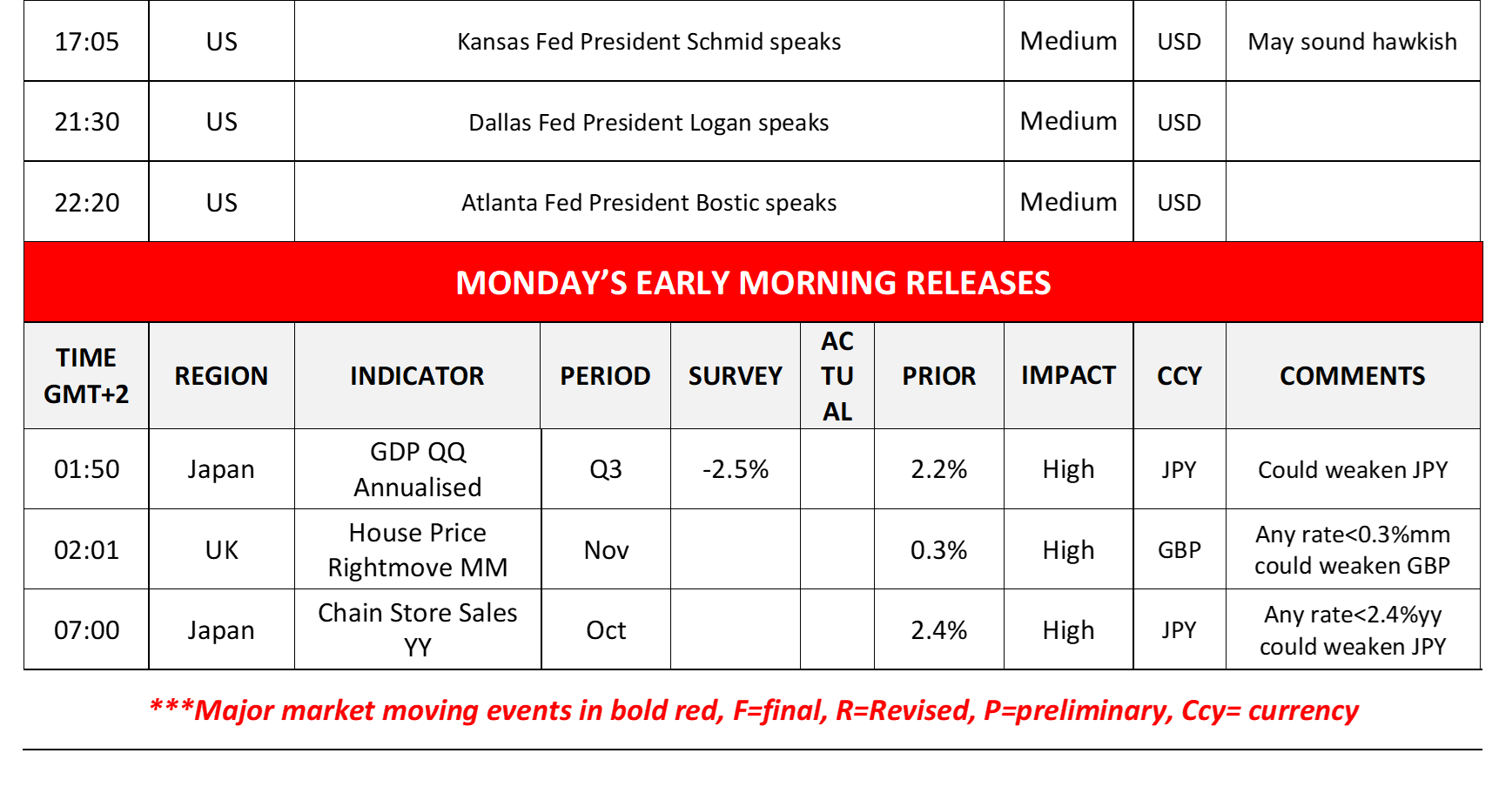

Today we get France’s final HICP rates for October, Euro Zone GDP rate for Q3, Canada’s manufacturing sales and wholesale trade for September and from the US we may get October’s PPI rates and retail sales rates. On a monetary level, we note that ECB’s Elderson, Buch and Lane are scheduled to speak as are the Fed’s Schmid, Logan and Bostic. In Monday’s Asian session, we get Japan’s GDP rates for Q3, UK’s Rightmove’s house prices for November and Japan’s Chain Store sales for October.

XAU/USD Daily Chart

- Support: 4155 (S1), 3890 (S2), 3615 (S3)

- Resistance: 4380 (R1), 4600 (R2), 4800 (R3)

USD/JPY Daily Chart

- Support: 152.90 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 156.00 (R1), 158.80 (R2), 161.90 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。