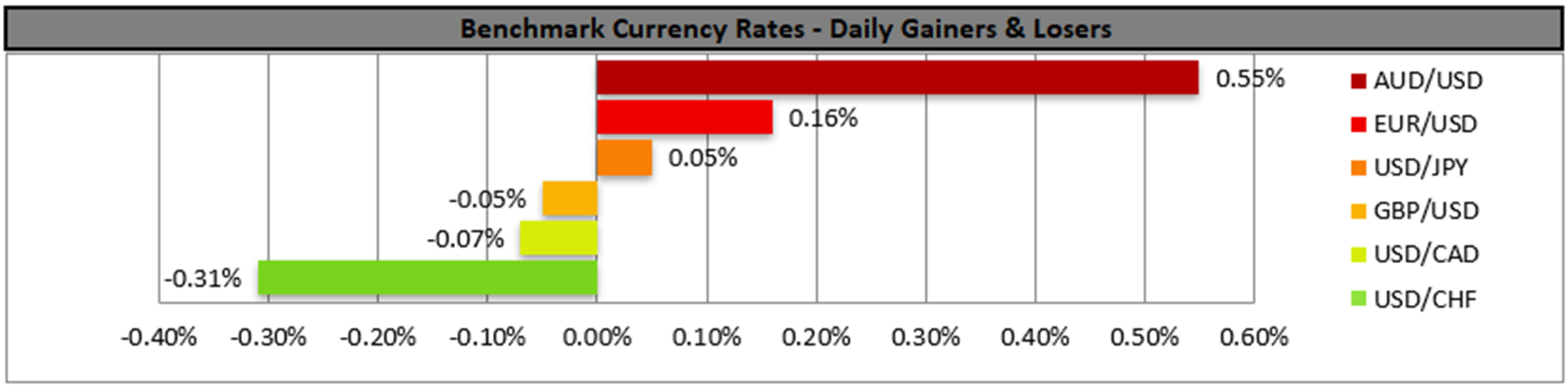

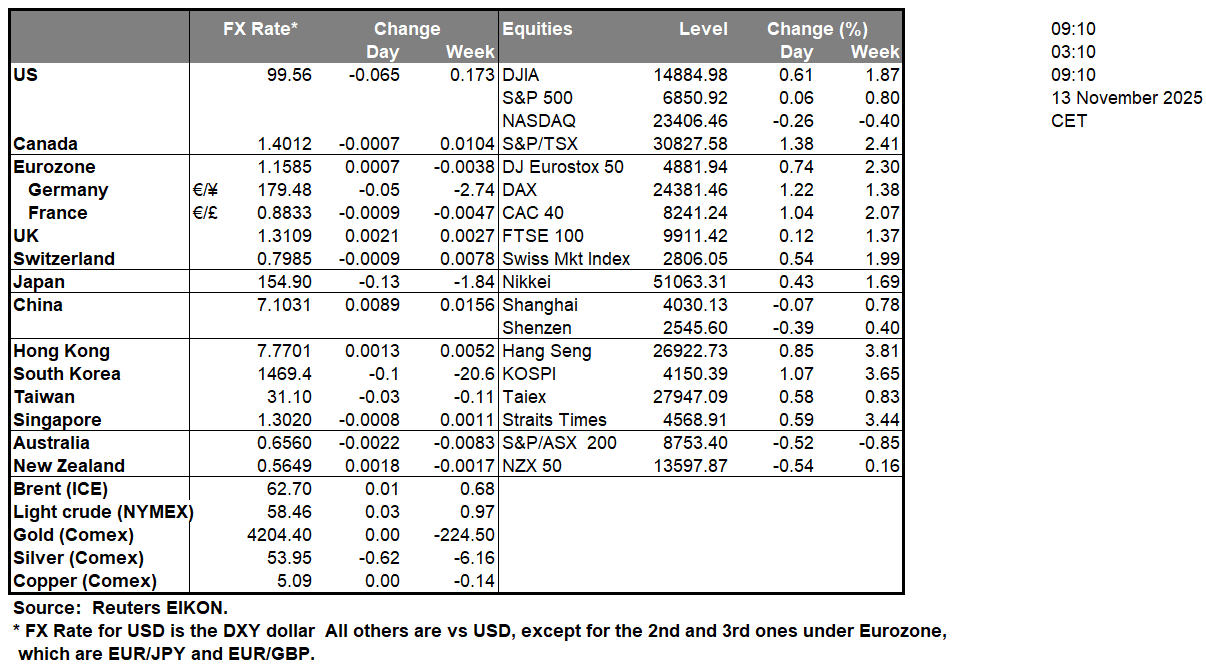

The main event for the markets yesterday, may have been that the US Government shutdown has been lifted. US President Trump signed the law to lift the longest US Government shutdown, which lasted 43 days. The issue seems to have weighed on the US economy, it remains to be seen to what degree. The spending package agreed is to fund the US Government until the 30th of January, thus may be characterised of a temporary nature, with the possibility of another shutdown at the end of January being ever-present. Now markets prepare for the mass release of high impact US financial data in the coming days which could alter the market’s expectations for the US macroeconomic outlook. Main market worries tend to revolve around the US employment market which is expected to weaken and growth. A possibly widening slack in the US employment market could enhance market expectations for the Fed to continue easing its monetary policy. For the time being we note that gold’s price got a lift and the USD tends to remain relatively stable against its counterparts, while US stock markets are gaining.

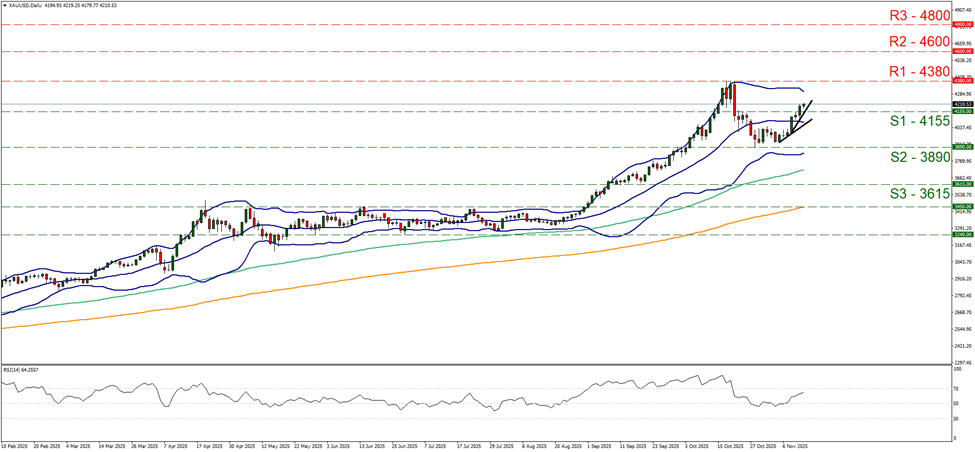

We note that gold’s price was able to break the 4155 (R1) resistance line, now turned to support. Given the precious metal’s bullish success, we switch our sideways motion for a bullish outlook and intend to keep it as long as the upward trendline guiding it remains intact. The RSI indicator is now aiming for the reading of 70, implying a strengthening bullish market supporting our bullish outlook. Should the bulls maintain control over the precious metal’s direction, we set the next possible stop for buyers at the (R1) resistance level, which marks an All Time High for the precious metal’s price. For a bearish outlook to be adopted we would require gold’s price to break the 4155 (S1) support line and continue to break also the 3890 (S2) support level.

On other news, JPY lost ground across the board yesterday as Japan’s new prime minister Ms. Takaichi stated that the Japanese Government would prefer BoJ’s interest rates to remain at low levels, thus exercising political pressure on the central bank. The statement was quite intense for Japanese standards in our opinion and now a response from the central bank is expected. For the time being, JPY’s bearish tendencies could be maintained, as the market’s past worries seem to be verified.

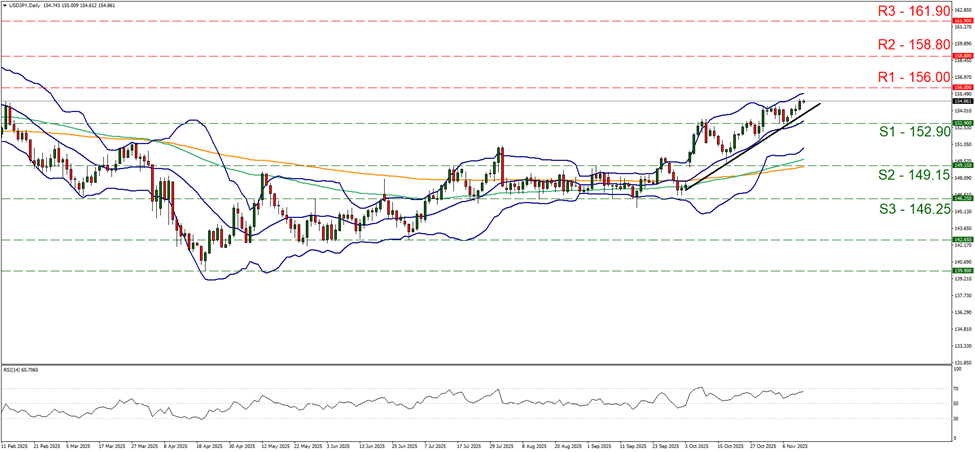

On a technical level, we note that USD/JPY continue to edge higher yesterday aiming for the 156.00 (R1) resistance line. We maintain a bullish outlook for the pair and intend to keep it as long as the upward trendline guiding it is not broken. Also the RSI indicator is nearing the reading of 70 in an upward trajectory implying an intensifying bullish market sentiment for the pair corroborating our outlook. Should the bullish outlook be maintained we may see the pair breaking the 156.00 (S1) support line clearly and starting to aim for the 158.80 (R2) resistance level. For a bearish outlook to prevail we would require the pair’s price action to break the prementioned upward trendline in a first signal that the upward motion has been interrupted, continue to also break the 152.90 (S1) support line clearly as a sign of the pair’s price action not merely stabilising but actually dropping and start actively aiming for the 149.15 (S2) support level.

その他の注目材料

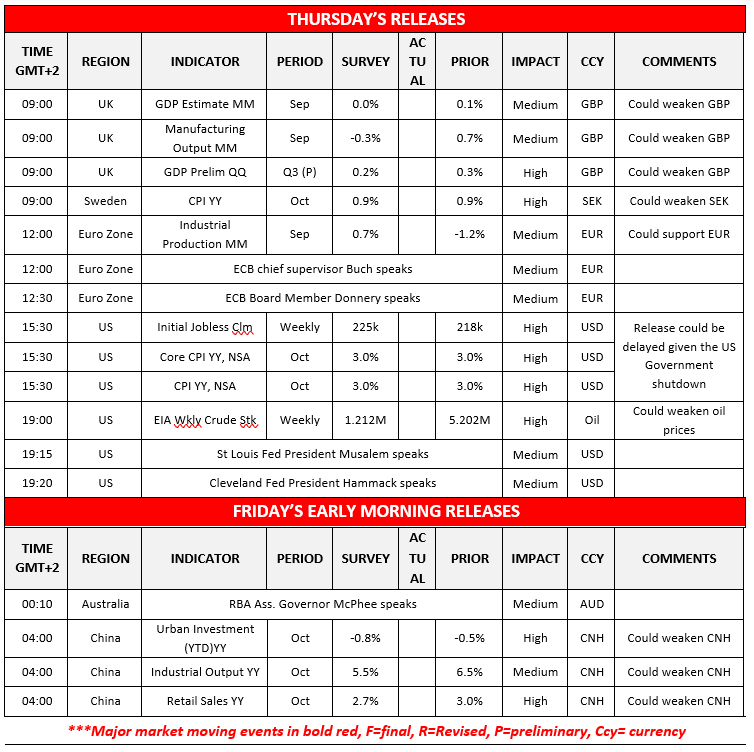

Today we note the slowdown of UK’s preliminary GDP rates for Q3, while Sweden’s CPI rates remained unchanged at low levels for October. Later on, we get Euro Zone’s industrial output for September, and the US session, we note the potential release from the US of the weekly initial jobless claims figure and October’s CPI rates, while oil traders may be more interested in the release of the EIA weekly crude oil inventories figure. On a monetary level we note that ECB chief supervisor Buch, ECB Board Member Donnery, St Louis Fed President Musalem and Cleveland Fed President Hammack are scheduled to speak. In tomorrow’s Asian session, we get from China the Urban investment, industrial output and retail sales growth rates for October, while RBA Assistant Governor McPhee speaks.

USD/JPY Daily Chart

- Support: 152.90 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 156.00 (R1), 158.80 (R2), 161.90 (R3)

XAU/USD Daily Chart

- Support: 4155 (S1), 3890 (S2), 3615 (S3)

- Resistance: 4380 (R1), 4600 (R2), 4800 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。