The US CPI rates for August are set to be released during today’s American session. Our concern is the possible uptick of inflationary pressures in the US economy, as it may result in recession worries surfacing. We attribute our concern to our opinion that the Fed may have no option but to cut rates in their meeting next week, especially considering we had the largest employment revision since 2009, implying a weaker than expected labour market. Hence, should inflationary pressures accelerate it may spell trouble for the Fed, which has been battling with its dual mandate. In Europe, the ECB’s interest rate decision is also set to occur during today’s European session with the majority of market participants currently anticipating the bank to remain on hold. In particular, EUR OIS currently implies a 99.8% probability for such a scenario to materialize. Therefore, attention turns to ECB President Lagarde’s press conference following their monetary policy meeting. In our view, the ECB President may point towards the bank remaining on hold for a prolonged period of time, which we would tend to agree with. Given the current situation in the Eurozone, we do not anticipate that the ECB feels in a rush to adjust its monetary policy.According to some reports the Russian drones which penetrated Poland’s airspace had intended to strike Poland’s logistic hub. Overall participants may be eagerly awaiting the response by NATO if there will be any and thus depending on the response gold’s price may be influenced. WTICash appears to be moving in a sideways fashion, after failing to clear our 61.75 (S1) support level. We opt for a sideways bias for the commodity’s price and supporting our case is the RSI indicator which currently registers a figure near 50, implying a neutral market sentiment. Moreover, our case is also aided by the failure of the commodity’s price to clear our S1 level. For our sideways bias to be maintained, we would require oil’s price to remain confined between our 61.75 (S1) support level and our 64.50 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 64.50 (R1) resistance level with the next possible target for the bulls being our 68.10 (R2) resistance line. Lastly, for a bearish outlook, we would require a clear break below our 61.75 (S1) support level, with the next possible target for the bears being the 58.65 (S2) support line.

EUR/USD appears to be moving in a relatively sideways motion. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1650 (S1) support level and our 1.1800 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 1.1800 (R1) resistance level with the next possible target for the bulls being our 1.1980 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below our 1.1650 (S1) support level with the next possible target for the bears being our 1.1480 (S2) support line.

その他の注目材料

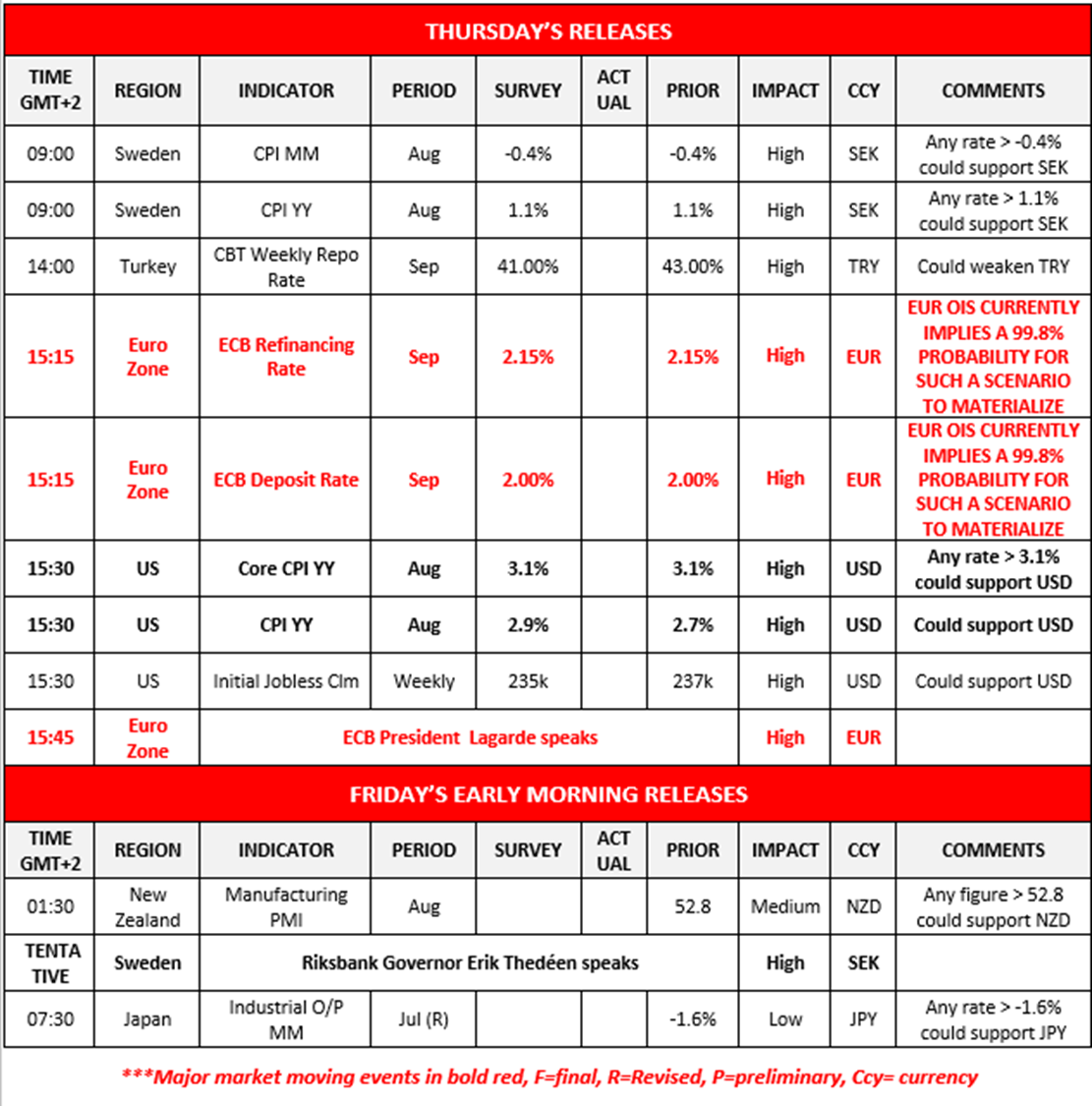

Today we get Sweden’s CPI rates for August, followed by Turkey’s interest rate decision, the ECB’s interest rate decision, the US CPI rates for August and the US weekly initial jobless claims figure. In tomorrow’s Asian session, we would like to note New Zealand’s manufacturing PMI figure for August and Japan’s revised industrial output rate for July.In term’s of speeches by key policymakers, we would like to note ECB President Lagarde’s press conference following the ECB’s interest rate decision and during tomorrow’s Asian session the speech by Riksbank Governor Erik Thedeen.

WTICash Daily Chart

- Support: 61.75 (S1), 58.65 (S2), 55.25 (S3)

- Resistance: 64.50 (R1), 68.10 (R2), 71.60 (R3)

EUR/USD Daily Chart

- Support: 1.1650 (S1), 1.1480 (S2), 1.1330 (S3)

- Resistance: 1.1800 (R1), 1.1980 (R2), 1.2160 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。