According to a report by the FT, as US Judge has ruled that Fed Governor Cook may not be fired whilst litigation is pending over her alleged mortgage fraud. The Judge stated that “Cook has made a strong showing that her purported removal was done in violation of the Federal Reserve Act” and thus the Board Governor will be sitting in the Fed’s next meeting as a voting member. In our view, the failure by the President to remove Governor Cook may not influence the bank’s expected rate cut in their next meeting.In Europe, tensions are running high between Poland and Russia, following the events that unfolded earlier today, where Poland was forced to fire on drones that entered its airspace during a massive Russian air strike in Ukraine. Poland has called the violation of its airspace an “act of aggression”. In turn the rising tensions could funnel safe haven inflows into gold’s price should the two nation’s exchange blows or if Russian military aircraft violate Polish airspace once again, as it may prompt a harsher response from Poland.Over in the Middle East, Israel struck a Hamas delegation located in Qatar. Thus, this marks the first time Israel has directly struck Qatar. Moreover, the apparent airstrike could re-heighten regional tensions and spark market worries over the stability in the region. In turn this may aid oil and gold prices should the situation deteriorate. Moreover, this brings into question the reliability of the US as an ally in the region. Nonetheless, the situation warrants closer monitoring. WTICash appears to be moving in a sideways fashion, after failing to clear our 61.75 (S1) support level. We opt for a sideways bias for the commodity’s price and supporting our case is the RSI indicator which currently registers a figure near 50, implying a neutral market sentiment. Moreover, our case is also aided by the failure of the commodity’s price to clear our S1 level. For our sideways bias to be maintained, we would require oil’s price to remain confined between our 61.75 (S1) support level and our 64.50 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 64.50 (R1) resistance level with the next possible target for the bulls being our 68.10 (R2) resistance line. Lastly, for a bearish outlook, we would require a clear break below our 61.75 (S1) support level, with the next possible target for the bears being the 58.65 (S2) support line.

GBP/USD appears to be moving in a sideways motion. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 1.3390 (S1) support level and our 1.3580 (R1) resistance line. On the other hand, for a bullish outlook we would require a clear break above our 1.3580 (R1) resistance line with the next possible target for the bulls being the 1.3750 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 1.3390 (S1) support level with the next possible target for the bears being the 1.3200 (S2) support line.

その他の注目材料

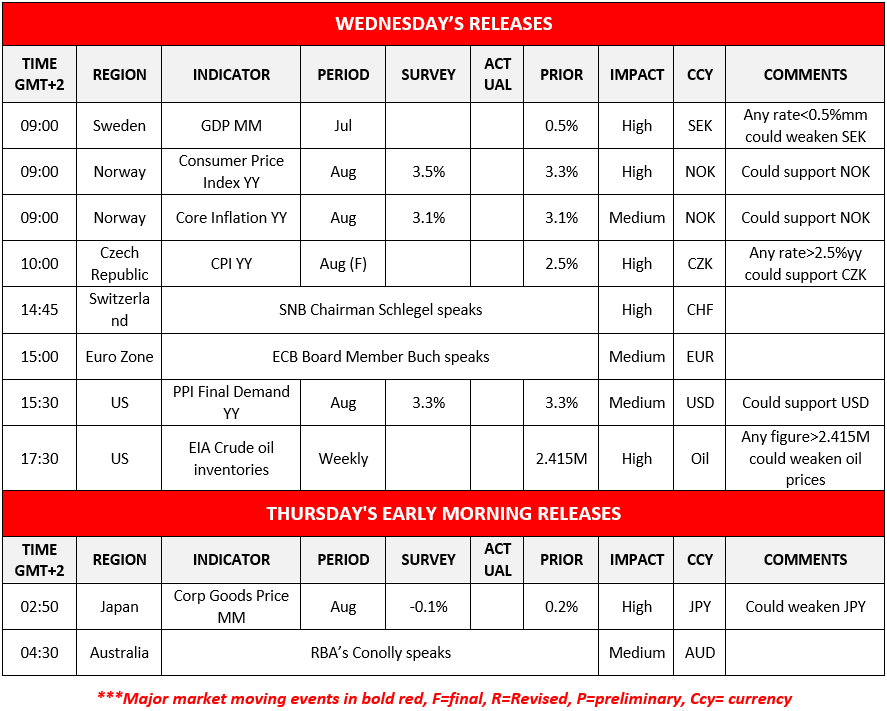

Today we get Sweden’s GDP rate for July as well as Norway’s and the Czech Republic’s CPI rates for August while from Switzerland SNB Chairman Schlegel and ECB Board Member Buch are scheduled to speak. In the American session, we note the release of the US PPI rates for August, while oil traders may be interested in the release of the EIA weekly crude oil inventories figure. In tomorrow’s Asian session, we get Japan’s Corporate Goods Price for August while RBA’s Conolly speaks.

WTICash Daily Chart

- Support: 61.75 (S1), 58.65 (S2), 55.25 (S3)

- Resistance: 64.50 (R1), 68.10 (R2), 71.60 (R3)

GBP/USD Daily Chart

- Support: 1.3390 (S1), 1.3200 (S2), 1.3005 (S3)

- Resistance: 1.3580 (R1), 1.3750 (R2), 1.3930 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。