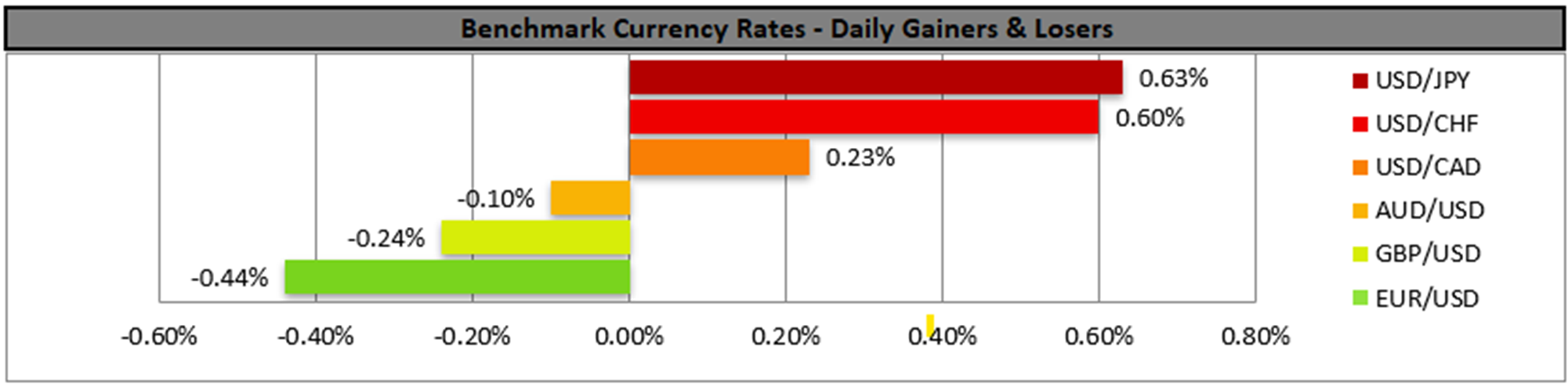

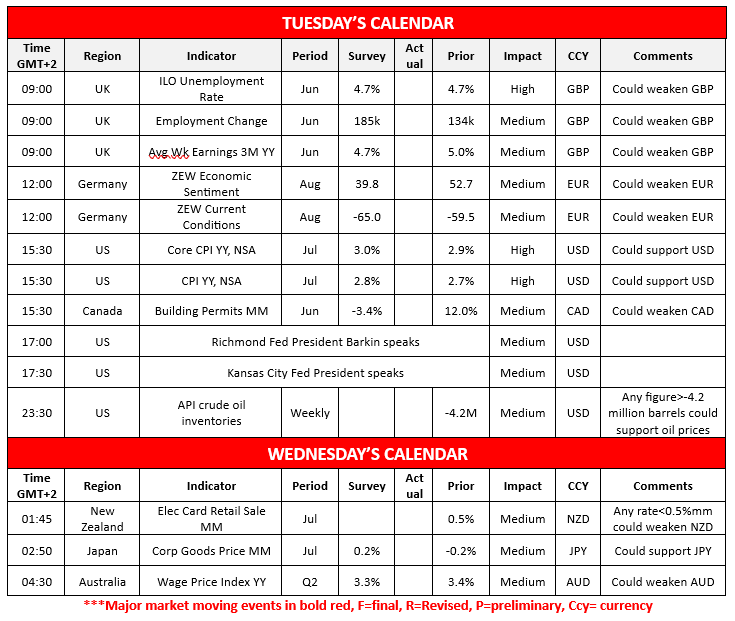

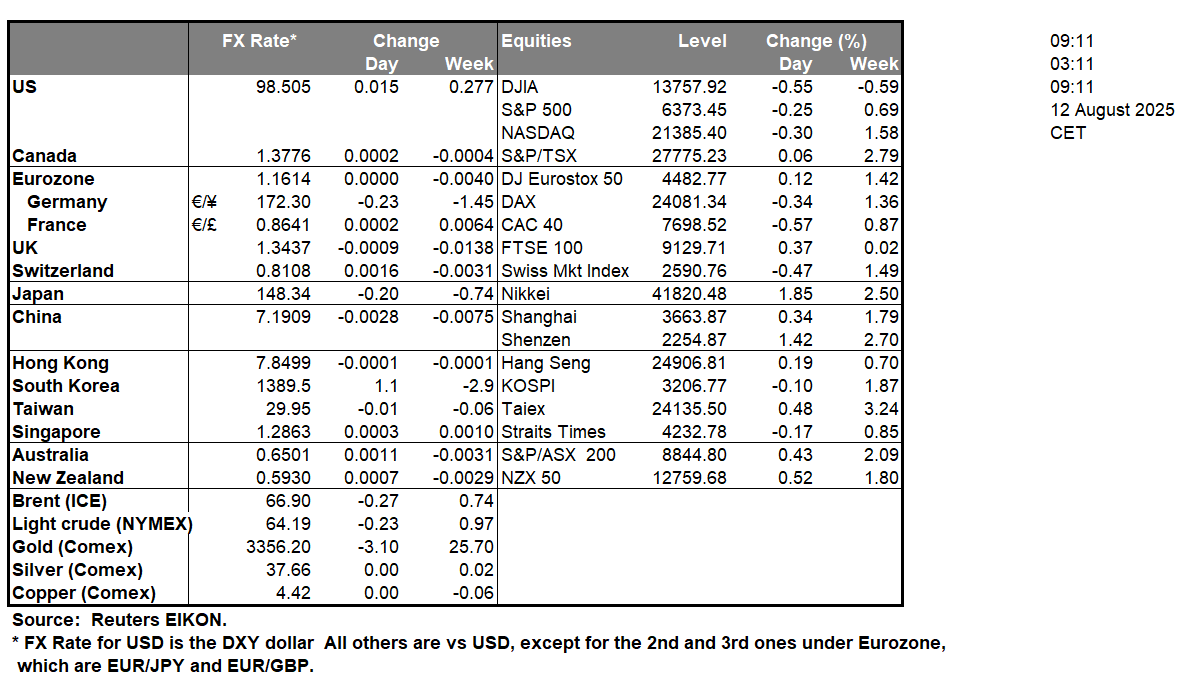

The USD was on the rise yesterday against its counterparts. Today, we highlight the release of the US CPI rates for July. The interest for the path of inflationary pressures in the US economy is enhanced given also that the effect of US President Trump’s tariff policy has not been revealed yet. Both rates, on a headline and core level, are expected to accelerate slightly. Should the rates tick up as expected, it would signal a resilience of inflationary pressures in the US economy. The rates are to be released after the release of the US employment data for July and is considered the next big test for the greenback. Should the rates accelerate beyond market expectations, we may see the Fed’s hesitation to ease its monetary policy widen, and thus the USD could get some support. On the flip side, should the rates unexpectedly slow down, the release could take the markets by surprise, amplifying its dovish expectations for the Fed’s next moves and thus could weigh asymmetrically on the USD. Yet the release may have ripple effects beyond the FX market and a possible wider acceleration of the rates could weigh on US equities and gold’s price and vice versa, a possible slowdown could support US stock markets and the precious metal’s price.

Across the pond, UK’s employment data for June came in stronger than expected with the unemployment rate remaining unchanged at 4.7% as expected yet the employment change figure rose beyond market expectations reaching a stellar 238k, a testament to the UK employment market’s ability to create new jobs. The pound got some support from the release, yet we note the release of the preliminary GDP rate for Q2 on Thursday as the next big test for the sterling.

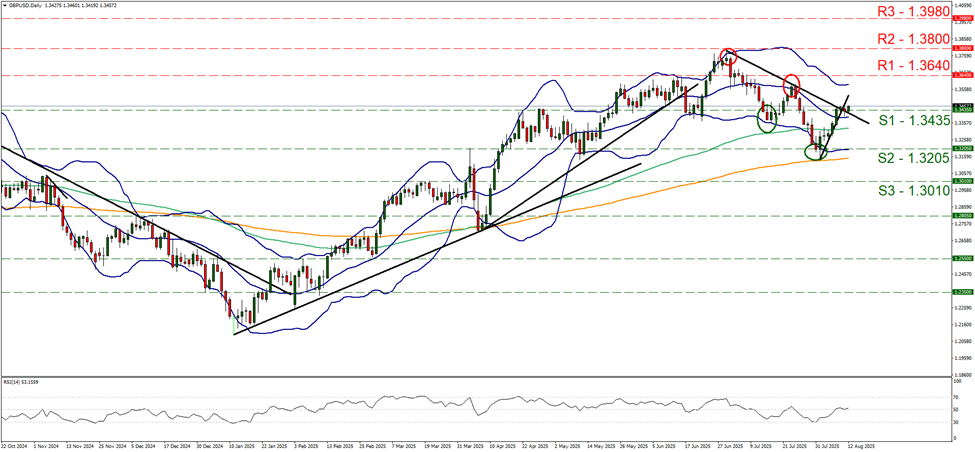

GBP/USD edged higher in today’s Asian session, breaking the 1.3435 (S1) resistance line now turned to support. For the time being we expect cable to maintain a sideways motion, given the relative stabilisation of the pair since Friday. Also the RSI indicator tends to remain near the reading of 50 implying a relative indecisiveness on behalf of the market for the pair’s direction. Should the bulls take over we may see the pair aiming if not breaking the 1.3640 (R1) resistance line with the next possible target for the bulls being set at the 1.3800 (R2) resistance level, a level that has not seen any price action since February 2022. Should the bears take over, we may see the pair breaking the 1.3435 (S1) support line and actively aiming if not breaching the 1.3205 (S2) support level.

Across the world, RBA proceeded with a 25-basis points rate cut as expected in today’s Asian session. The bank in its forward guidance highlighted the uncertainty in the outlook of the world economy while also mentioned that it will remain data dependent, focusing primarily on inflation and employment data. Hence, we highlight the release of Australia’s employment data on Thursday’s Asian session as the next possible market mover for the Aussie.

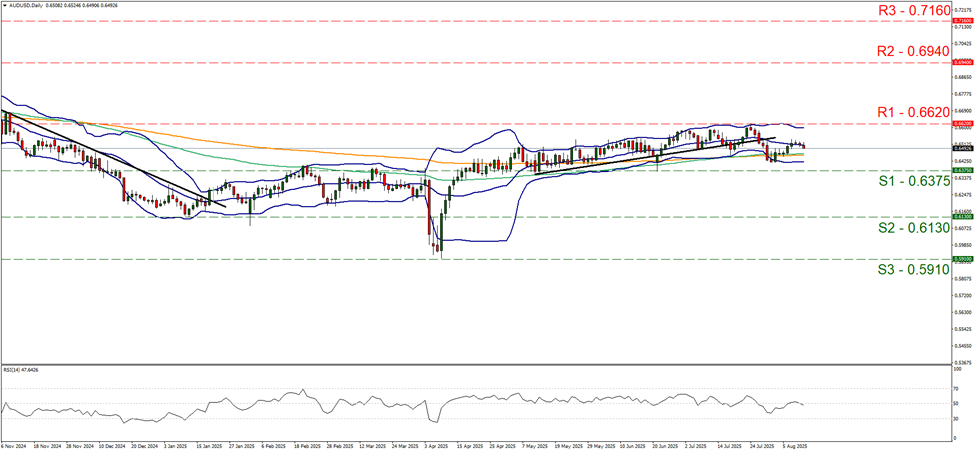

AUD/USD tended to stabilise on Friday and during today’s Asian session, between the 6620 (R1) resistance line and the 0.6375 (S1) support level. We tend to maintain our bias for the pair’s sideways motion to continue and supporting our case is the RSI indicator, which is running along the reading of 50, implying a relative indecisiveness on behalf of market participants for the pair’s direction. Should the bulls be in the lead, we may see AUD/USD breaking the 0.6620 (R1) resistance line and starting to aim the 0.6940 (R2) resistance level. Should the bears take over, we may see AUD/USD breaking the 0.6375 (S1) support line and start aiming for the 0.6130 (R2) support level.

その他の注目材料

Today we get Germany’s ZEW indicators for August, Canada’s building permits for June, while oil traders may be more interested in the API weekly crude oil inventories figure.

AUD/USD Cash Daily Chart

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

GBP/USD Daily Chart

- Support: 1.3435 (S1), 1.3205 (S2), 1.3010 (S3)

- Resistance: 1.3640 (R1), 1.3800 (R2), 1.3980 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。