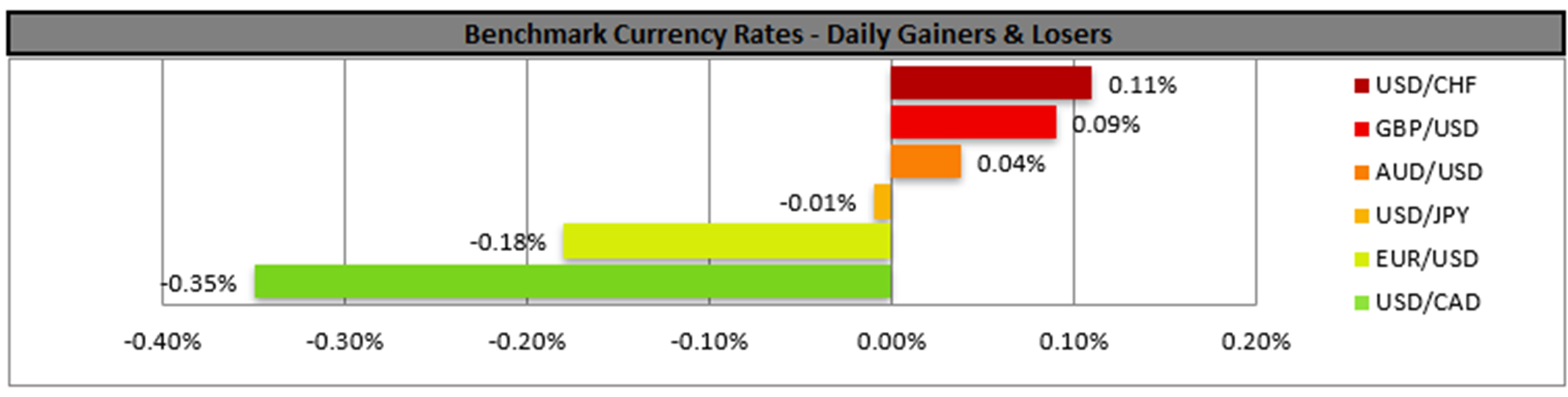

The USD edged lower against its counterparts yesterday yet the bullish tendencies seem to be still present. On a fundamental level, the markets may have some doubts about US President Trump’s intentions to impose tariffs on the 2 of April, given the flexibility mentioned by White House officials in imposing tariffs. On a macroeconomic level, we note the more pessimistic consumer outlook in the US highlighted by the wider-than-expected drop of March’s consumer confidence. Today we note the release of the US durable goods orders growth rate for February and the rate is expected to retreat into the negatives, implying a lack of confidence on behalf of US businesses to actually invest in the US economy and thus could weigh on the greenback in the early American session today.

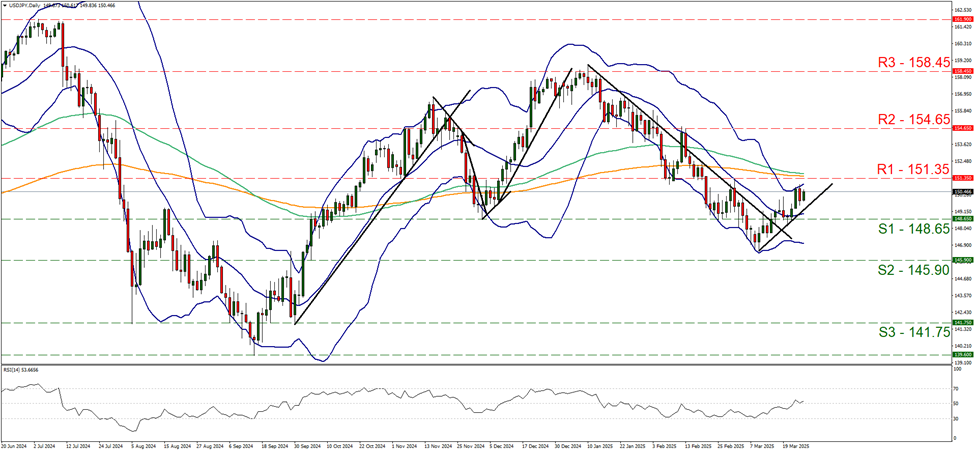

On a technical level, we note the drop of USD/JPY’s price action yesterday, relatively stabilizing the pair. The upward trendline guiding the pair since the 11 of March remains intact, thus implying the continuance of the bullish outlook. Yet the RSI indicator has stabilised near the reading of 50, implying an indecisive market for the pair’s direction. Thus for a continuation of the bullish outlook, we would require the pair to break the 151.35 (R1) line clearly and start aiming for the 154.65 (R2) resistance level. For a bearish outlook, we would require the pair’s price action to break the prementioned upward trendline, signaling the interruption of the upward motion continue to break the 148.65 (S1) support line and start aiming for the 145.90 (S2) base.

Across the pond, pound traders may have been disappointed by the wider-than-expected slowdown of the UK CPI rates both on a headline and core level for February. The easing of inflationary pressures weighed on the pound, upon the release of the rates and may be adding pressure on the BoE to ease its monetary policy further. It should be noted that BoE Governor Bailey stated that AI had the potential to push the UK economy expediting growth rates for the UK, but also the global, economy. On the other hand, the BoE Governor has highlighted how the low productivity has slowed down growth for the UK economy and the statements. The statement tended to underscore the bank’s awareness of the supportive role the BoE may have to play for the UK economy, thus one could see the statements as being in a dovish tone. On a fiscal level, we note that Chancellor of the Exchequers Reeves, is to present later today the UK Government’s half-yearly forecasts, and headlines are highlighting the possibility of new budget cuts at the level of GB£15 billion. We note that austerity concerns seem to be looming over the UK government’s intentions and should they magnify, we may see them weighing on the pound.

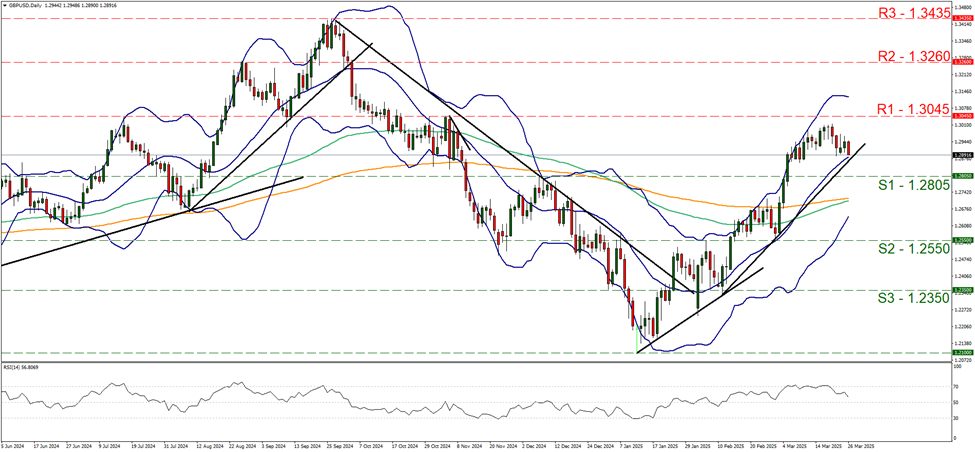

Cable seems undecisive of a new direction, remaining well between the 1.3045 (R1) resistance line and the 1.2805 (S1) support level. On the other hand despite the correction lower in today’s Asian and early European session, the upward trendline underscoring the upward movement of GBP/USD continues to be active suggesting that the bulls may still be present. The RSI indicator despite correcting lower remains at relatively high levels, yet acts in a clear indication of an easing of the bullish sentiment of the market for the pair. For a continuation of the bullish outlook cable would have to bounce on the prementioned upward trendline, rise, break the 1.3045 (R1) resistance line and start aiming for the 1.3260 (R2) resistance level. For a bearish outlook, GBP/USD has to break the prementioned upward trendline clearly and continue lower to break the 1.2805 (S1) support line and start aiming for the 1.2550 (S2) support level.

その他の注目材料

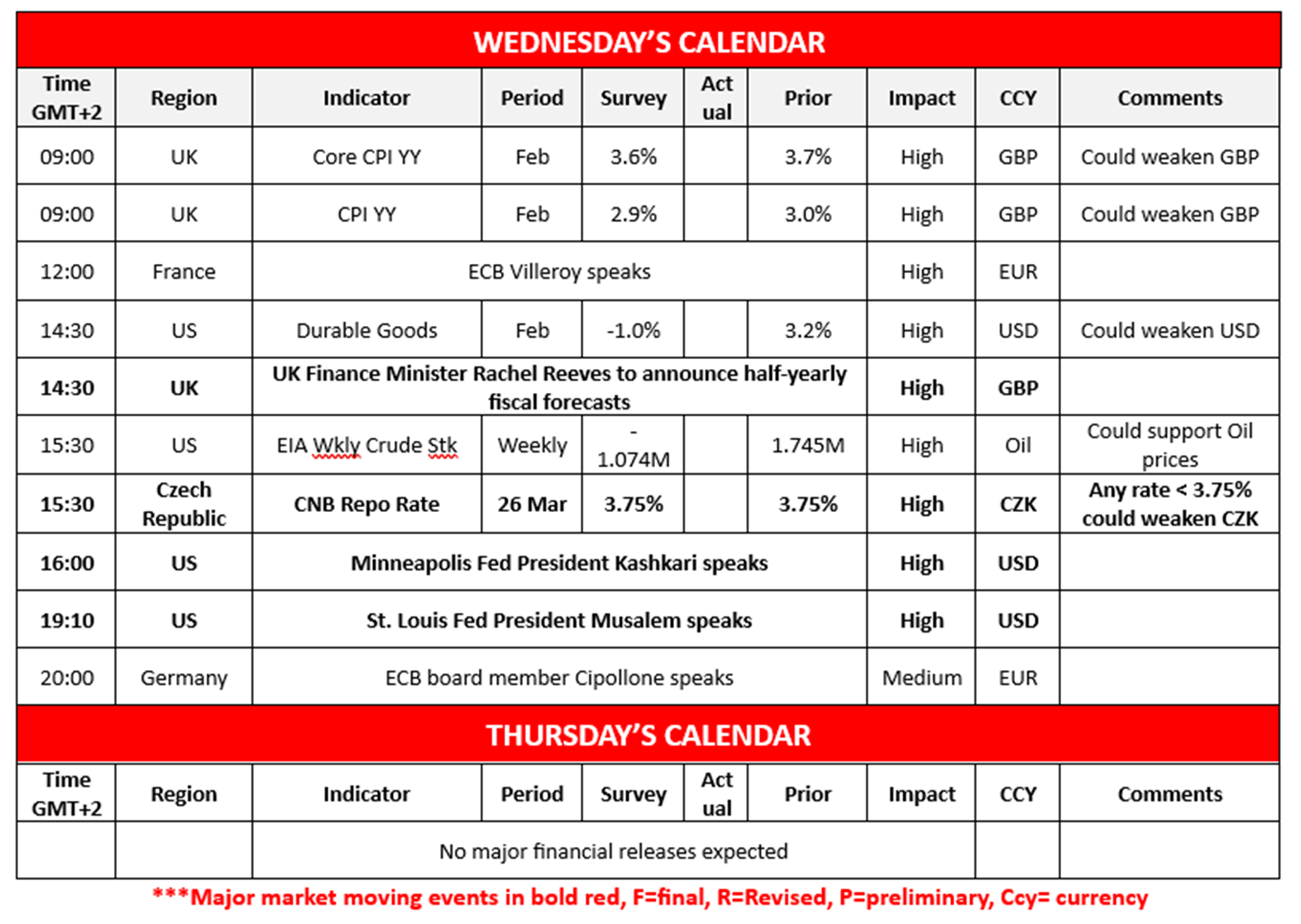

Today we get the weekly EIA crude oil inventories figure. On a monetary level, we note the speech by ECB Villeroy, the announcement by UK Finance Minister Reeves, the Czech Republic’s CNB interest rate decision, the speeches by Minneapolis Fed President Kashkari and St Louis Fed President Musalem, and ending off the day is the speech by ECB member Cipollone.

USD/JPY Daily Chart

- Support: 148.65 (S1), 145.90 (S2), 141.75 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

GBP/USD Daily Chart

- Support: 1.2805 (S1), 1.2550 (S2), 1.2350 (S3)

- Resistance: 1.3045 (R1), 1.3260 (R2), 1.3435 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。