In Europe Germany’s Ifo figures for March are set to be released in today’s European trading session. The Ifo figures from Germany may provide insight into the business sentiment in the nation. The figures could influence the EUR given Germany’s economic significance in the Zone.In the US President Trump appears to have provided some leeway for his tariff implementations with Reuters stating that President Trump told reports not all new tariffs would be announced on the 2nd of April and that he may give “a lot of countries” break on tariffs. The comments by the President and his apparent flexibility to the imposition of tariffs may imply that there is some leeway for negotiations. In turn, this may ease concerns over the impact on the US Equities markets and could thus provide some support for US stock markets.In the commodities market, President Trump stated per the FT that the US would be imposing a 25% tariff on all imports from any country that buys oil from Venezuela. The announcement by Trump could curb the oil supply into the market stemming from Venezuela, which in turn could aid oil prices.Over in Asia, the BOJ’s last meeting minutes were released earlier on today. In the bank’s meeting minutes, “Some members noted that, looking at recent indicators of inflation expectations and other factors, it could be judged that the likelihood of underlying inflation increasing was rising”. The comments may imply that the bank could be prepared to raise interest rates which in turn could aid the JPY.

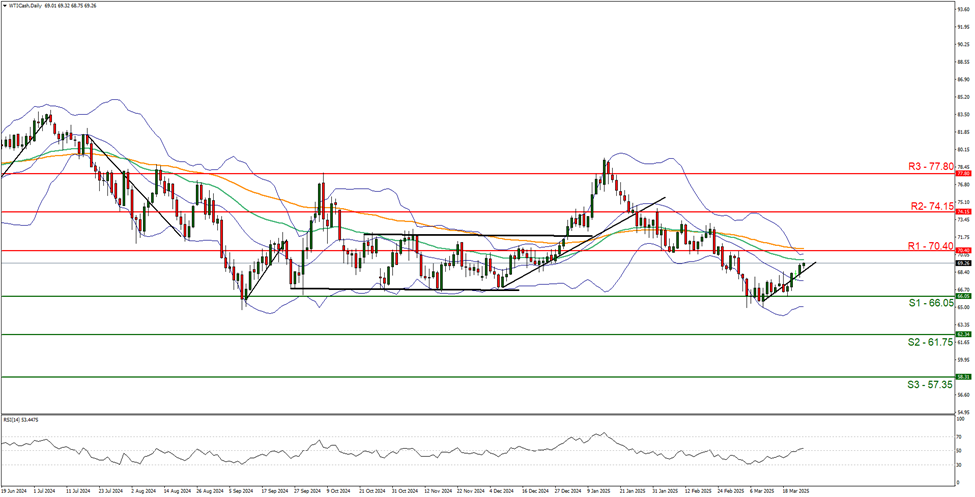

WTICash appears to be moving in a sideways fashion, with the commodity’s price appearing to be taking aim for our 70.40 (R1) resistance level. We opt for a sideways bias for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. On the other hand, for a bullish outlook we would require a clear break above the 70.40 (R1) resistance level with the next possible target for the bulls being the 74.15 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below the 66.05 (S1) support level with the next possible target for the bears being the 61.75 (S2) support line.

EUR/USD appears to be moving in a downwards fashion with the pair currently testing our 1.0780 (S1) support level. We opt for a bearish outlook for the pair’s price and supporting our case is the RSI indicator below our chart which despite registering a figure close to 60, appears to be showcasing that the bullish momentum guiding the pair’s price may be easing. For our bearish outlook to continue we would require a clear break below our 1.0780 (S1) support level ,with the next possible target for the bears being the 1.0665 (S2) support line. On the flip side for a sideways bias we would require the pair’s price to remain confined between the 1.0780 (S1) support level and the 1.0910 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 1.0910 (R1) resistance line with the next possible target for the bulls being the 1.1012 (R2) resistance level.

その他の注目材料

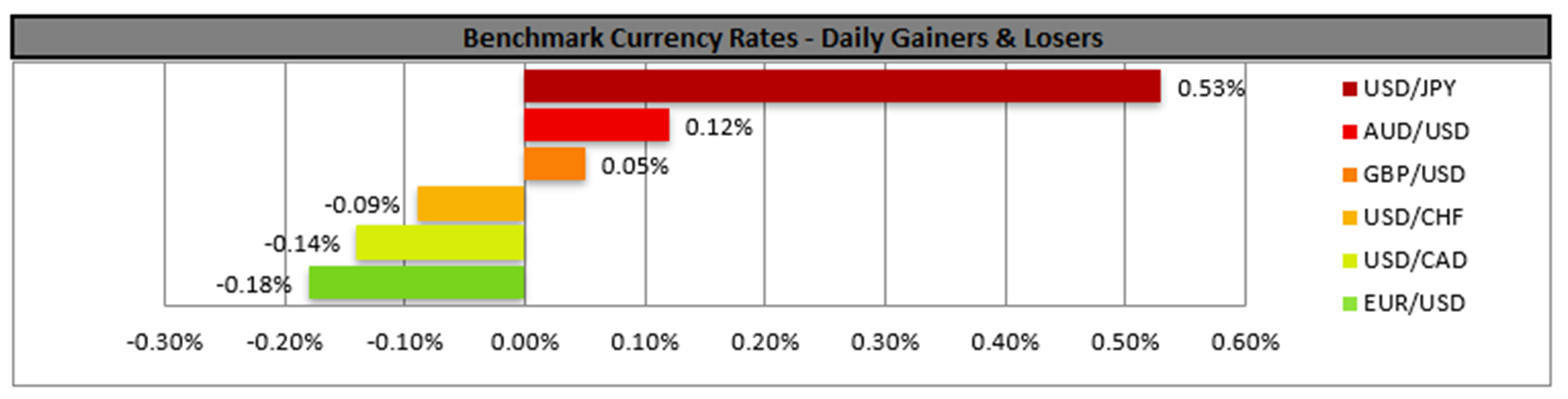

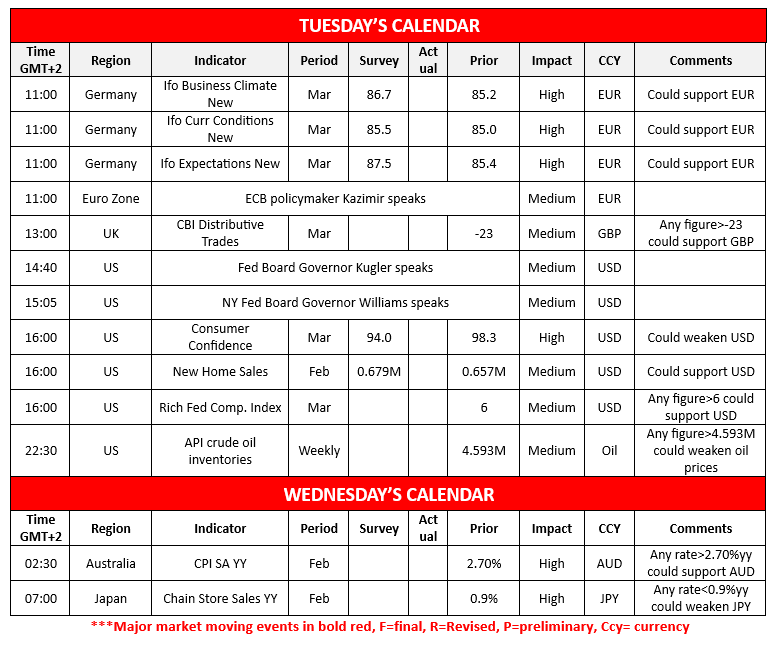

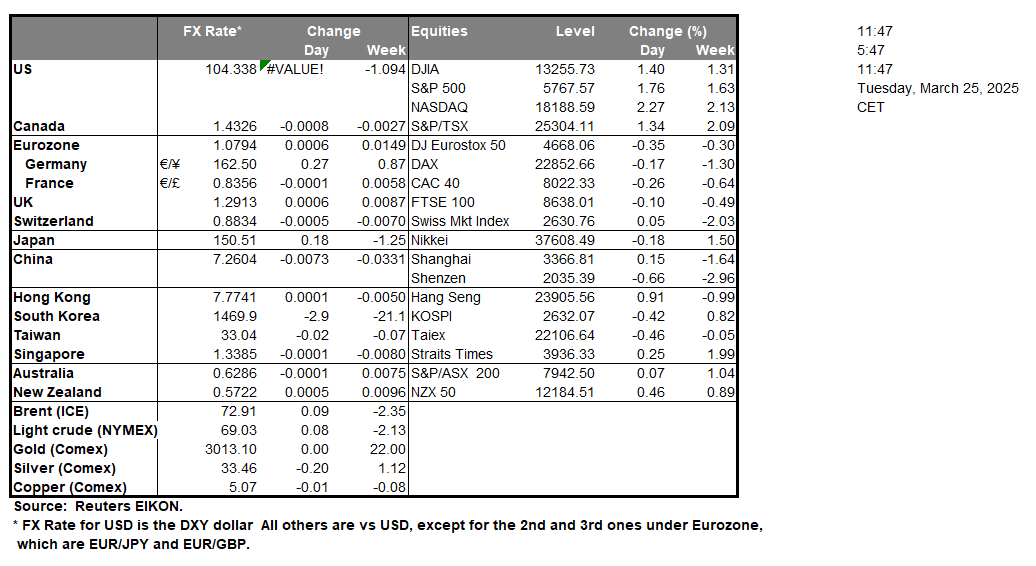

Today we get Germany’s Ifo indicators for March, and UK’s CBI distributive trades indicator for the same month, while ECB’s Kazimir speaks. In the American session, we get from the US March’s consumer confidence, February’s New Home sales for February and the Richmond Fed Composite index for March, while the Fed’s Kugler and Williams are scheduled to speak, while oil traders may be interest in the release of the weekly API crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s CPI rates for February and Japan’s Chain store sales for the same month.

WTICash Daily Chart

- Support: 66.05 (S1), 61.75 (S2), 57.35 (S3)

- Resistance: 70.40 (R1), 74.15 (R2), 77.80 (R3)

EUR/USD デイリーチャート

- Support:1.0780 (S1), 1.0665 (S2), 1.0530 (S3)

- Resistance: 1.0910 (R1), 1.1012 (R2), 1.1110 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。