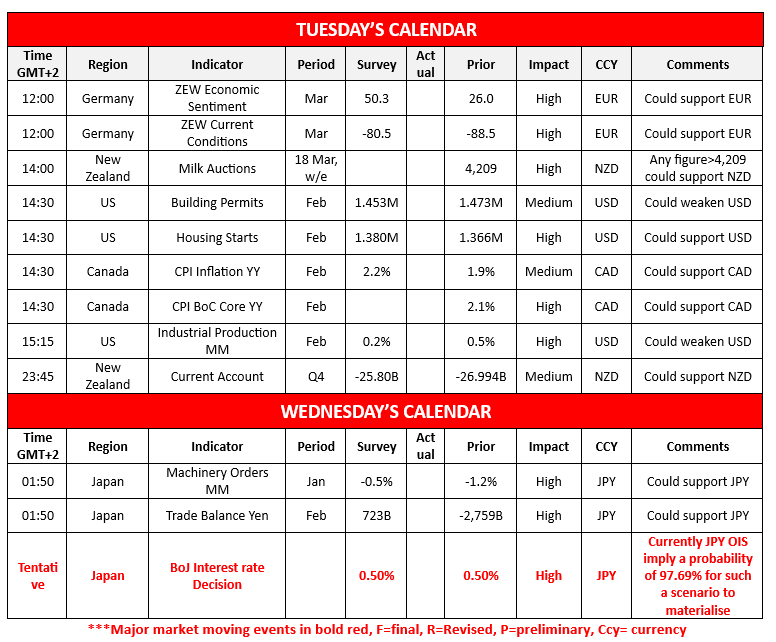

The BOJ’s interest rate decision is set to occur in tomorrow’s Asian session. The majority of market participants are currently anticipating the bank to remain on hold at 0.50% with JPY OIS currently implying a 97.96% probability for such a scenario to materialize. As such we turn our attention to the bank’s accompanying statement, in which should the bank imply that they may continue hiking rates during the year, it may aid the JPY and vice versa. In our view, we would not be surprised to see the bank raising their concerns over the ongoing trade wars between the US, Canada, Mexico and the EU and how it may raise concern over the resiliency of the global economy. In turn, this may be perceived as a willingness by the bank to remain on hold until the dust has settled and the impact on the global economy is clearer. Over in Canada, the nation’s CPI rates for February are set to be released during today’s American session. The headline CPI rate is expected by economists to accelerate from 1.9% to 2.2% which could aid the Loonie. As such, should the CPI rates showcase an acceleration of inflationary pressures it may aid the CAD and vice versa. However, when looking at the big picture, the CPI rates are at or near the bank’s 2% inflation target and could thus keep the door open for the bank should they wish to continue cutting rates. Yet, with the trade war currently occurring with the US, a higher inflation print could provide the bank with some leeway should they wish to remain on hold until the impact on the Canadian economy is seen.In the US, the preliminary Atlanta Fed GDPNow rate for Q1 of 2025 came in better than expected at -2.1% versus -2.4%, which may have alleviated some of the downwards pressures faced by the US Equities markets.On a political level, Trump and Putin are set to speak today in regards to the ongoing war in Ukraine.

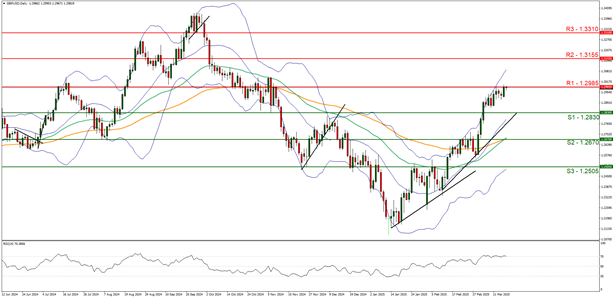

GBP/USD appears to be moving in an upwards fashion with the pair currently testing our 1.2985 (R1) resistance line. We opt for a bearish outlook for the pair’s price and supporting our case is the RSI indicator below our chart which currently registers a figure of 70 implying a bullish market sentiment. For our bullish outlook to continue we would require a clear break above the 1.2985 (R1) resistance line with the next possible target for the bulls being the 1.3155 (R2) resistance level. On the flip side for a sideways bias we would require the pair to remain confined between the 1.2830 (S1) support level and the 1.2985 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.2830 (S1) support level, with the next possible target for the bears being the 1.2670 (S2) support line.

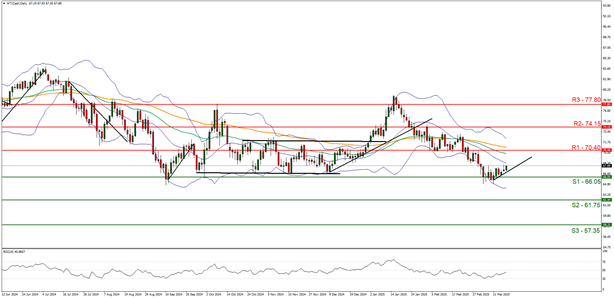

WTICash appears to be moving in a sideways fashion. We opt for a sideways bias for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. For our sideways bias to be maintained we would require the commodity’s price to remain confined between the 66.05 (S1) support level and the 70.40 (R1) resistance line. On the flip side for a bullish outlook, we would require a clear break above the 70.40 (R1) resistance line, with the next possible target for the bulls being the 74.15 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 66.05 (S1) support level with the next possible target for the bears being the 61.75 (S2) support line.

その他の注目材料

Today we get Germany’s ZEW indicators for March, New Zealand’s biweekly Milk auctions Canada’s CPI rates for February, from the US the February’s construction data and industrial production growth rate and just before tomorrow’s Asian session, New Zealand’s current account balance for Q4. In tomorrow’s Asian session, we get from Japan’s machinery orders for January, February’s trade data and the highlight is to be BoJ’s interest rate decision.

GBP/USD Daily Chart

- Support: 1.2830 (S1), 1.2670 (S2), 1.2505 (S3)

- Resistance: 1.2985 (R1), 1.3155 (R2), 1.3310 (R3)

WTICash Daily Chart

- Support: 66.05 (S1), 61.75 (S2), 57.35 (S3)

- Resistance: 70.40 (R1), 74.15 (R2), 77.80 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。