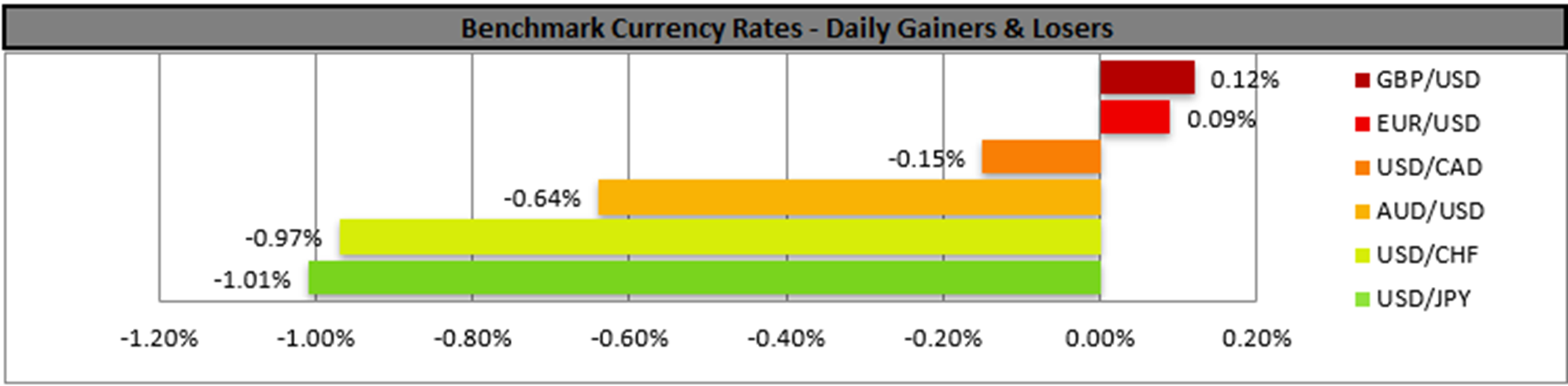

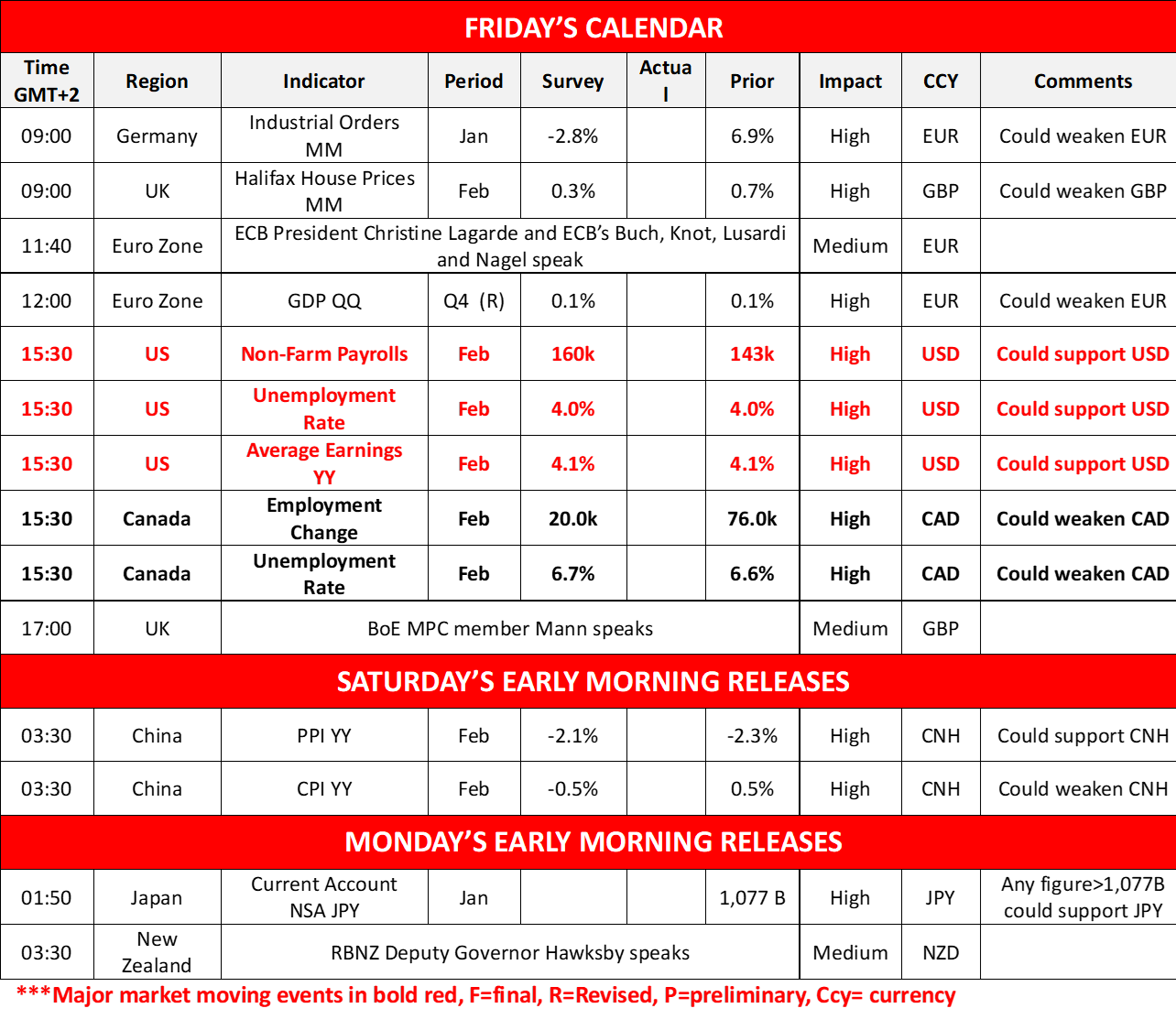

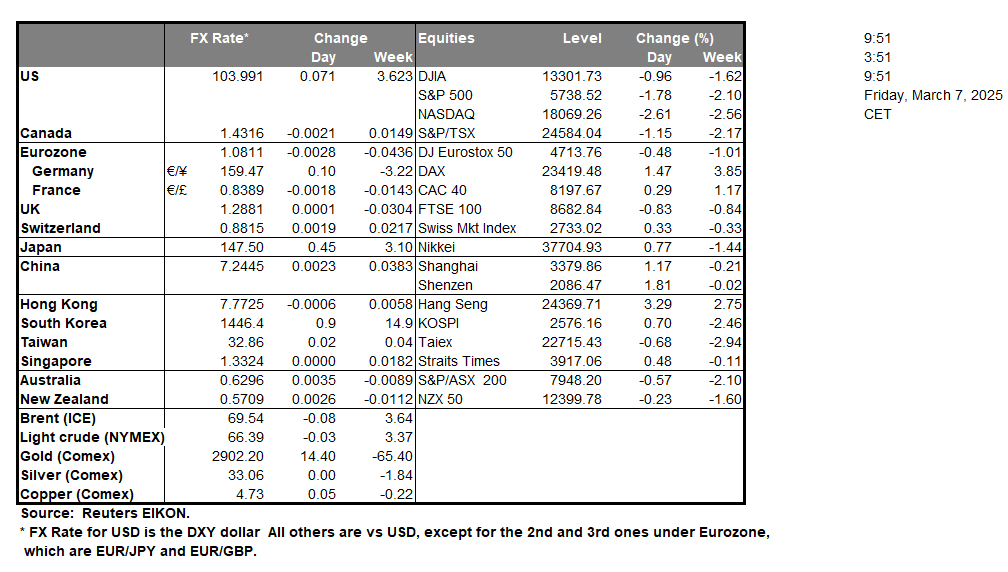

The USD continued to weaken against its counterparts yesterday and markets are increasingly focusing on the release of February’s US employment report in today’s early American session. The Non-Farm Payrolls (NFP) figure is expected to rise to 160k if compared to January’s 143k, while the unemployment rate is expected to remain unchanged at 4.0% and the average earnings growth rate also to remain unchanged at 4.1%yy. Should the actual rates and figures meet their respective forecasts, we may see the USD getting some slight support as the rise of the NFP figure, may excite traders. Overall we see the forecasted picture showing that the US employment market remains relatively tight, thus allowing the Fed to maintain its hesitations in cutting rates further, albeit even the forecasted NFP figure may be relatively low. Should the report imply a tighter-than-expected US employment market we may see the USD getting finally some support. On the other hand, a possibly looser employment market than expected could weigh on the USD. The release may have ripple effects beyond the FX market and signals of a possibly tighter US employment could weigh on US equities and gold’s price.

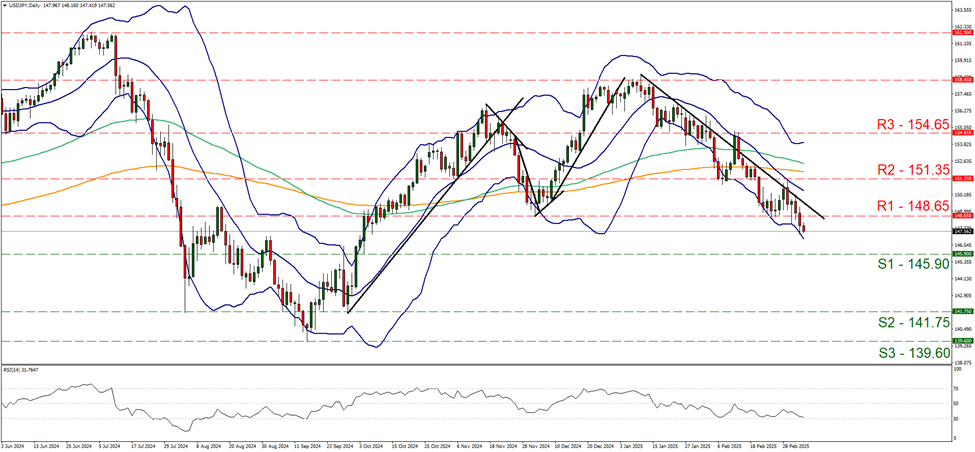

USD/JPY continued to weaken yesterday clearly breaking the 148.65 (R1) support line, now turned to resistance. We intend to maintain our bearish outlook for the pair as long as long as the downward trendline guiding it since the 10 of January remains intact. Also we note that the RSI indicator has practically reached the reading of 30, implying a strong bearish market sentiment for the pair. Should the bears maintain control over the pair, we may see USD/JPY breaking the 145.90 (S1) support line while even lower we note the 141.75 (S2) support level, as the next possible target for the bears. Should the bulls take over, we may see the pair reversing direction, breaking initially the prementioned downward trendline, in a first signal that the downward motion has been interrupted, continue to break the 148.65 (R1) resistance line and start aiming for the 151.35 (R2) resistance barrier.

At the same time as the US employment report for February, we also get Canada’s employment data for the same month. The unemployment rate is expected to tick up to 6.8% if compared to December’s 6.7% and the employment change figure is expected to drop to 20.0k if compared to January’s 76.0k. Overall, the forecasts tend to align in implying a loosening Canadian employment market which in turn could weigh on the Loonie as such data may enhance the dovishness of BoC. The release gains in importance as BoC is set to release its interest rate decision next week and the release of February’s employment data may affect the bank’s stance.

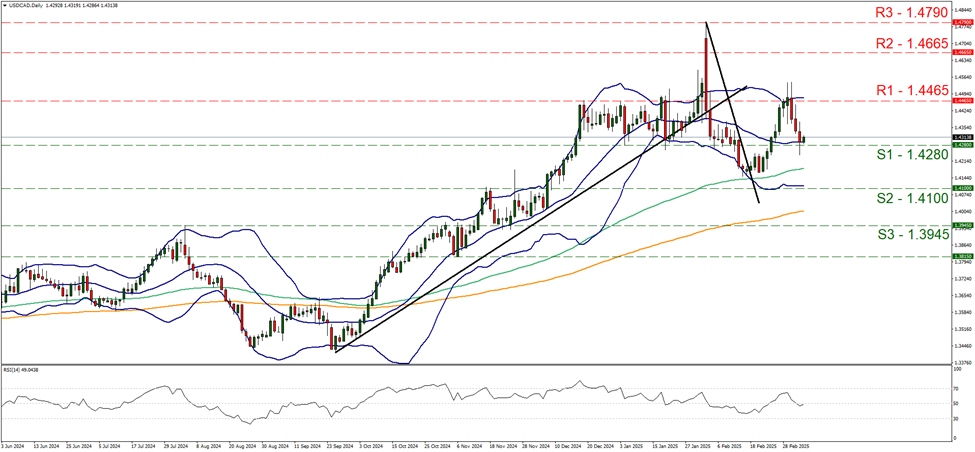

On a technical level, USD/CAD tested the 1.4280 (S1) support line yesterday. The pair seems to have hit a floor at the S1 for the time being and we tend to maintain a bias for a sideways motion for the time being. Furthermore, we note that the RSI indicator tends to remain at the reading of 50, implying a relative indecisiveness on behalf of market participants for the pair. Should the downward motion of the past three days be maintained, we may see the pair breaking the 1.4280 (S1) support line and start aiming for the 1.4100 (S2) support level. A bullish outlook currently seems remote and for its adoption we would require the pair break the 1.4465 (R1) resistance line and start aiming for the 1.4665 (R2) resistance level.

その他の注目材料

In today’s European session, we get Germany’s industrial orders for January, UK’s Halifax House Prices for February and Euro Zone’s revised GDP rate for Q4, while ECB President Christine Lagarde and ECB’s Buch, Knot, Lusardi and Nagel speak. On Saturday we get China’s inflation metrics for February. On Monday’s Asian session, we get Japan’s current account balance for January, while RBNZ Deputy Governor Hawksby speaks.

USD/JPY Daily Chart

- Support:145.90 (S1), 141.75 (S2), 139.60 (S3)

- Resistance: 148.65 (R1), 151.35 (R2), 154.65 (R3)

USD/CAD Daily Chart

- Support: 1.4280 (S1), 1.4100 (S2), 1.3945 (S3)

- Resistance: 1.4465 (R1), 1.4665 (R2), 1.4790 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。