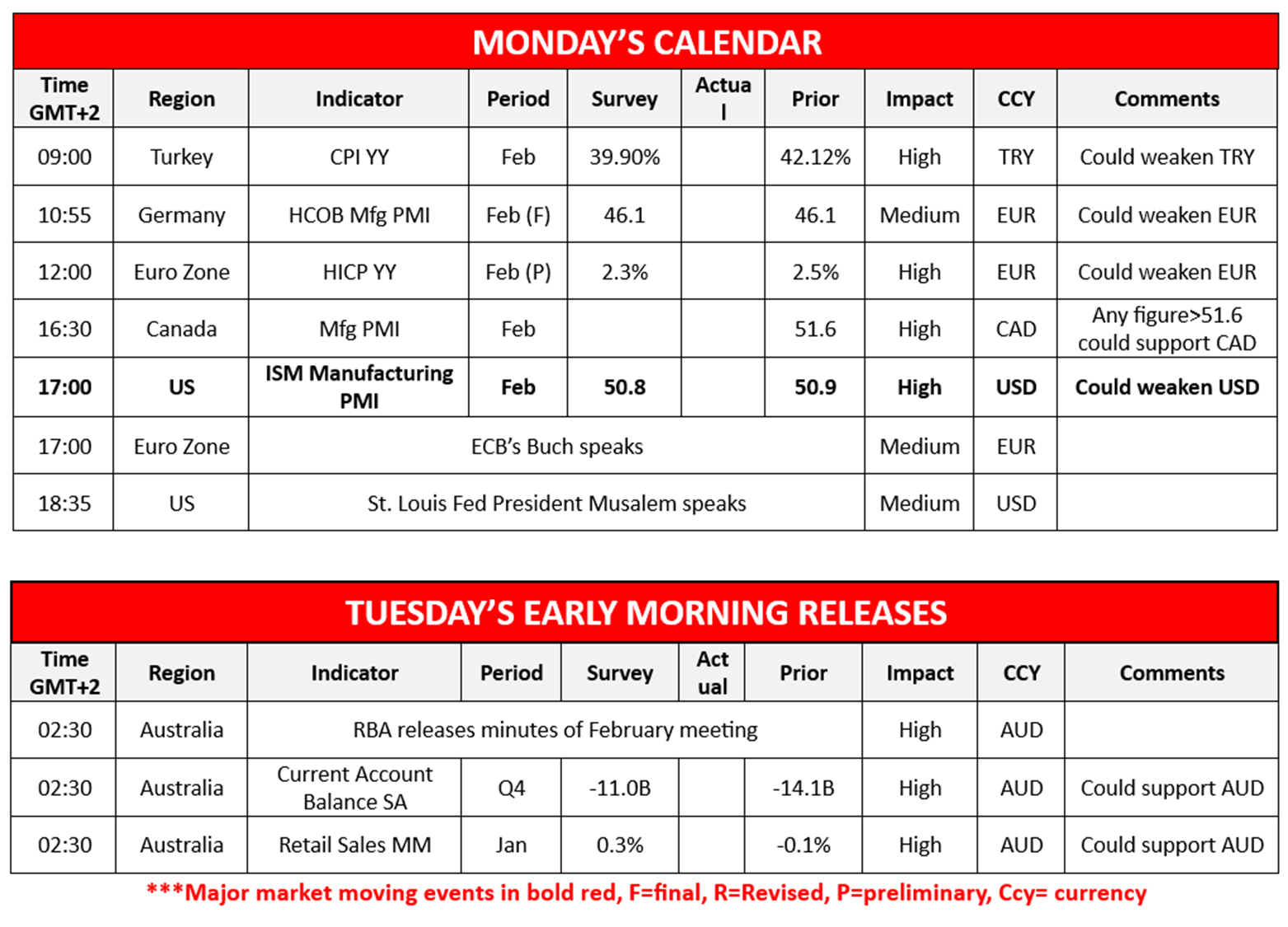

The Eurozone’s preliminary HICP is set to be released later on today. The current market expectations, are for the HICP rate to ease from 2.5% to 2.3% which could imply easing inflationary pressures in the Eurozone. Thus, should the rate come in as expected or lower, it could increase pressure on the ECB to maintain it’s rate cutting approach as inflation nears the banks 2% target and in turn may weigh on the EUR. On the other hand, should the HICP rate come in higher than expected implying persistent inflationary pressures in the Zone, it may have the opposite effect and could thus lead to ECB policymakers adopting a more cautionary approach, which could entail remaining on hold. Therefore, an HICP rate higher than the expected rate could in turn aid the EUR. In our view, if the preliminary HICP rate comes in lower than the prior rate of 2.5%, we wouldn’t be surprised to see ECB policymakers adopting a more dovish tone, as inflation in that scenario would move close to the bank’s 2% target. Yet, should the HICP rate showcase an unexpected acceleration in inflationary pressures, i.e coming in higher than 2.5%, we wouldn’t be surprised to see some concerns emerging from ECB policymakers.In tomorrow’s Asian session, the RBA February meeting minutes are going to be interesting. Specifically, the bank cut rates by 25 basis points in their last meeting, with policymakers highlighting the uncertain outlook in their accompanying statement.Hence in our view ,we would not be surprised to see the minutes showcasing a willingness by RBA policymakers to continue cutting rates, yet stressing concern in regards to the economy and the possibility of adopting a more gradual rate cutting approach. Nonetheless, should the minutes be perceived as dovish in nature it could weigh on the Aussie, whereas should they be perceived as predominantly hawkish in nature it may aid the AUD.

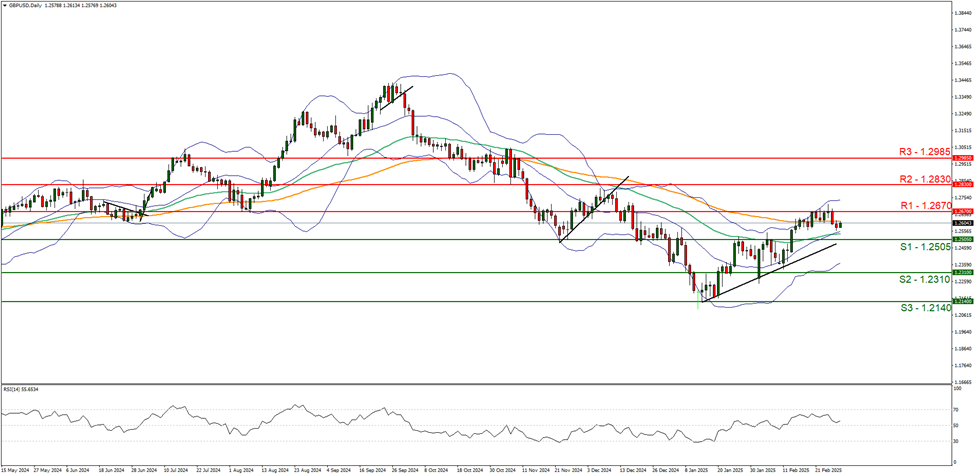

GBP/USD appears to be moving in a sideways fashion after having failed to break above our 1.2670 (R1) resistance line. We opt for a sideways bias for the pairs direction and supporting our case is the RSI indicator below our chart which currently registers a figure close to 50, implying a neutral market sentiment. However, we would like to note that our upwards moving trendline which was incepted on the 14 of January remains intact. Nonetheless, for our sideways bias to be maintained we would require the pair to remain confined between the 1.2505 (S1) support level and the 1.2670 (R1) resistance line. On the flip side for a bullish outlook we would require a clear break above the 1.2670 (R1) resistance level, with the next possible target for the bulls being the 1.2830 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.2505 (S1) support level with the next possible target for the bears being the 1.2310 (S2) support line.

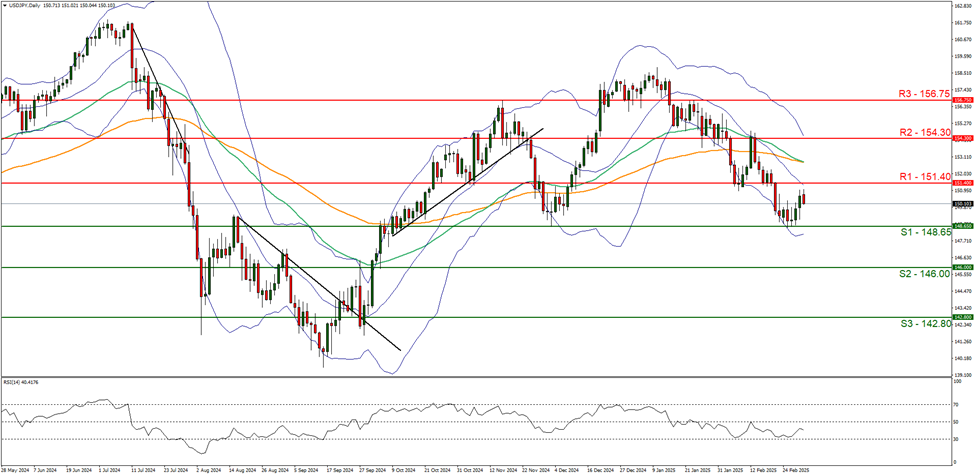

USD/JPY appears to be moving in a downwards fashion, despite bouncing off our 148.65 (S1) support level. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator which currently registers a figure of 40, implying a bearish market sentiment. For our bearish outlook to continue we would require a clear break below the 148.65 (S1) support level, with the next possible target for the bears being the 146.00 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between the 148.65 (S1) support level and the 151.40 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 151.40 (R1) resistance line with the next possible target for the bulls being the 154.30 (R2) resistance level.

その他の注目材料

Today we get Turkey’s CPI rate, Germany’s final HBOC manufacturing PMI figure the Eurozone’s preliminary HICP rate, Canada’s Manufacturing PMI figure and lastly the US ISM Manufacturing PMI figure all for February. Today we would like to also note the speeches by ECB Buch and St Louis Fed President Musalem. In tomorrow’s Asian session we make a start with the release of the RBA’s February meeting minutes, followed by Australia’s trade balance figure for Q4 and retail sales rate for January.

GBP/USD Daily Chart

- Support: 1.2505 (S1), 1.2310 (S2), 1.2140 (S3)

- Resistance: 1.2670 (R1), 1.2830 (R2), 1.2985 (R3)

USD/JPY Daily Chart

- Support: 148.65 (S1), 146.00 (S2), 142.80 (S3)

- Resistance: 151.40 (R1), 154.30 (R2), 156.75 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。