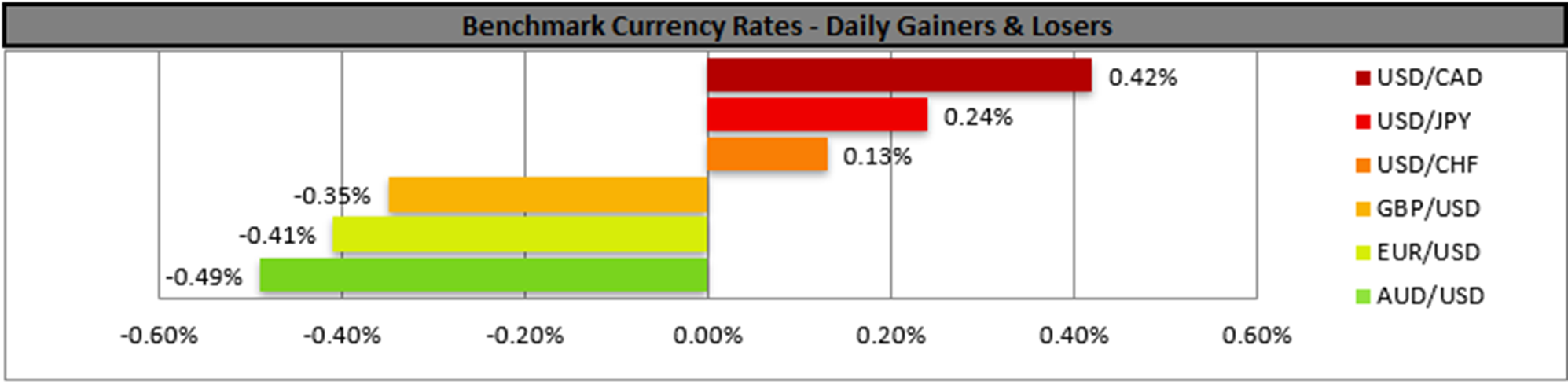

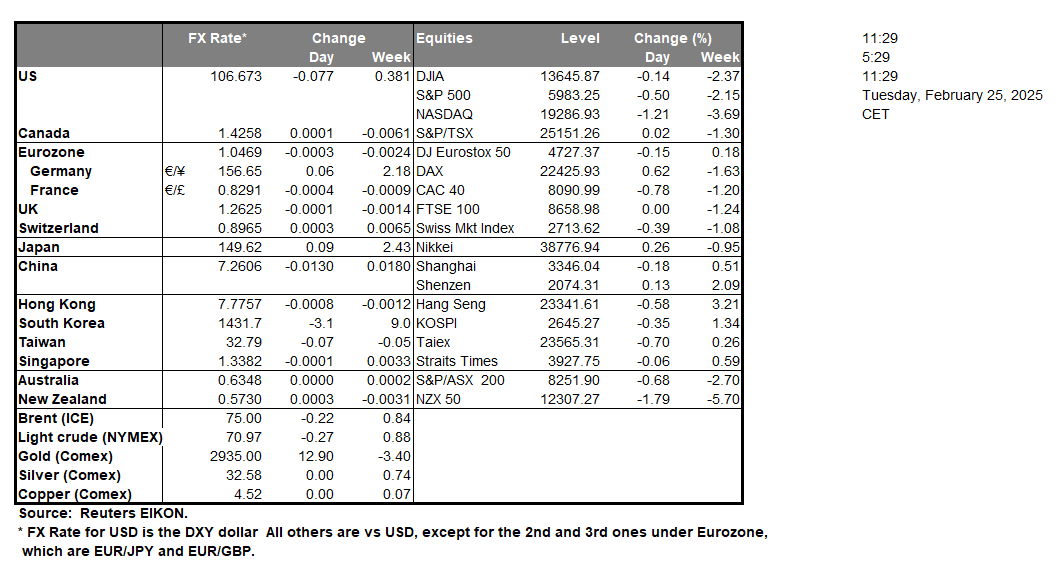

The USD regained some of the lost ground yesterday against its counterparts as market worries for tariffs on US imports intensified once again. US President Trump stated that the planned tariffs on US imports from Canada and Mexico are “on time and on schedule”, a statement that was interpreted that they will proceed as expected. It should be noted that the US is to impose tariffs on Canadian and Mexican products despite the efforts of the two countries to enhance security, at the southern and northern US border. There were hopes that the two countries could persuade Trump to further delay the tariffs, yet to no avail, as it seems. Overall, the situation seems to have boosted USD safe haven inflows as the uncertainty among market participants is being enhanced. At the same time, the bearish sentiment for US stockmarkets seems to continue, while gold’s price despite easing the slope of its upward direction, seems to still be dominated by the bulls.

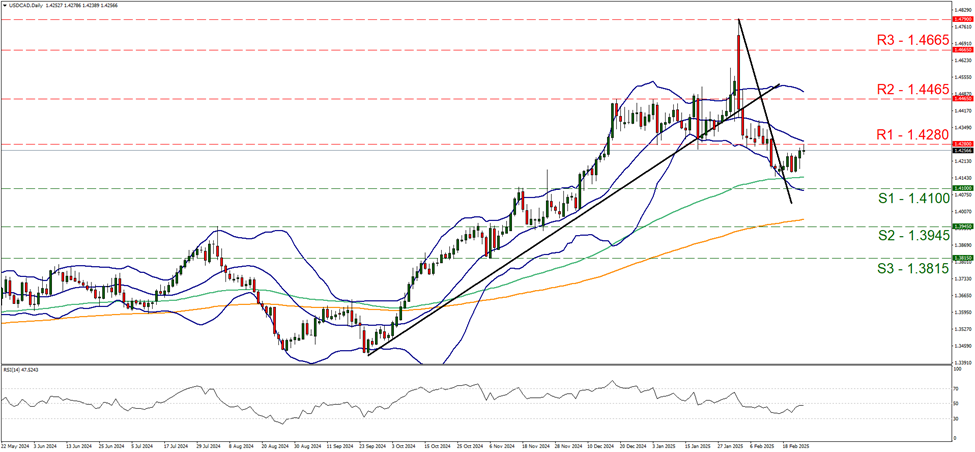

USD/CAD edged higher yesterday and during today’s Asian session, tested the 1.4280 (R1) resistance line. Yet for the time being, we still refrain from a bullish outlook for the pair and maintain our bias for a sideways motion of the pair between the 1.4280 (R1) resistance line and the 1.4100 (S1) support level. We also note that the RSI indicator has risen yet remains below the reading of 50, implying that the bearish sentiment has eased yet a bullish sentiment for the pair is still to be seen. For the adoption of a bullish outlook we would require the pair to break clearly the 1.4280 (R1) resistance level and start aiming for the 1.4465 (R2) resistance base. Should the bears take over, we may see the pair breaking he 1.4100 (S1) support line and set as the next possible target for the bears the 1.3745 (S2) support barrier.

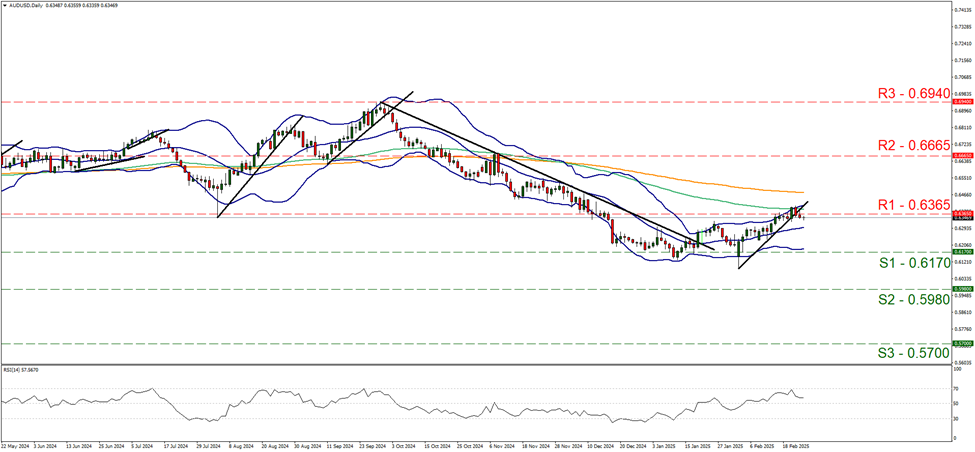

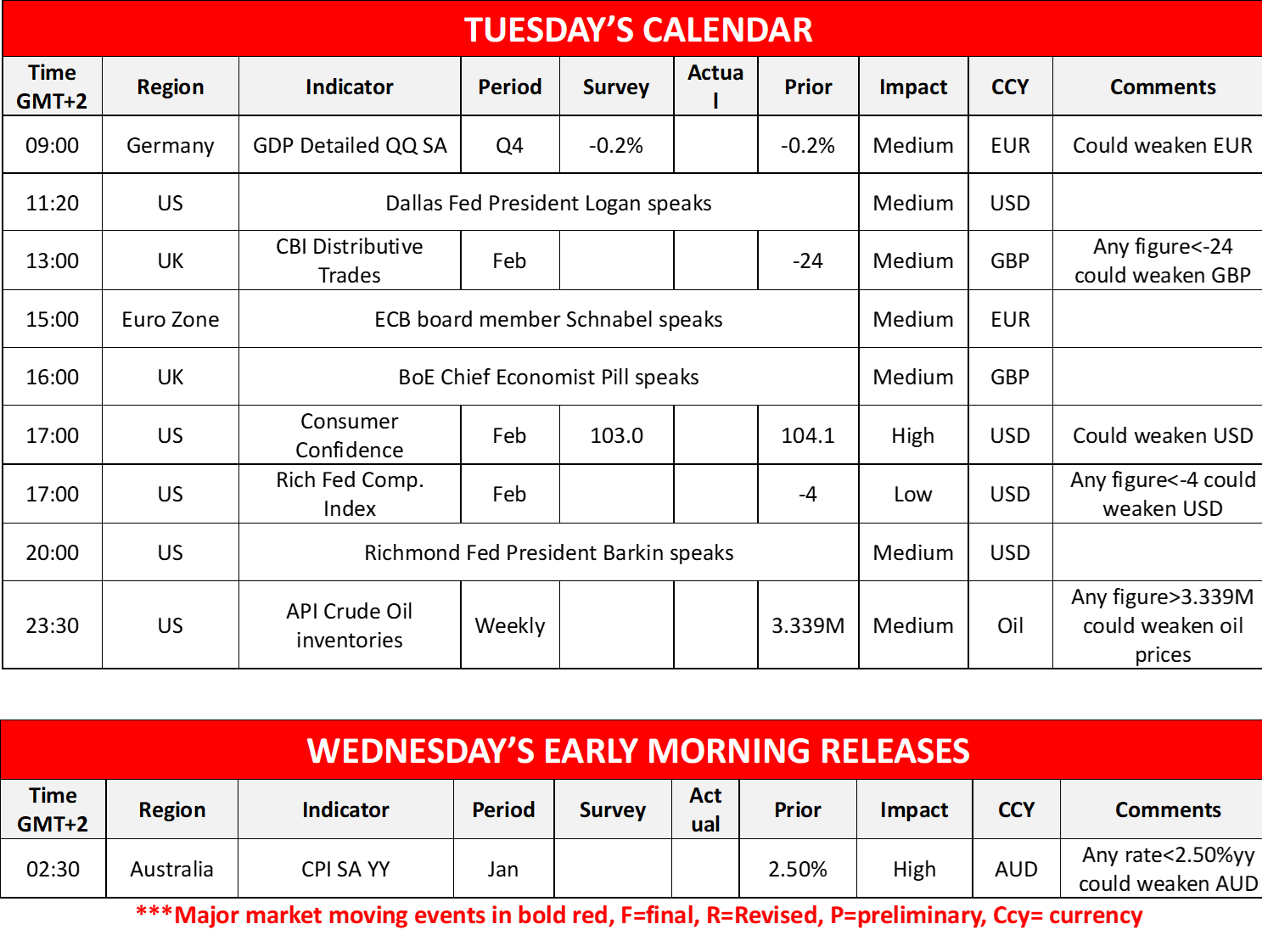

In tomorrow’s Asian session, we shift our attention to the release of Australia’s CPI rates for January. The release could affect the market’s expectations for RBA’s stance, which currently seems to expect a rate cut in the May meeting and another rate cut in September. On a macroeconomic level, we note the release of Australia’s employment data for January last week. The release showed a tighter-than-expected Australian employment market as the employment change figure, dropped less than expected. Should the CPI rates show a resilience of inflationary pressures in the Australian economy we may see the pressure on RBA to keep rates unchanged for a longer period intensifying and thus providing some support for AUD. Also given the market’s perception for the Aussie as a riskier asset given its commodity nature, should the market sentiment turn more cautious, it could weigh on AUD.

On a technical level, AUD/USD edged lower breaking the 0.6365 (R1) support line, now turned to resistance. We tend to maintain a bias for a sideways motion of the pair given also the clear breaking of the upward trendline guiding the pair since the 3rd of February. We also note that the RSI indicator, has dropped from the highs of 70 on Thursday and is currently nearing the reading of 50, implying a substantial easing of the bullish sentiment among market participants for the pair. A bearish outlook currently seems remote and for its adoption, we would require the pair to break the 0.6170 (S1) support line clearly. For a renewal of the bullish outlook we would require the pair to break the 0.6365 (R1) resistance line and start aiming for the 0.6665 (R2) resistance level.

その他の注目材料

Today we get Germany’s detailed GDP rate for Q4 and the UK’s CBI distributive trades for February, while on the monetary front, Dallas Fed President Logan, ECB Board member Schnabel and BoE Chief Economist Pill are scheduled to speak. In the American session, we get from the US the consumer confidence and Richmond’s Fed Composite index, both being for February, as well as the API weekly crude oil inventories figure, while Richmond Fed President Barkin speaks.

USD/CAD Daily Chart

- Support: 1.4100 (S1), 1.3945 (S2), 1.3815 (S3)

- Resistance: 1.4280 (R1), 1.4465 (R2), 1.4665 (R3)

AUD/USD デイリーチャート

- Support: 0.6170 (S1), 0.5980 (S2), 0.5700 (S3)

- Resistance: 0.6365 (R1), 0.6665 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。