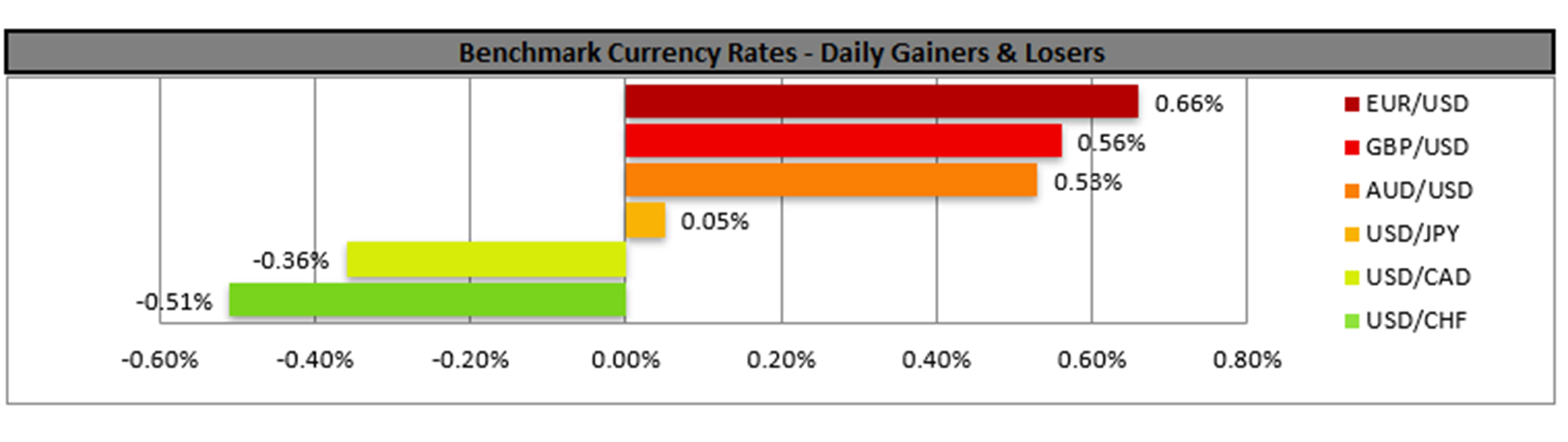

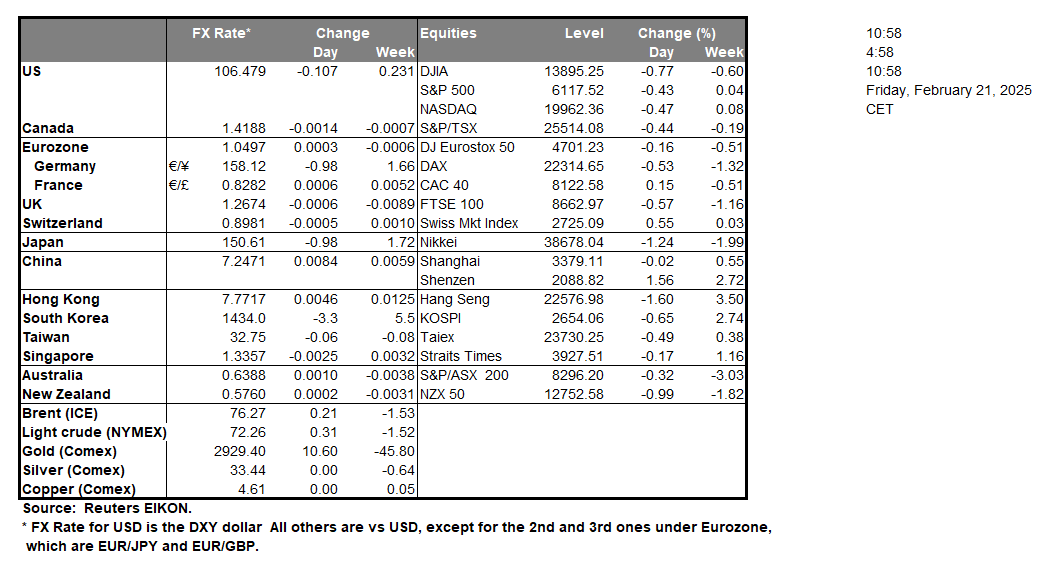

Japan’s CPI rate for January were released earlier on today. We would like to focus on the Core CPI rate for January, which came in hotter than expected by coming in at 3.2% versus the expected rate of 3.1% and higher than the prior rate of 3.0%. In turn the acceleration of inflationary pressures in the Japanese economy may increase pressure on the BOJ to resume their rate hiking cycle, which in turn could aid the JPY. Over in Europe, the release of January’s services, manufacturing and composite preliminary PMI figures for France,Germany and the Zone respectively, are set to be released during today’s European station. The preliminary PMI figures may provide great insight into the current situation in the Zone and could thus have a profound impact on the common currency.On a political level, Germany’s elections are set to take place on Sunday. The latest polls by POLITICO have the CDU/CSU in first place at 30%, with the AfD in second place at 21% and the SPD in third place at 16%. Should the polls be materialized, the CDU/CSU would be given the opportunity to form a coalition Government because as things stand they would require to form a coalition government. Interestingly the polls also show that the Left, BSW and FDP are all set to enter the Bundestag which could complicate matters for a coalition government. Overall, the party that wins the elections and is given the mandate to form a government may face a particularly difficult task ahead which could in turn impact the EUR should the political situation in Germany deteriorate.

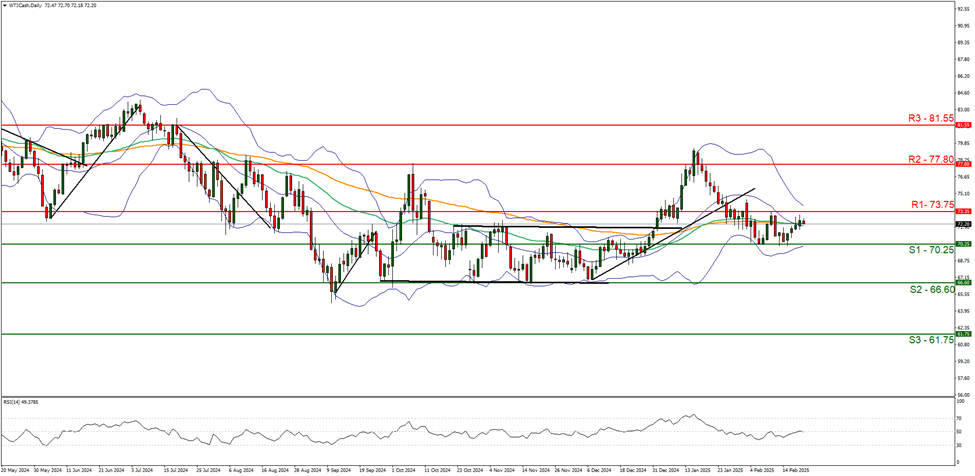

WTICash appears to be moving in a sideways fashion. We opt for a neutral outlook for the commodity’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the commodity’s price to remain confined between the 70.25 (S1) support level and the 73.75 (R1) resistance line. On the other hand for a bearish outlook we would require a clear break below the 70.25 (S1) support level with the next possible target for the bears being the 66.60 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 73.75 (R1) resistance line with the next possible target for the bulls being the 77.80 (R2) resistance level.

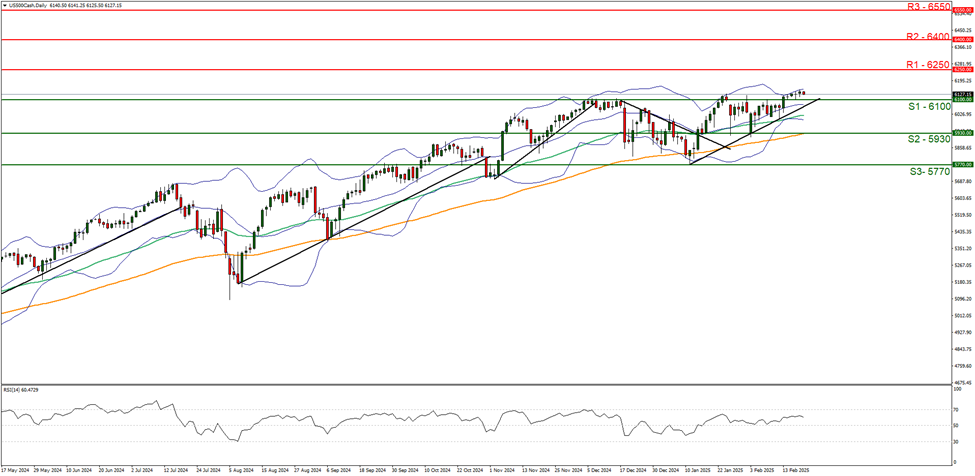

US500 appears to be moving in an upwards fashion. We opt for a bullish outlook for the index and supporting our case is the RSI indicator below our chart which currently registers a figure close to 60, implying a bullish market sentiment in addition to the upwards moving trendline which was incepted on the 13 of January. For our bullish outlook to continue, we would require a clear break above the possible 6250 (R1) resistance level with the next possible target for the bulls being the 6400 (R2) resistance line. On the flip side for a bearish outlook we would require a clear break below our 6100 (S1) support level with the next possible target for the bears being the 5930 (S2) support line. Lastly, for a sideways bias we would require the index’s price to remain confined between the 6100 (S1) support level and the possible 6250 (R1) resistance line.

その他の注目材料

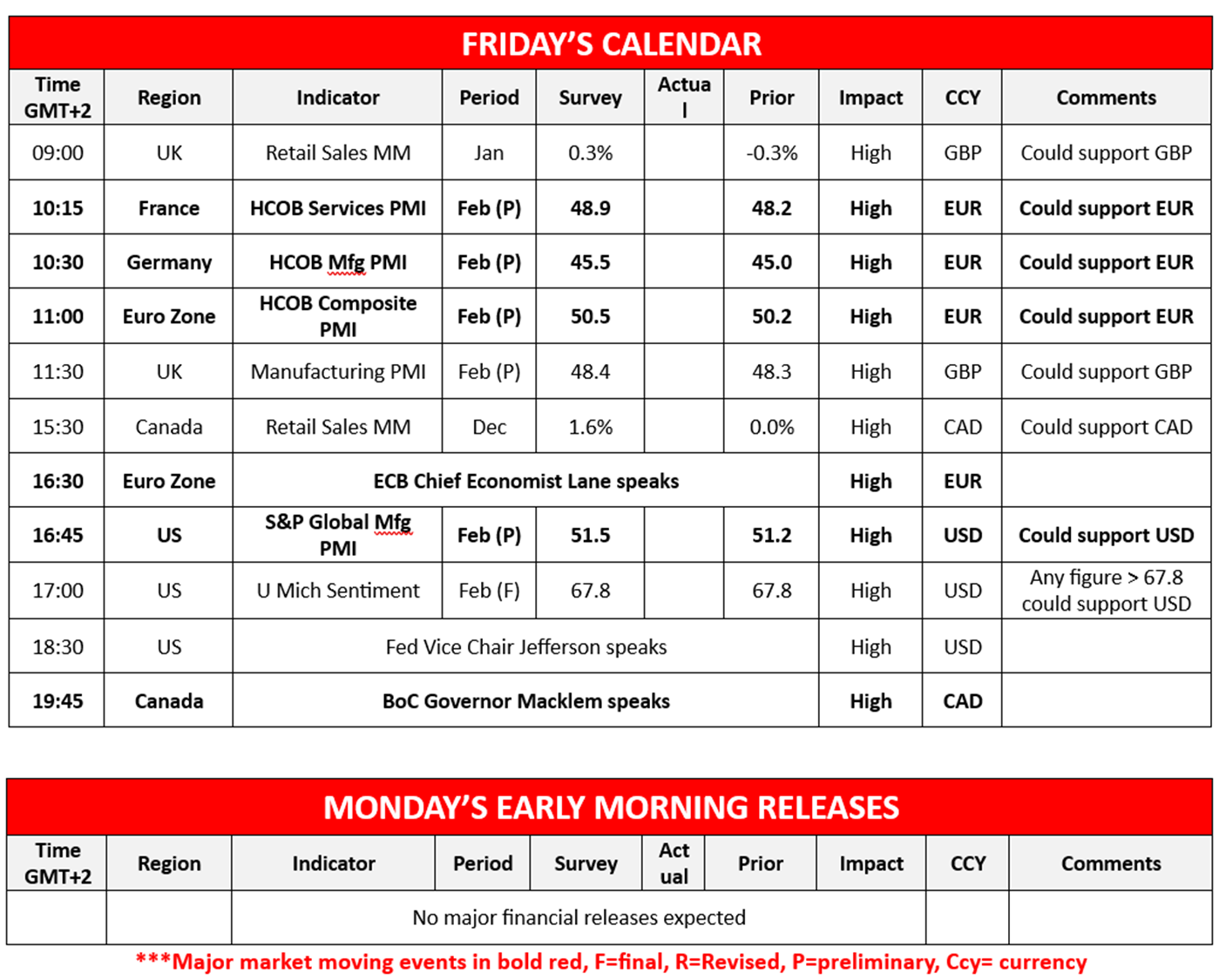

Today we get the UK’s retail sales rate for January, France’s preliminary services PMI figure, Germany’s preliminary manufacturing PMI figure and the Eurozone’s preliminary composite PMI figure all for the month of February in addition to the UK’s preliminary manufacturing PMI figure for February. In the American session, we note Canada’s retail sales rate for December, the US S&P preliminary manufacturing PMI figure and the US final University of Michigan consumer sentiment figure both for February. On a monetary level, we note the speeches by ECB Chief Economist Lane, Fed Vice Chair Jefferson and BoC Governor Macklem.

WTICash Daily Chart

- Support: 70.25 (S1), 66.60 (S2), 61.75 (S3)

- Resistance: 73.75 (R1), 77.80 (R2), 81.55 (R3)

US500 Daily Chart

- Support: 6100 (S1), 5930 (S2), 5770 (S3)

- Resistance: 6250 (R1), 6400 (R2), 6550 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。