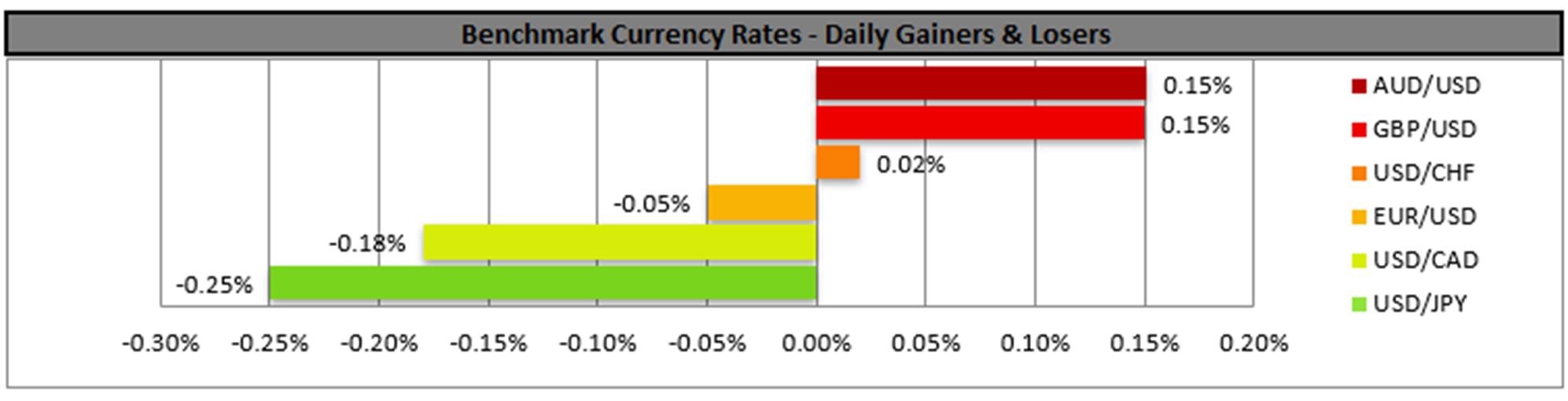

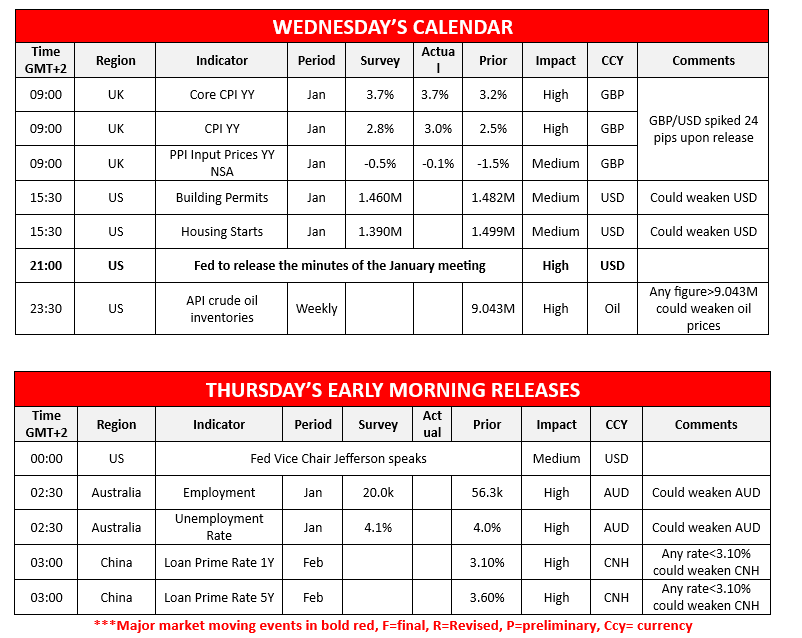

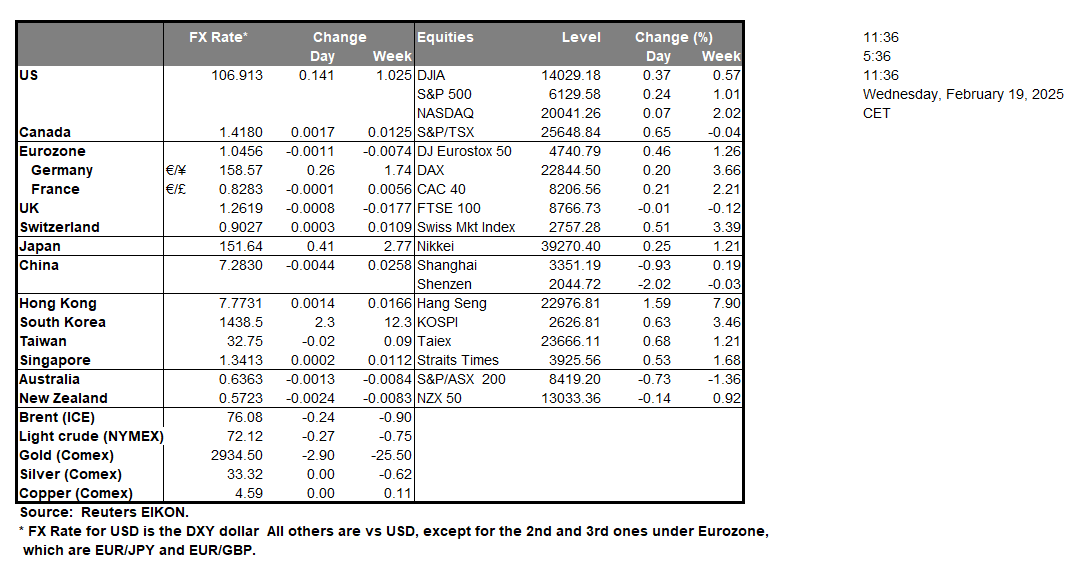

The USD tended to remain supported in the FX market yesterday as fundamentals continued to provide safe haven inflows for the greenback. On the one hand, US President Trump intentions to impose 25% tariffs on US imports of cars, pharmaceuticals and chips, on the other, the developments in the US-Russian negotiations for Ukraine tend to enhance uncertainty about the outlook on a global level. On a monetary level, we highlight the release of the Fed’s January meeting minutes, late in the American session today. Should the document enhance market expectations that the bank is in no hurry to cut rates or even delay any rate cut further, we may see the USD gaining as it would imply tight financial conditions in the US economy for a longer period. On the flip side, should the minutes show that the bank is willing to deliver a rate cut earlier that what the market currently expects the release may weigh on the USD.

Across the pond we note the acceleration of the UK CPI rates for January, with the release highlighting the resilience of inflationary pressures in the UK economy. If the CPI rates are combined with the stronger-than-expected employment data for December, macroeconomic data increase the pressure on the BoE to delay the next rate cut, which may support the GBP.

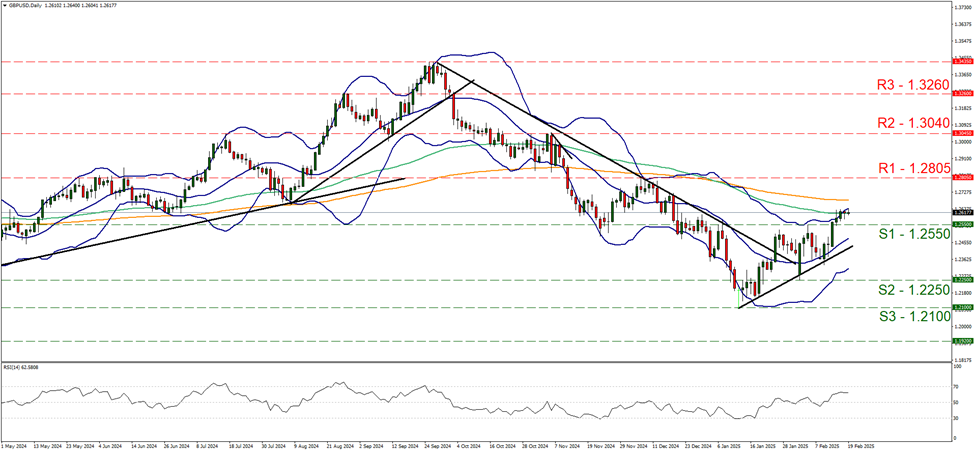

GBP/USD seems to have stabilised yesterday, just above the 1.2550 (S1) support line. In its lack of movement the pair seems to be forming a new higher peak, diverging higher from the upward trendline supporting the pair’s price action since the 13 of January. The price action stabilised after hitting on the upper Bollinger band, while the RSI indicator remains above the reading of 50 implying the presence of a bullish predisposition of the market for cable. We expect that the pair may correct lower, yet as long as cable’s price action remains above the prementioned upward trendline, we maintain our bullish outlook for the pair. Should the bulls maintain control as expected, we may see the pair rising and aiming if not breaking the 1.2805 (R1) line. A bearish outlook seems remote currently and for its adoption we would require the pair to break the 1.2550 (S1) support level, continue to also break the prementioned upward trendline in a first signal that the upward movement has been interrupted and continue lower to test the 1.2250 (S2) barrier.

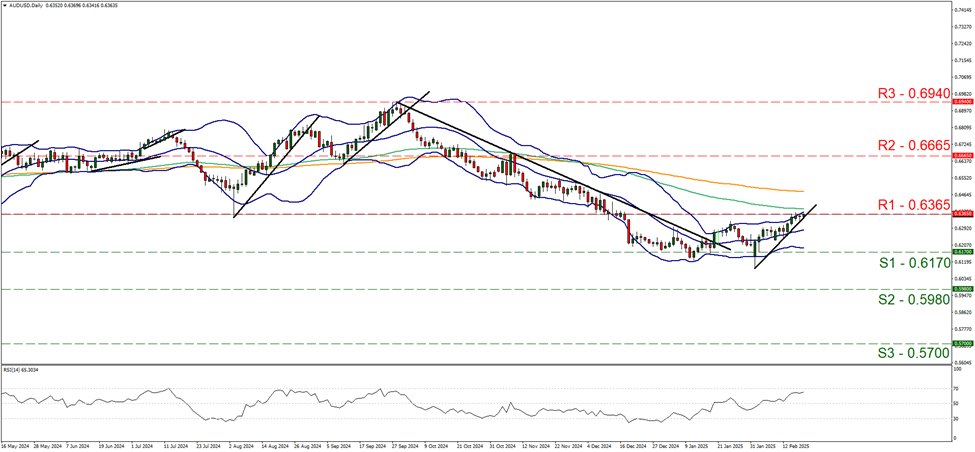

In tomorrow’s Asian session in the land down under, we note the release of January’s employment data. The employment change figure is expected to drop to 20.0k if compared to December’s 56.3k and the unemployment rate to tick up to 4.1% if compared to December’s 4.0%. Given also the slowdown of the average earnings growth rate for Q4, should the forecasts be realised, there would be another signal of easing of the Australian employment market and thus could weaken the Aussie. The release gets more attention given the recent rate cut by RBA, which seems to place attention to the employment market along inflation.

On a technical level, AUD/USD seems to have difficulties in breaking the 0.6365 (R1) resistance line. For the time being we maintain a bullish outlook for the pair yet we note that AUD/USD has reached a make or break point for the bulls, as the upward trendline guiding the pair since the 3rd of February is being put to the test. Should the bulls maintain control over the Aussie, we may see AUD/USD breaking the 0.6365 (R1) resistance line and start aiming for the 0.6665 (R2) resistance level. Should the bears take charge of the pair’s direction we may see AUD/USD reversing course, breaking the 0.6170 (S1) support line, with the next target being set at the 0.5980 (S2) support base.

その他の注目材料

Today we get the US number of building permits and housing starts for the past month. Oil traders may be more interested in the release of the weekly API crude oil inventories figure. In tomorrow’s Asian session, we note the speech of Fed Vice Chair Jefferson, while we highlight the release of China’s PBoC interest rate decision.

GBP/USD Daily Chart

- Support: 1.2550 (S1), 1.2250 (S2), 1.2100 (S3)

- Resistance: 1.2805 (R1), 1.3040 (R2), 1.3260 (R3)

AUD/USD Cash Daily Chart

- Support: 0.6170 (S1), 0.5980 (S2), 0.5700 (S3)

- Resistance: 0.6365 (R1), 0.6665 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。