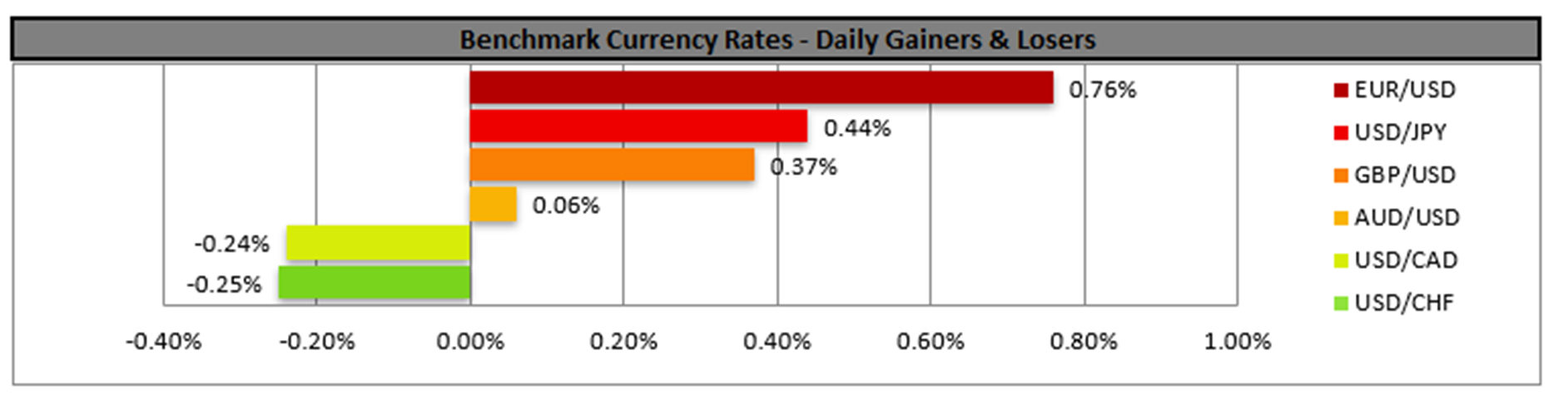

The US CPI rates for January on a headline and core level on a year-on-year basis were released yesterday. Notably the Core CPI rate was expected to showcase easing inflationary pressures, yet by coming in at 3.3% versus the expected rate of 3.1%, that narrative has changed. Moreover, the headline CPI rate also accelerated to 3.0% from 2.9%, implying that inflationary pressures in the US economy remain elevated and could upend the Fed’s progress in its battle against inflation. In turn the possibility of the Fed cutting rates according to FFF has shifted from July to September 2025, implying that the Fed may remain on hold for a prolonged period of time, which may have aided the dollar. In our view we would not be surprised to see a more ‘restrictive’ rhetoric emerging from Fed policymakers, such as Atlanta Fed President Bostic who stated yesterday that “It’s going to take a while to just figure out what is going”. Overall, the hawkish rhetoric that appears to be emerging from policymakers could aid the greenback. Over in the UK the preliminary GDP rate for Q4 came in better than expected on all counts, implying economic growth in the UK economy. In particular on a year-on-year level for Q4 the GDP came in at 1.4% which is higher than the expected rate of 1.1%.In general the better-than-expected preliminary GDP rates for Q4 could potentially aid the pound, as it may imply that the UK economy is resilient. In France, French Prime Minister Bayrou has survived another no-confidence vote yesterday, with Bloomberg stating that his survival has now cleared the way forward towards implementing a delayed 2025 budget. This is the 5th attempt to oust Prime Minister Bayrou since his appointment in December.

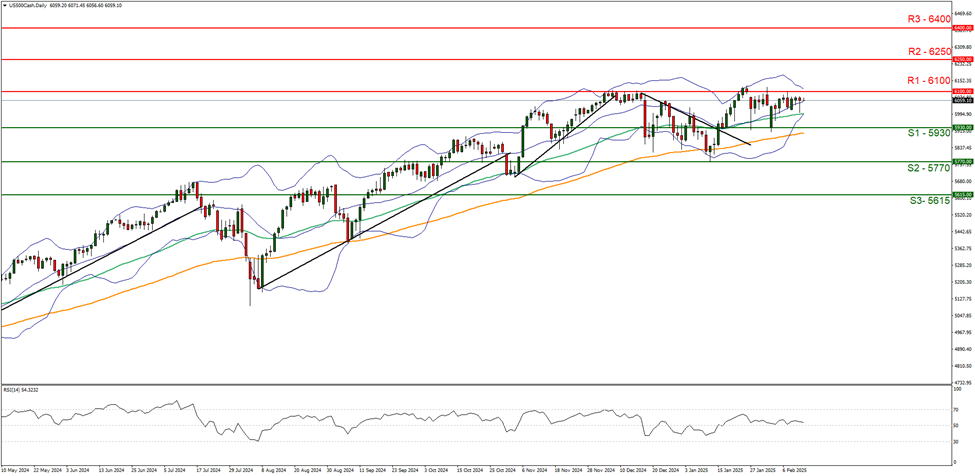

The S&P 500 appears to be moving in a predominantly sideways fashion. We opt for a sideways bias for the index, despite the RSI indicator below our chart ticking upwards and closing on the 60 figure, which may imply bullish market tendencies. Nonetheless, for our sideways bias to be maintained we would require the index’s price to remain confined between the 5930 (S1) support level and the 6100 (R1) resistance line. On the flip side for a bullish outlook, we would require a clear break above the 6100 (R1) resistance line with the next possible target for the bulls being the 6250 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 5930 (S1) support level, with the next possible target for the bears being the 5770 (S2) support base.

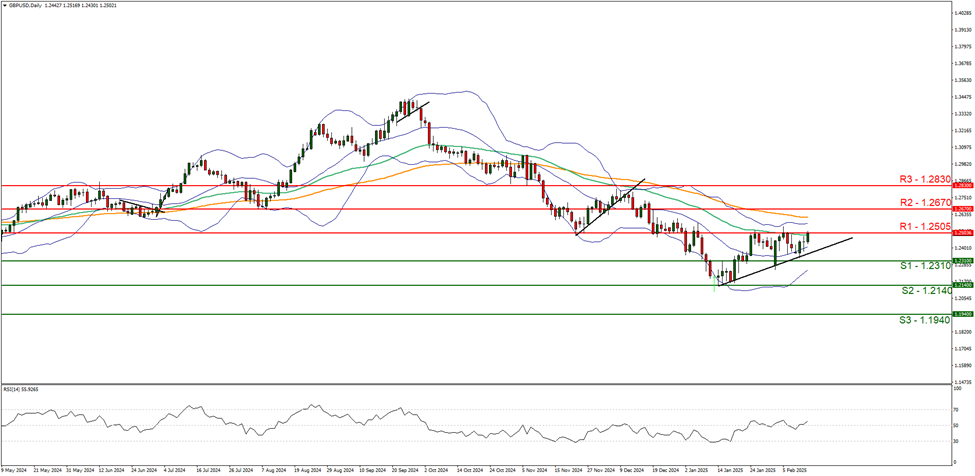

GBP/USD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the upwards-moving trendline which was incepted on the 14th of January. However would like to point out that the RSI indicator below our chart currently registers a figure close to 50. Nonetheless, for our bullish outlook to continue we would require a clear break above the 1.2505 (R1) resistance line, with the next possible target for the bulls being the 1.2670 (R2) resistance level. On the flip side for a sideways bias, we would require the pair to remain confined between the 1.2310 (S1) support level and the 1.2505 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.2310 (S1) support line with the next possible target for the bears being the 1.2140 (S2) support base.

その他の注目材料

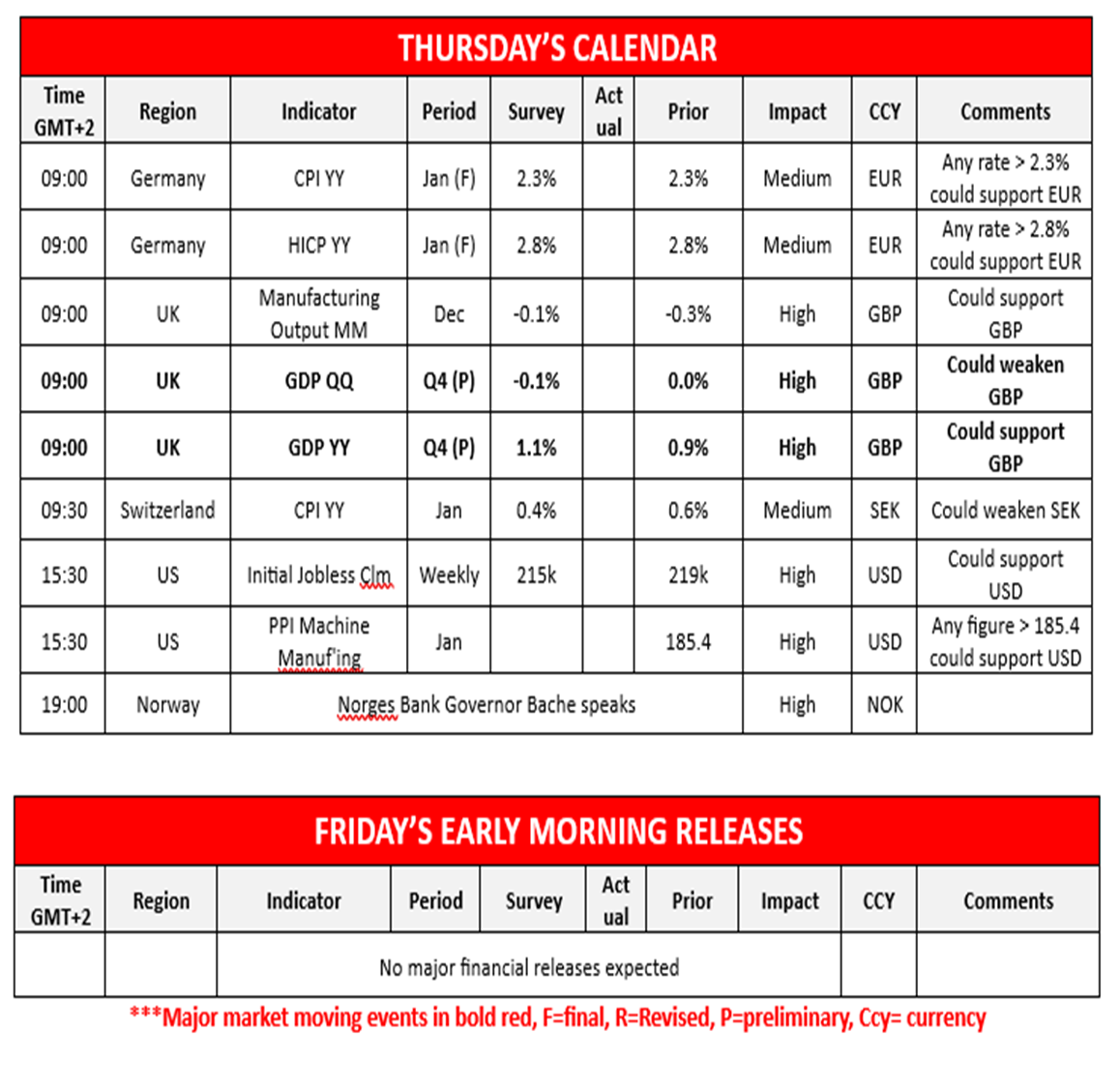

Today we note the release of Germany’s final HICP rates for January, followed by the UK’s manufacturing rate for December, the UK’s preliminary GDP rates for Q4, Switzerland’s CPI rate for January, the US weekly initial jobless claims figure and the US PPI Machine manufacturing figure for January. On a monetary level, we would like to note the speech by Norges Bank Governor Bache.

US500 Daily Chart

- Support: 5930 (S1), 5770 (S2), 5615 (S3)

- Resistance: 6100 (R1), 6250 (R2), 6400 (R3)

GBP/USD Daily Chart

- Support: 1.2310 (S1), 1.2140 (S2), 1.1940 (S3)

- Resistance: 1.2505 (R1), 1.2670 (R2), 1.2830 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。