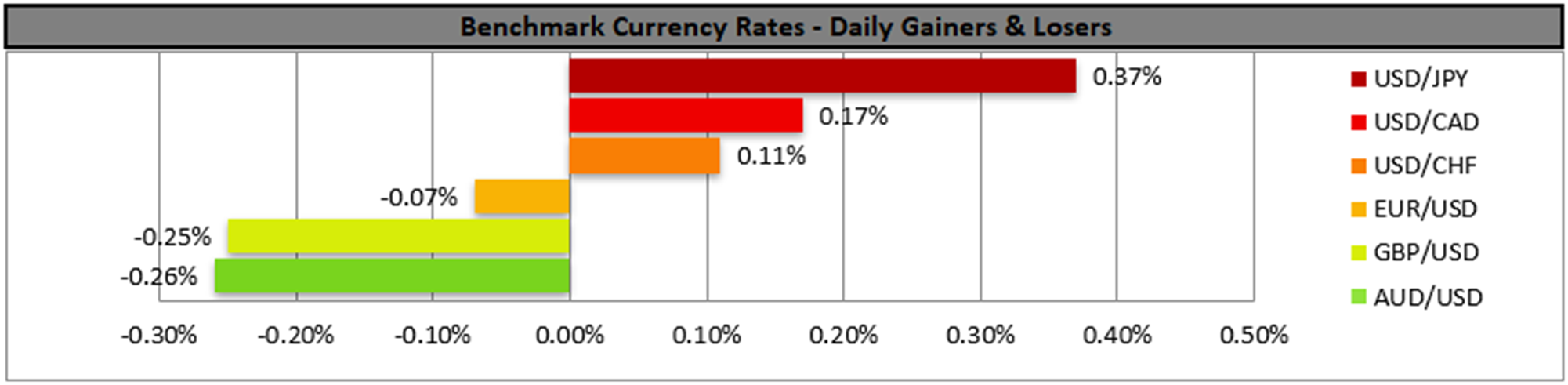

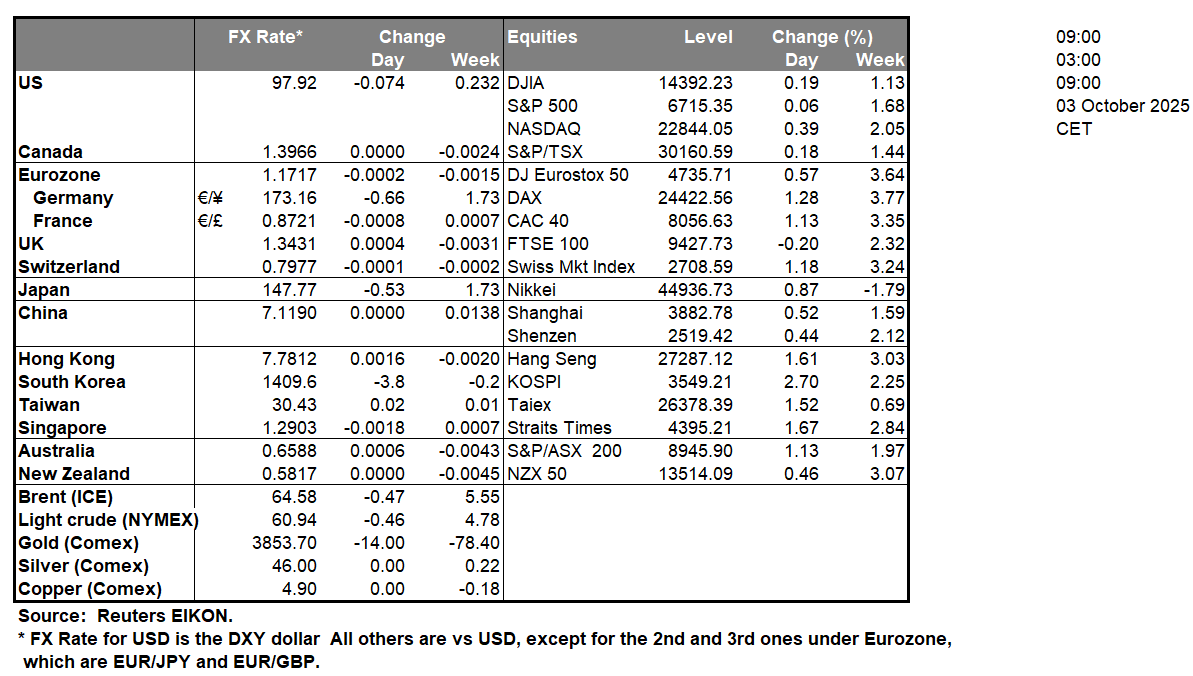

The shutdown of the US Government is entering its third day, maintaining uncertainty in the market. The market’s worries for the US employment market tend to intensify as due to the shutdown, the release of the US employment report for September is to be delayed. The worries for the US employment market intensify further as alternative sources, point towards sluggish hiring and no change in the unemployment rate. Furthermore, we highlight US President Trump’s considerations to fire thousands of federal workers with the opportunity of the shutdown. Such a move could enhance the slack in the US employment market, while the shutdown as such may cause a contraction of the economy on a regional level, in areas such as Washington DC should it be prolonged for a substantial period. We continue to see the case for the US Government shutdown as an issue that could weigh on the USD and US stock markets as uncertainty is maintained.

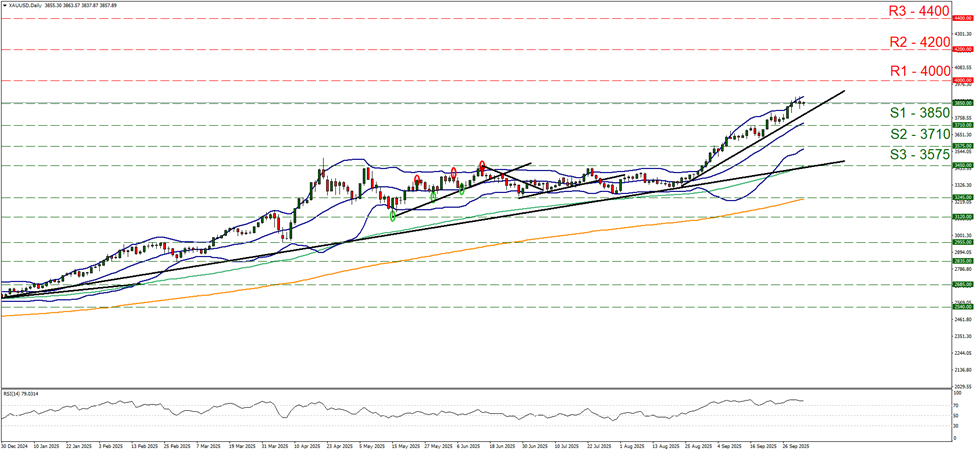

Gold’s bulls seem to be getting a breather as the precious metal’s price stabilised just above the 3850 (S1) support line. The upward trendline guiding the precious metal’s price remains intact though, hence we maintain our bullish outlook for gold. The RSI indicator remains above the reading of 70, in a testament of the strong bullish market sentiment for gold’s price yet also as a warning that gold’s price is at overbought levels and possibly ripe for a correction lower. Should the bulls maintain control over gold’s price, we may see it aiming for the 4000 (R1) resistance line. On the flip side for the adoption of a bearish outlook, a scenario we currently view as remote, we would require gold’s price to break the 3850 (S1) support line continue to break the prementioned upward trendline in a first signal that the upward motion has been interrupted and continue to also break the 3710 (S2) support base.

Across the world JPY tended to weaken yesterday despite preparing to end the week in the greens against the USD, GBP and EUR in a sign of wider strength. The safe haven inflows for JPY, deriving from the US Government shutdown are still present, yet JPY traders are turning their attention to the leadership election of the new leader of the LDP, which is to largely also decide Japan’s new PM. The new Government is expected to influence Japan’s fiscal policy but also the Japanese government’s approach to BoJ’s monetary policy. Frontrunners for the election seem to oppose BoJ’s intentions to tighten its monetary policy which was in the epicenter of attention once again in today’s Asian session. Overall, we view risks stemming from the LDP elections over the weekend as tilted to the bearish side for JPY.

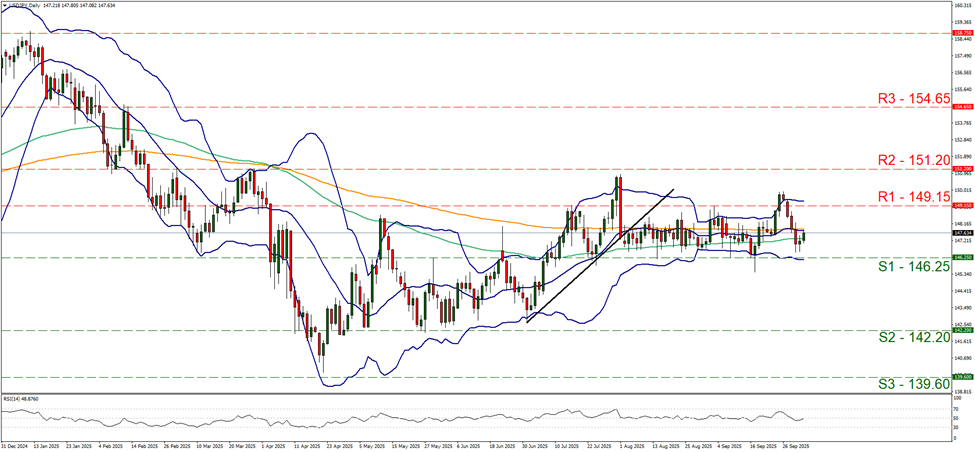

On a technical level, USD/JPY edged higher yesterday just before hitting the 146.25 (S1) support line. As the pair’s price action remains well within the corridor set between the 146.25 (S1) support line and the 149.15 (R1) resistance level, we maintain our bias for its sideways motion to continue. We also note that the RSI indicator remains just below the reading of 50, which is rather unconvincing for a bearish market sentiment among market participants and view rather as an indecisiveness for the direction of the pair’s next leg. Should the bulls take over, we may see USD/JPY breaking the 149.15 (R1) resistance line and start aiming for the 151.20 (R2) resistance level. Should the bears be in charge of the pair’s direction we may see USD/JPY breaking the 146.25 (S1) support line and aiming for the 142.20 (S2) support level.

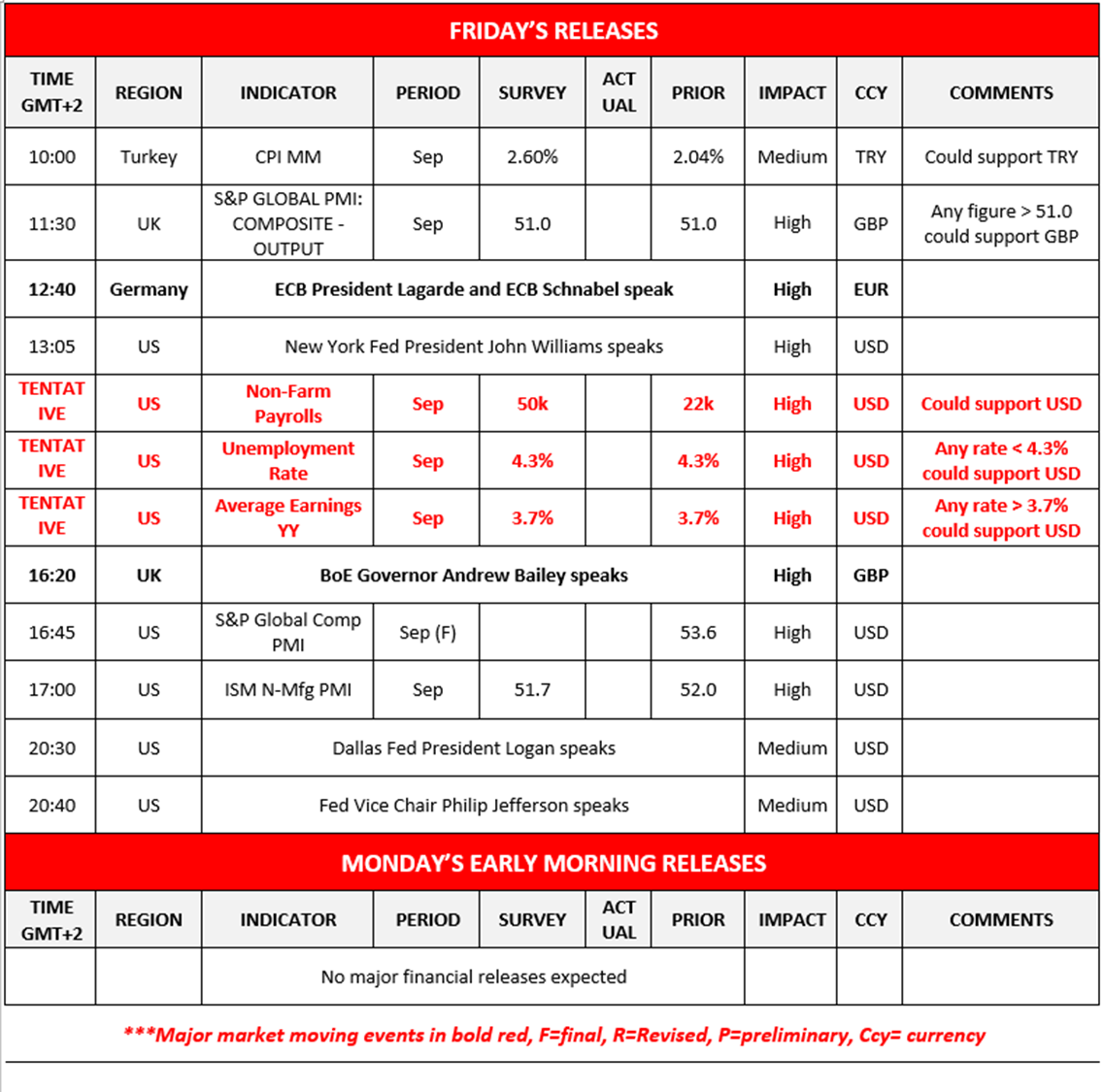

Other highlights for the day:

In today’s European session, we get Turkey’s CPI rates and the UK’s composite PMI figure both for September, followed by the speeches by ECB President Lagarde and New York Fed President Williams and in the American session, we note the US Employment data for September which may not be released as a result of the US government shutdown, the speech by BoE Governor Bailey, the US final composite PMI figure for September and ISM non-manufacturing PMI figure for September and the speeches by Dallas Fed President Logan and Fed Vice Chair Jefferson.

USD/JPY Daily Chart

- Support: 146.25 (S1), 142.20 (S2), 139.60 (S3)

- Resistance: 149.15 (R1), 151.20 (R2), 154.65 (R3)

XAU/USD Daily Chart

- Support: 3850 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4000 (R1), 4200 (R2), 4400 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.