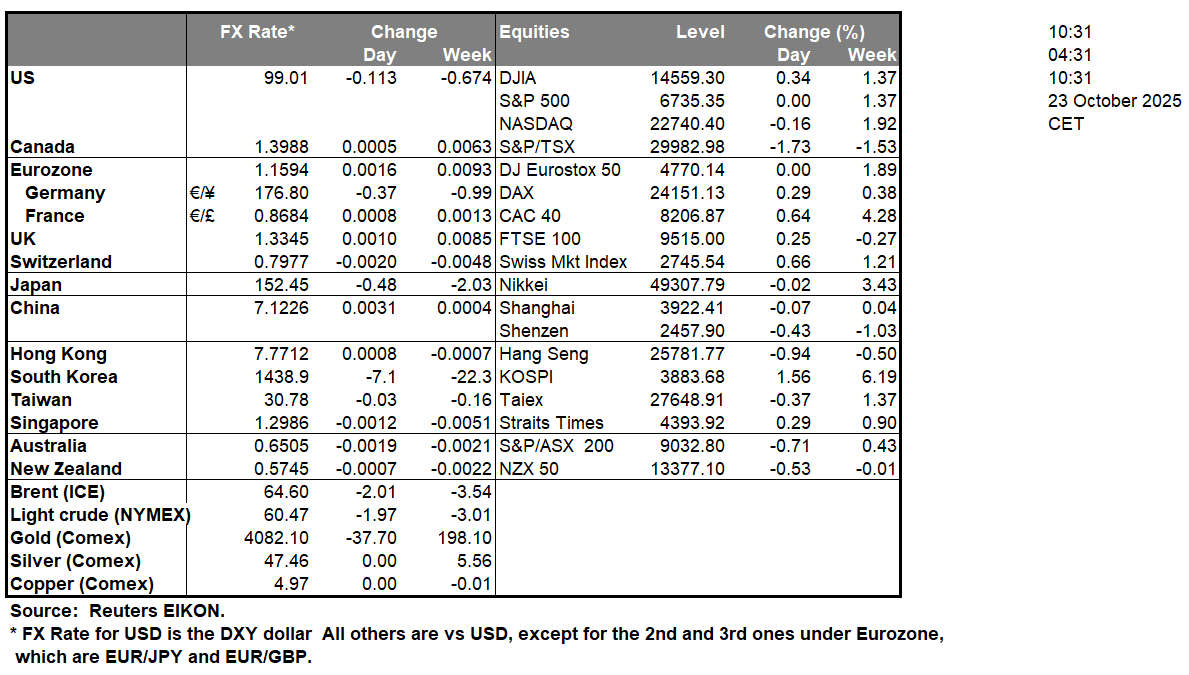

According to various media outlets, the US has imposed sanctions on Russia’s two biggest oil companies, Rosneft and Lukoil in an attempt to weaken Russia’s negotiation leverage in possible future peace talks. The development by the Trump administration showcases the US’s plans to continue to weaken Russia’s economy and thus by exerting economic pressure, the US may be hoping to bring Russia to the negotiation table. In turn the sanctions on Russian oil companies may further curb the supply of oil into the global market and may in turn provide support for oil prices. Moreover, per Reuters Indian refiners are poised to sharply curtail imports of Russian oil, a scenario which in our view is not at all unlikely and could thus further aid oil prices.

Over in Japan, the nation’s inflation print for the month of September are set to be released during tomorrow’s Asian session and could thus garner significant attention from Yen traders. In particular, economists are currently anticipating Japan’s Core CPI rate to accelerate from 2.7% to 2.9% which could increase calls for the bank to resume their rate hiking path. Therefore, should the CPI rates showcase an acceleration of inflationary pressures in the Japanese economy it may provide support for the Yen and vice versa. In our view we would not be surprised to see an acceleration of inflationary pressures in the Japanese economy. Moreover, Japan’s manufacturing and services preliminary PMI figures for October are also due out tomorrow, thus potentially leading to heightened trading volatility in the Yen.

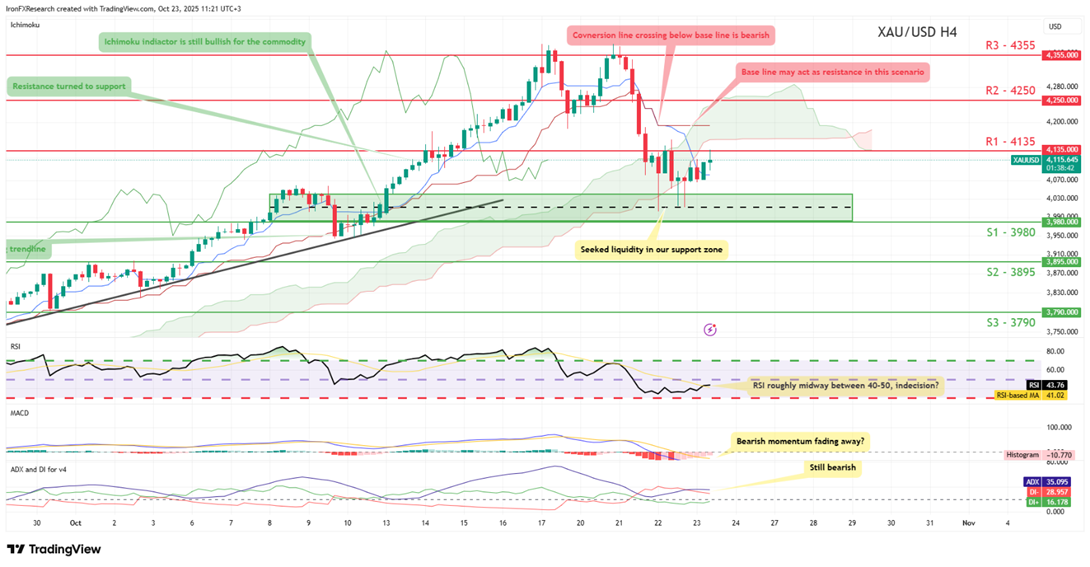

XAU/USD appears to have dropped from it’s all-time high figure with the commodity having dipped close to 4k per troy ounce. We now opt for a short term sideways bias for the commodity’s price and supporting our case is the ADX and DI indicator below our chart. In particular, we take a look at our RSI indicator below our chart which the figure having dipped below 50, although its current figure may imply that the bearish momentum may be losing some steam. For our sideways bias to be maintained we would require the commodity’s price to remain confined between our 3980 (S1) support level and our 4135 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 3980 (S1) support level with the next possible target for the bears being our 3895 (S2) support level. Lastly, for a bullish outlook we would require a clear break above our 4135 (R1) resistance line with the next possible target for the bulls being our 4250 (R2) resistance level.

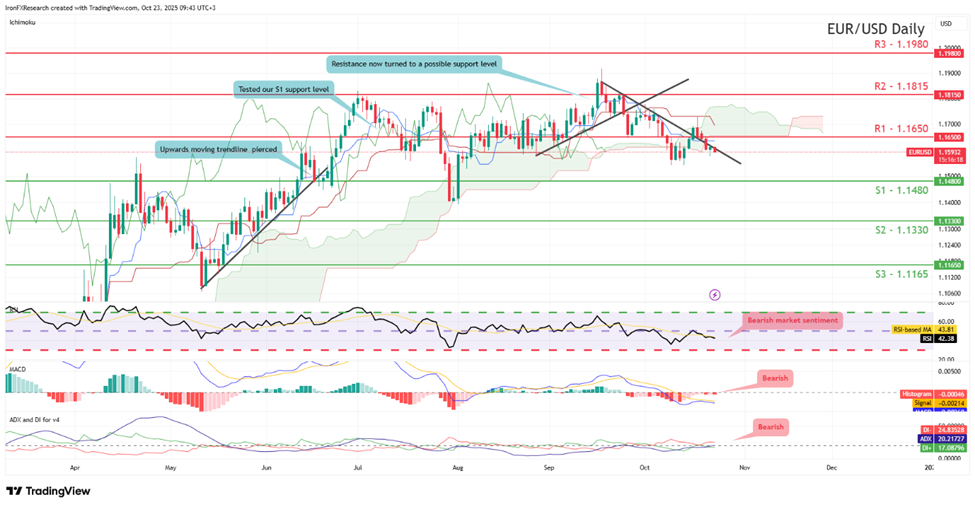

EUR/USD appears to be moving in a downwards fashion. We opt for a bearish outlook for the pair and supporting our case are the RSI, MACD and ADX with DI indicators below our chart. For our bearish outlook to continue we would require a break below our 1.1480 (S1) support level with the next possible target for the bears being our 1.1330 (S2) support line. On the other hand for a sideways bias we would require the pair to remain confined between our 1.1480 (S1) support line and our 1.1650 (R1) resistance level. Lastly, for a bullish outlook we would require a clear break above our 1.1650 (R1) resistance level if not also our 1.1815 (R2) resistance line with the next possible target for the bulls being our 1.1980 (R3) resistance level.

Autres faits marquants de la journée :

Today we note the release of France’s Business climate figure for October, the SNB’s monetary policy meeting minutes, the UK’s CBI trends orders figure for October, the CBT’s interest rate decision, the Eurozone’s preliminary consumer confidence figure for October, the US existing home sales figure and the US PPI machine manufacturing figure both for September. In tomorrow’s Asian session we make a start with Australia’s preliminary manufacturing and services PMI figures both for October, followed by Japan’s CPI rates for September and Japan’s preliminary manufacturing and services PMI figures both for the month of October.

XAU/USD H4 Chart

- Support: 3980 (S1), 3895 (S2), 3790 (S3)

- Resistance: 4135 (R1), 4250 (R2), 4355 (R3)

EUR/USD Daily Chart

- Support: 1.1480 (S1), 1.1330 (S2), 1.1165 (S3)

- Resistance: 1.1650 (R1), 1.1815 (R2), 1.1980 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.