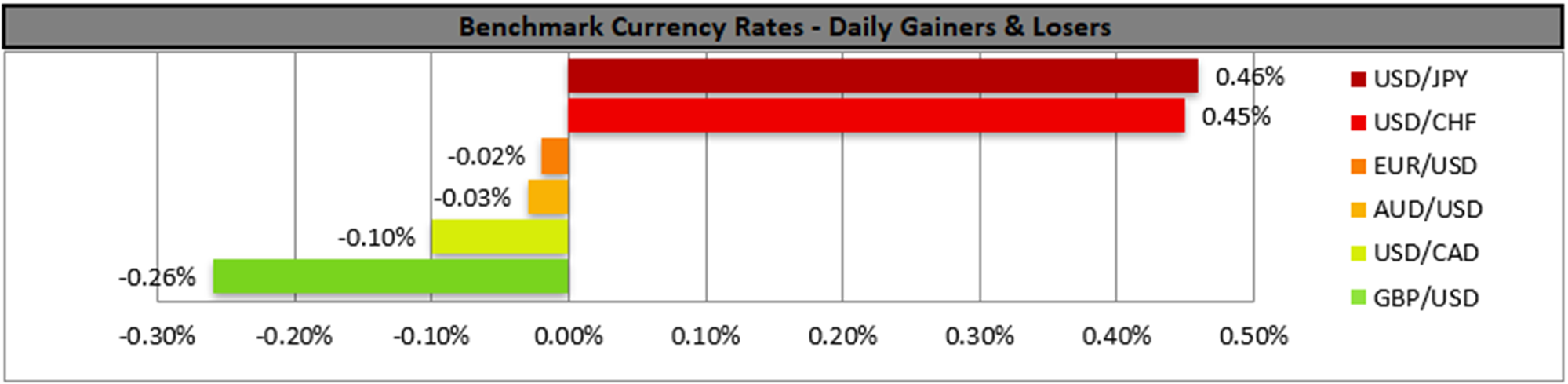

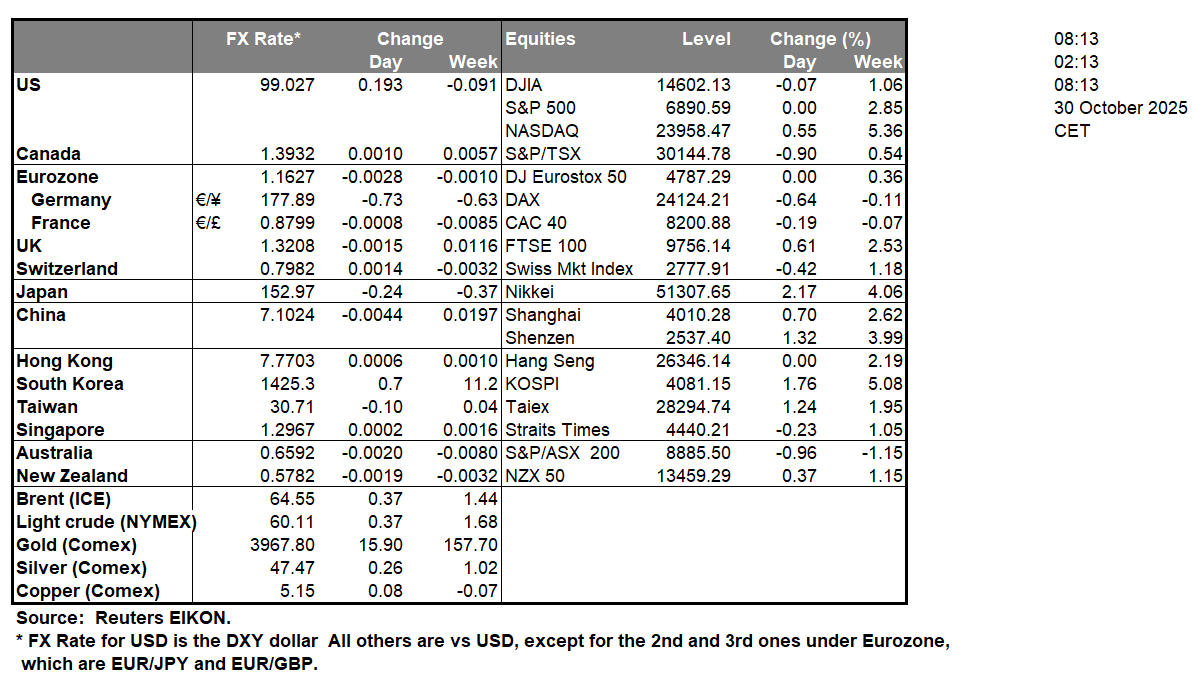

Starting with yesterday’s news, the Fed cut rates by 25 basis points as was expected, yet Fed Chairman Powell in his press conference cast doubts for the scenario of another rate cut in the December meeting. The market’s expectations for further easing of the bank’s monetary policy have eased, yet the market still prices in another rate cut in the December meeting. The event as a whole, provided support for the USD and should we see more Fed policymakers aligning with Powell’s statement we may see the USD rising further. Also, on a fundamental level, the Trump-Xi meeting seems to have gone well, as US President Trump stated that he had an “amazing” meeting with Xi. We are still waiting for the specifics, yet it seems that the US will reduce tariffs on Chinese products, while China is to resume US soybean purchases and allow for the flow of rare earth exports to the US. The deal could thaw the tensions in the US-Sino trade relationships, thus increasing the risk on sentiment of the market, yet the devil may be hiding in the details, hence we stand by for more news regarding the meeting.

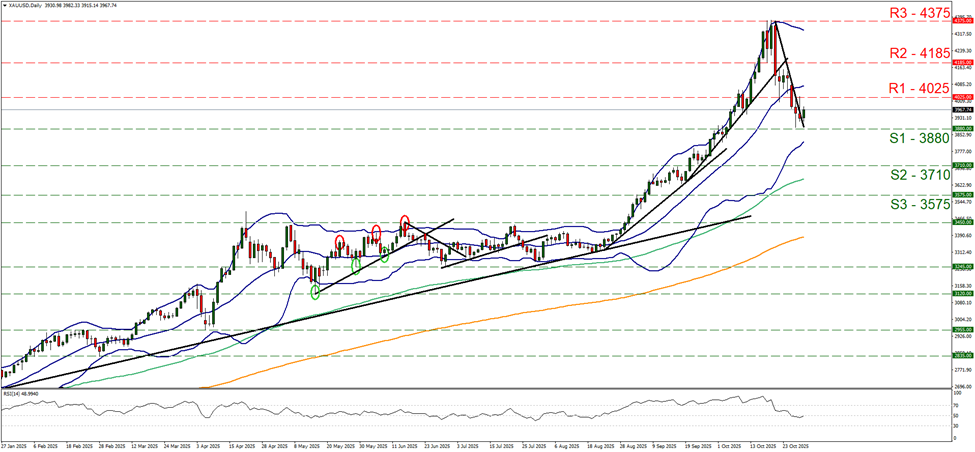

On a technical level we note that the recent movement of gold’s price forced us to readjust our resistance and support levels. We note that the precious metal’s price yesterday dropped and during today’s Asian session, bounced on the 3880 (S1) support line. In its movement gold’s price broke the downward trendline guiding it lower since the 21st of October, hence we temporarily switch our bearish outlook in favour of a sideways motion bias. We also note that the RSI indicator seems to stabilise somewhat near the reading of 50 for the past two days, implying a relative indecisiveness on behalf of market participants for the direction of the next leg of gold’s price action. For a bearish outlook to re-emerge we would require gold’s price to drop below the 3880 (S1) line and start aiming for the 3710 (S2) support level. For a bullish outlook to be adopted, the bullion’s price has to break the 4025 (R1) resistance line and start aiming for the 4185 (R2) level.

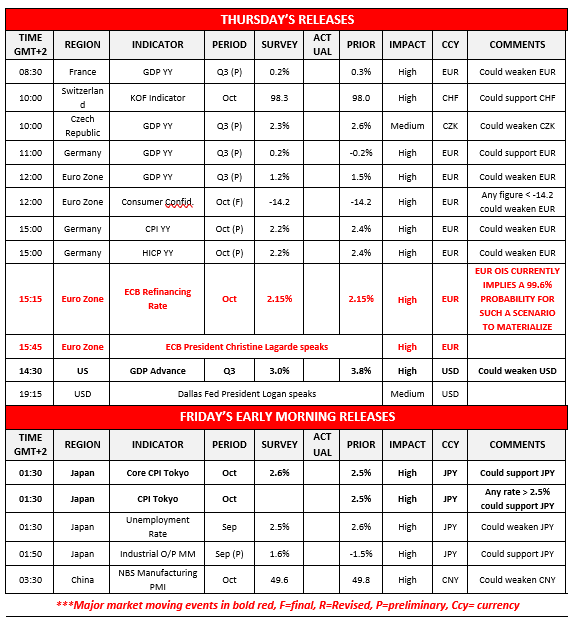

Across the Atlantic, market focus is on the EUR as the ECB’s interest rate decision is to be released. The bank is widely expected to remain on hold. We expect a very careful forward guidance to be issued in the bank’s accompanying statement and ECB President Lagarde’s press conference, providing little about the bank’s intentions, possibly reiterating that the bank’s monetary policy is in a “good place”, which could be considered as supportive for the common currency. Should the bank unexpectedly include dovish innuendos in its forward guidance, we may see the single currency losing ground.

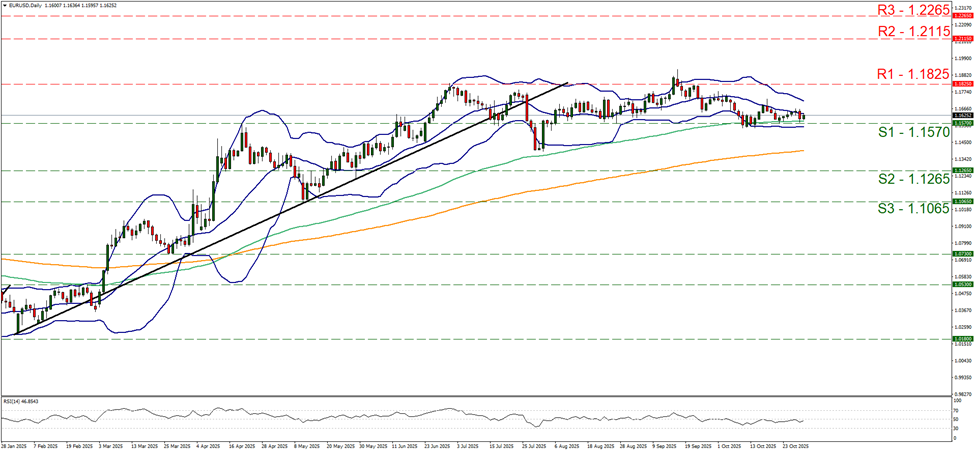

EUR/USD continued to move in a tight sideways motion just above the 1.1570 support line. We maintain our sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. Also the narrowing Bollinger Bands tend to support our bias for a continuance of the sideways movement. Should the bears take over, we may see the pair breaking the 1.1570 (S1) support line and start aiming for the 1.1265 (S2) support level. Should the bulls take over, we may see EUR/USD’s price breaking the 1.1825 (R1) resistance line, thus paving the way for the 1.2115 (R2) resistance barrier.

Autres faits marquants de la journée :

Today we get France’s preliminary GDP rate for Q3, Switzerland’s KOF indicator figure for October, the Czech Republic’s, Germany’s and the Eurozone’s preliminary GDP rates for Q3, the Eurozone’s final consumer confidence figure, Germany’s preliminary CPI rates both for October, the ECB’s interest rate decision followed by ECB President Lagarde’s press conference, the US GDP advance rate for Q3 and the speech by ECB President Logan. In tomorrow’s Asian session we note Japan’s CPI rates for October, Japan’s unemployment rate and preliminary industrial output rate both for September and lastly, China’s NBS manufacturing PMI figure for October.

XAU/USD Daily Chart

- Support: 3880 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4025 (R1), 4185 (R2), 4375 (R3)

EUR/USD Quotidienne

- Support: 1.1570 (S1), 1.1265 (S2), 1.1065 (S3)

- Resistance: 1.1825 (R1), 1.2115 (R2), 1.2265 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.