Gold’s appears to have moved higher since our last report and President Trump’s firing of Governor Cook. Today’s report is to discuss the recent comments made by Fed Chair Powell, the firing of Governor Cook, the US’s inflation print and we are to conclude the report with a technical analysis of gold’s daily chart.

President Trump fires Governor Cook

Tensions between the US Government and the Federal Reserve continue to intensify. In particular, President Trump has fired Fed Governor Cook yesterday. Specifically, the letter states as follows “pursuant to my authority under Article II of the Constitution of the United States and the Federal Reserve Act of 1913, as amended, you are hereby removed from your position on the Board of Governors of the Federal Reserve, effective immediately”.

The decision came after Governor Cook allegedly falsified mortgage applications and marks the first time that a Fed Governor has been fired in the bank’s 111-year history. In response, Fed Governor Cook stated that “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so” which may imply that a long legal battle could ensue, with the Fed’s independence at stake.

Regardless of whether the allegations are true or not, the White House’s decision to in our opinion, pre-emptively remove the Governor, calls into question the independence of the Federal Reserve. In turn, this could provide support for gold’s price, given its safe-haven asset status.

The Fed’s dovish pivot?

Fed Chair Powell’s speech at the Jackson Hole Symposium occurred on Friday, and through his comments, it appeared to showcase a pivot in the Fed’s monetary policy approach. In particular, we are referring to the following statement that “Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance”.

Hence, the comments by the Fed Chair imply that the Fed may be considering cutting interest rates in the near future, which may have weighed on the dollar whilst aiding gold’s price, given their assumed inverse relationship with one another.

US Inflation data this week

The Fed’s favourite tool for measuring inflationary pressures in the US economy is set to be released this Friday. Specifically, the US PCE rates for July with the Core PCE rate expected to showcase an acceleration of inflationary pressures in the economy as it expected to come in at 2.9% which would be higher than the prior month’s rate of 2.8%.

Hence should the PCE rates showcase an uptick of inflationary pressures in the US economy it may increase pressure on the Fed to delay their possible dovish pivot which was implied in Fed Chair Powell’s comments on Friday. In turn this may aid the dollar whilst weighing on gold’s price. In our opinion, a small uptick in inflation may not necessarily ‘prevent’ the Fed from cutting rates in their next meeting

Gold Technical Analysis

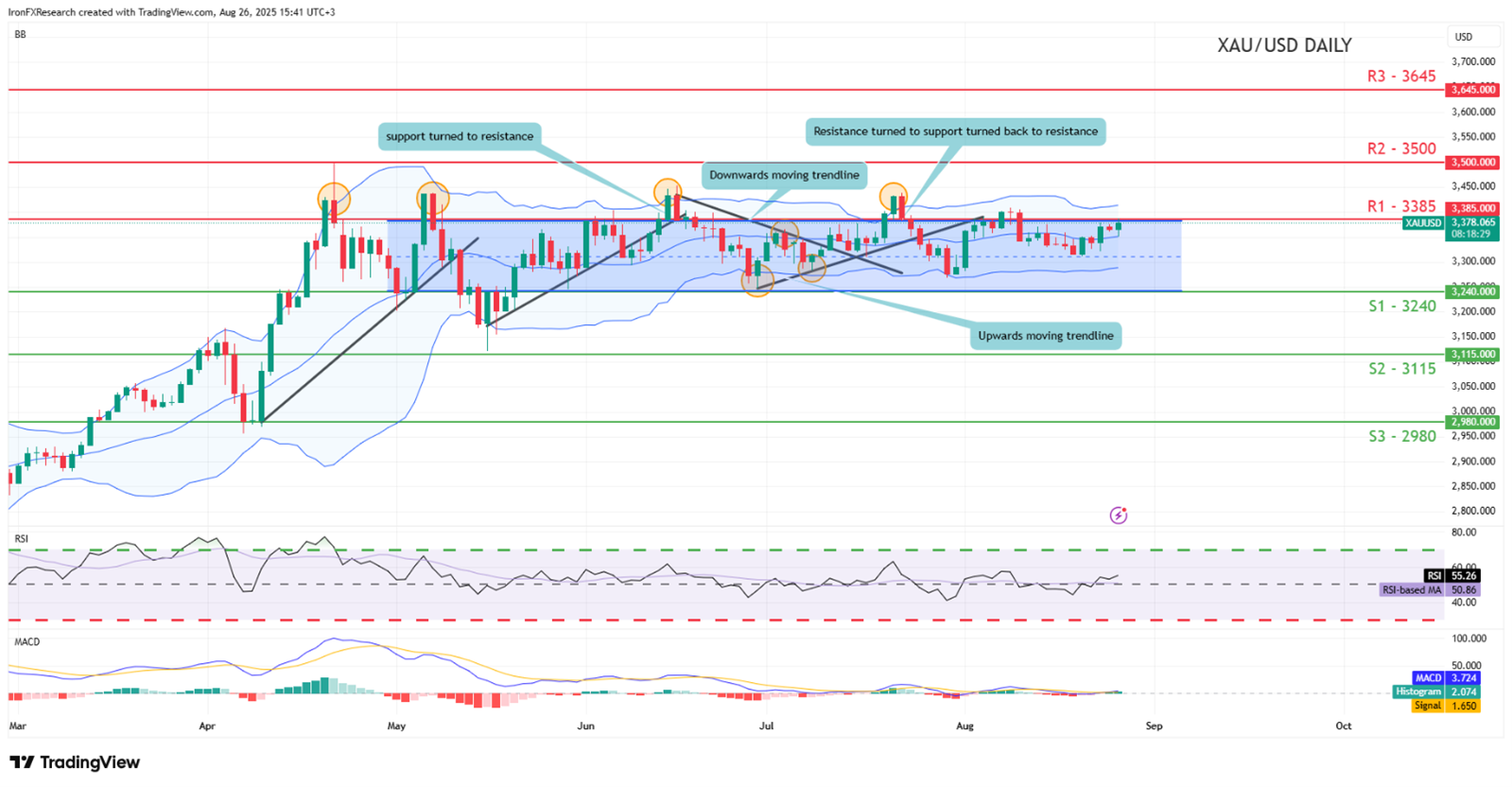

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30th of April, despite some breakouts. Nonetheless, we opt for a sideways bias for gold’s price. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line.

On the other hand, for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 3240 (S1) support line with the next possible target for the bears being the 3115 (S2) support level.

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing