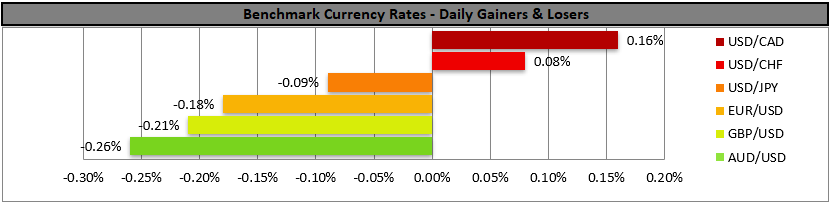

USD rises amidst thin trading conditions

The USD was on the rise in the FX market yesterday, and during today’s Asian session, thin trading conditions tend to apply in the markets, given the US and Canadian public holidays yesterday and the Lunar New Year celebrated across Asia today.

The markets are increasingly awaiting the release of the Fed’s January meeting minutes tomorrow and the preliminary US GDP rates for Q4 on Friday, as well as the US PCE rates for January on the same day.

December UK employment data weigh on the pound

The release of the UK employment data for December showed an unexpected easing of the UK employment market, and the release weighed on the pound as it lost notable ground against the USD, EUR and JPY, showing signs of a wider weakness.

In tomorrow’s early European session, we highlight the release of the UK CPI rates for January, and should there be a possibly wider than expected slowdown of the rates being reported, we may see the sterling tumbling.

US stock markets on the retreat

Despite yesterday’s US public holiday, US equities seem to be on the retreat as market worries for the oversized investments of US mega-cap tech companies in Artificial Intelligence, continue to tantalise the markets.

We highlight today’s American opening as a moment of truth for US equities as the markets restart their engines after the holiday.

Bitcoin continues to wobble

In the crypto market, Bitcoin’s price action continued to wobble without clear direction, and we still view its movement resembling more like equities rather than safe havens.

We expect that should a wider risk-off market sentiment emerge, Bitcoin’s price could react negatively as it considered a riskier asset in the markets.

Autres points forts pour aujourd'hui

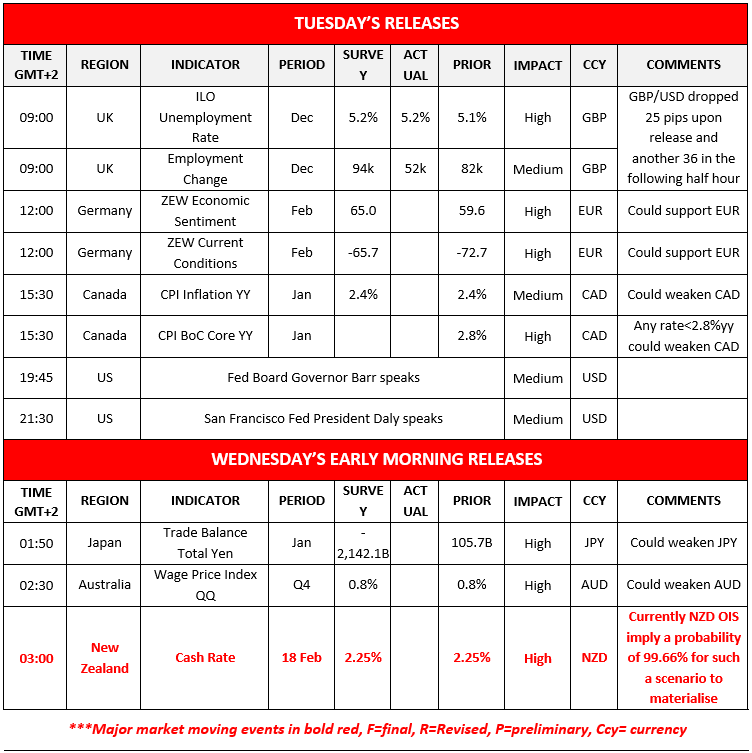

Today we get Germany’s ZEW indicators for February, and Canada’s delayed release of the CPI rates for January. On a monetary level, we note that Fed Board Governor Barr and San Francisco Fed President Daly are speaking.

In tomorrow’s Asian session, we get Japan’s trade data for January, Australia’s Wage Price for Q4 and in New Zealand RBNZ releases its interest rate decision, which is expected to remain on hold, yet a possibly dovish tone could weigh on the Kiwi (Kiwi) and vice versa.

Charts to keep an eye out

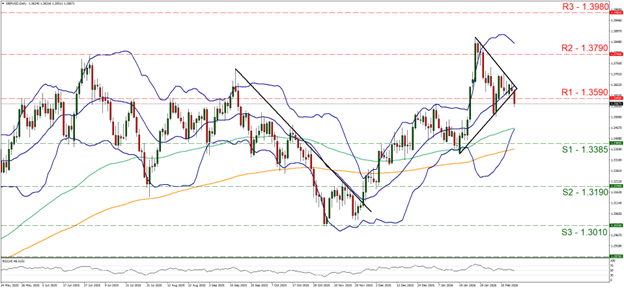

GBP/USD dropped in today’s European session breaking the 1.3590 (R1) support line now turned to resistance. Yet the RSI indicator remained near the reading of 50, implying a relative indecisiveness on behalf of market participants.

For the time being we expect the sideways motion to continue yet warn for any bearish tendencies of cable. Should the bears actually take over we may see GBP/USD aiming if not breaching the 1.3385 (S1) support line.

Should the bulls take over, we may see the pair reversing today’s losses, breaking the 1.3590 (R1) resistance line and start aiming for the 1.3790 (R2) resistance level.

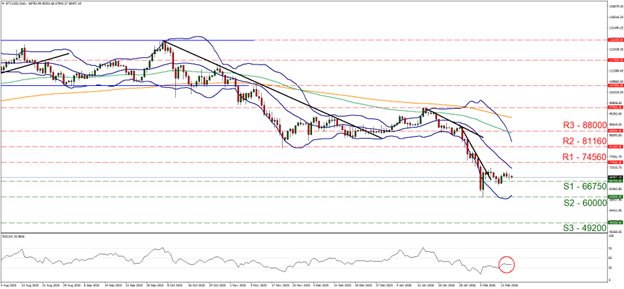

BTC/USD continued to wobble just above the 66750 (S1) support line yesterday and during today’s Asian session edged a bit lower.

We maintain currently a bias for the crypto’s sideways motion to continue, yet we highlight the possibility of a bearish movement as the RSI indicator remains near the reading of 30, implying a continuance of the market’s bearish sentiment.

For a bearish outlook to emerge we would require the crypto’s price action to break the 66750 (S1) support line and continue to also break the 60000 (S2) support barrier.

For a bullish outlook to be adopted, the crypto-king’s price action has to break the 74560 (R1) resistance line clearly and start aiming for the 81160 (R2) resistance hurdle.

GBP/USD Daily Chart

- Support: 1.3385 (S1), 1.3190 (S2), 1.3010 (S3)

- Resistance: 1.3590 (R1), 1.3790 (R2), 1.3980 (R3)

BTC/USD Daily Chart

- Support: 66750 (S1), 60000 (S2), 49200 (S3)

- Resistance: 74560 (R1), 81160 (R2), 88000 (R3)

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.