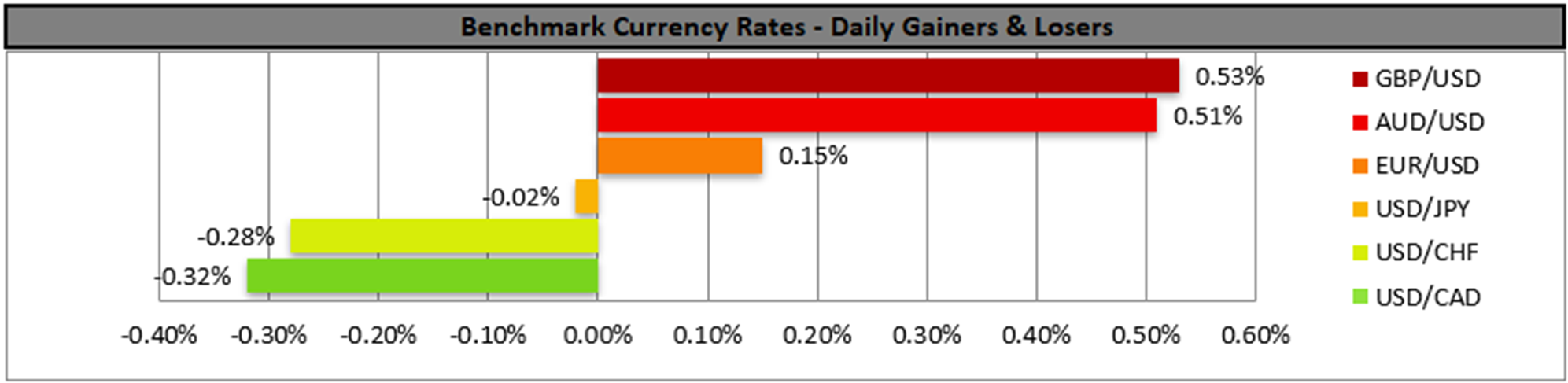

The USD continued to weaken against its counterparts yesterday, as the market continues to increasingly expect the Fed to proceed with a rate cut in the December meeting. Currently Fed Fund Futures imply a probability of 85% for such a scenario to materialise. It should be noted that the release of the September PCE rates mentioned in yesterday’s report, which could alter the market’s expectations, has been delayed for the 5th of December. Furthermore, another issue that tends to enhance the market’s expectations for an easing of the Fed’s monetary policy, albeit in a more long-term manner and a more fundamental level, is the replacement of Fed Chairman Powell late next spring. Currently, White House economic adviser Kevin Hassett seems to be the main candidate who in turn could maintain a bias for a looser monetary policy on the Fed’s behalf with a wider and/or faster rate-cutting pace.

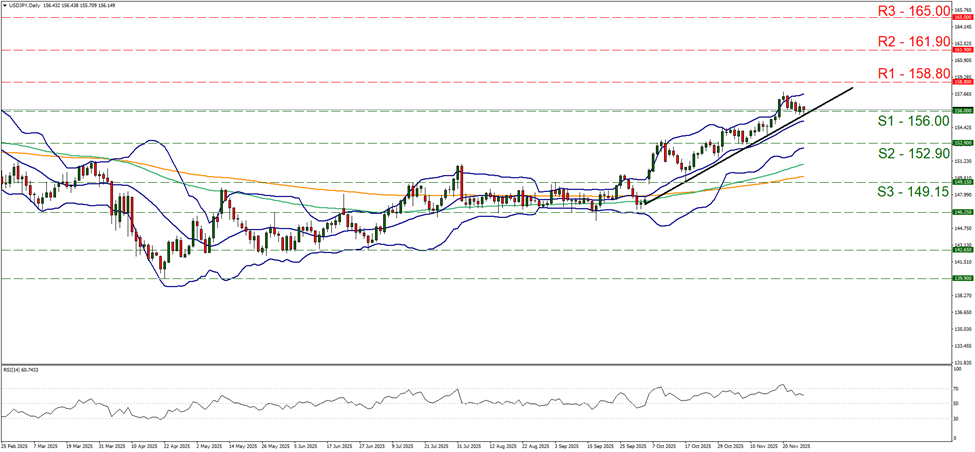

USD/JPY remained relatively stable yesterday and during todays’ Asian session after bouncing on the 156.00 (S1) support line. The upward trendline guiding the pair since the 3rd of October remains intact and the RSI indicator remains between the readings of 50 and 70, despite dropping over the past few days, implying the persistence of some bullish tendencies among market participants for the pair. Hence we maintain our bullish outlook for the pair currently, yet warn for a possible stabilisation. Should the bulls maintain control over USD/JPY we may see it aiming if not breaching the 158.80 (R1) resistance line. On the flip side should the bears take over, we may see the pair breaking the 156.00 (S1) support line, continue to break also the prementioned upward trendline, in a first signal of an interruption of the pair’s upward movement and proceed to aim the 152.90 (S2) support level.

Across the pond, UK finance minister Rachel Reeves yesterday seems to have stabilised the markets at least somewhat, with the announcement of the Autumn Budget in the UK Parliament. The release was a bit of a mess with OBR releasing earlier than intended the budget, yet in the grand scheme of things, Reeves is to impose high taxation and thus raise more than 26 billion pounds ($34 billion) in taxes. The budget is supposed to stabilise the fiscal outlook of the UK. Yet in our opinion, it remains questionable whether the new budget is to promote growth. The market tended to show a positive reaction to the news, increasing demand for UK bonds and a consecutive drop of their yields, while in the FX market the pound continued to strengthen across the board yesterday, in a sign of wider strength.

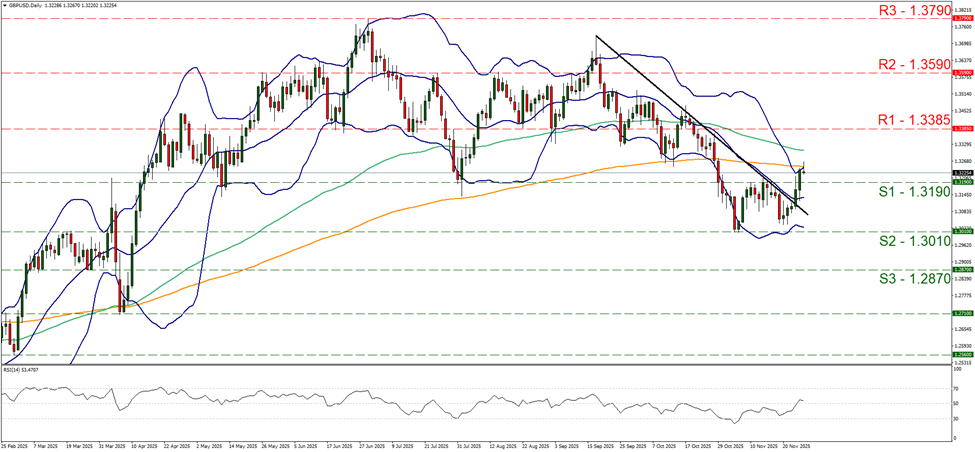

Cable continued to rise yesterday breaking the 1.3190 (S1) resistance line, now turned to support. As the pair’s price action has broken the 1.3190 (S1) level, which was the upper boundary of the pair’s sideways motion since the end of October, we temporarily switch our past sideways motion bias, in favour of a bullish outlook. Yet the bullish outlook seems weak, as the RSI indicator has broken just above the reading of 50 and unconvincing regarding the bullish market sentiment for the pair. Furthermore we note that the price action has hit a ceiling of the upper Bollinger band which has forced GBP/USD’s price action to correct lower in today’s Asian session. For a bullish outlook to be maintained the pair has to start actively aiming for the 1.3385 (R1) resistance level. For a bearish outlook to re-emerge we would require the pair to reverse course and break the 1.3190 (S1) line and continue lower breaking also the 1.3010 (S2) level.

Autres faits marquants de la journée :

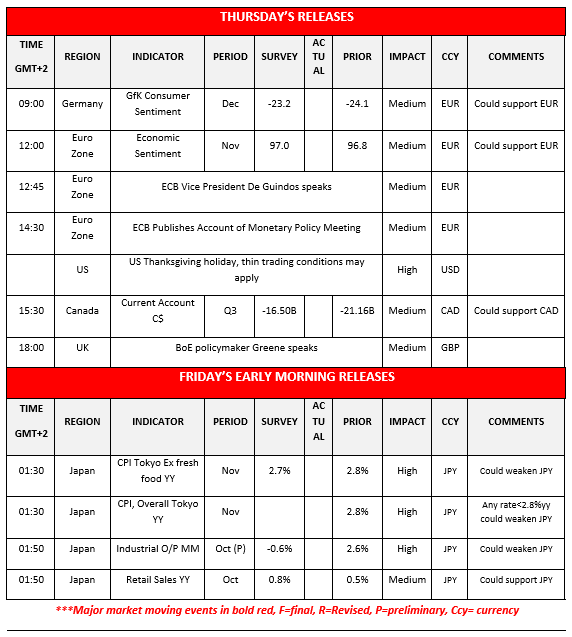

Today we get Germany’s GfK consumer sentiment for December, Euro Zone’s economic sentiment for November and from Canada the current account balance for Q3. On a monetary level, that from the UK BoE policymaker Greene is speaking. Please note that in the US we have the Thanksgiving holiday, thus thin trading conditions may apply. In tomorrow’s Asian session, we get Japan’s Tokyo CPI rates for November and the preliminary industrial output for October and retail sales for the same month.

USD/JPY Daily Chart

- Support: 156.00 (S1), 152.90 (S2), 149.15 (S3)

- Resistance: 158.80 (R1), 161.90 (R2), 165.00 (R3)

GBP/USD Daily Chart

- Support: 1.3190 (S1), 1.3010 (S2), 1.2870 (S3)

- Resistance: 1.3385 (R1), 1.3590 (R2), 1.3790 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.