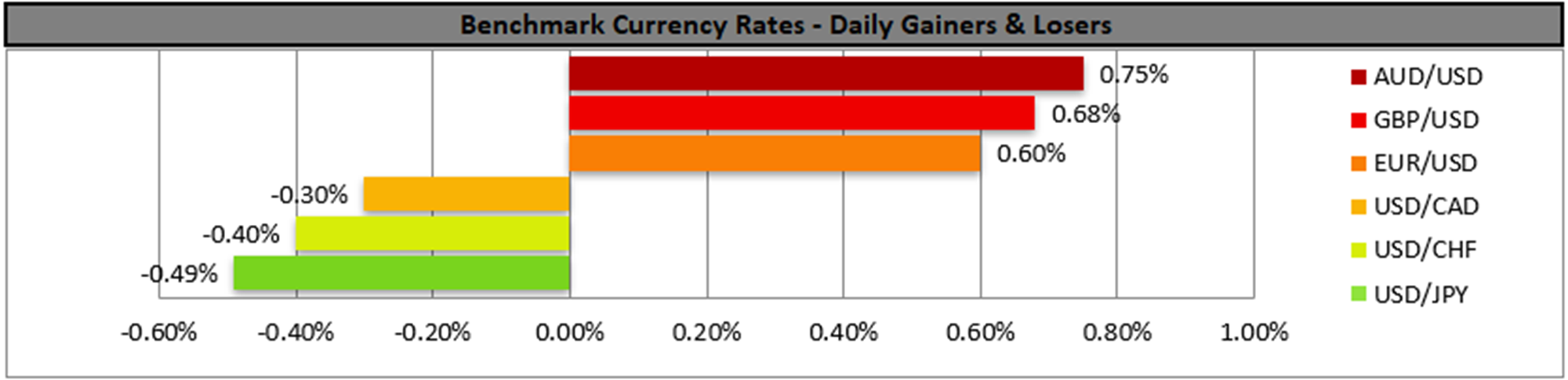

The USD was on the retreat yesterday as market expectations for the Fed to cut rates in the December meeting remain high. Currently, Fed Fund Futures imply a probability of 76% for such a scenario to materialise at the current stage. It should be noted that US data were rather lukewarm, on the one hand the PPI rates for September ticked up as expected, yet the retail sales for the same month accelerated but failed to reach the market’s expectations, and the consumer confidence dropped for November materially signaling a possible weakness in the demand side of the US economy. Today, we highlight the release of the PCE rates for September, and the GDP 2nd estimate for Q3, and a possible acceleration of the rates could reverse the market sentiment as it may add pressure on the Fed to remain on hold in December. On the flip side a possible intensification of the market’s dovish expectations could weigh on the USD and support gold’s price and US stock markets.

In the Far East, JPY was supported yesterday, as market expectations for BoJ to tighten its monetary policy seem to be intensifying. On a fiscal level, the Japanese Government seems to be ready to intervene in the markets for JPY’s support. Rumours about a possible market intervention tomorrow are intensifying, as it’s Thanksgiving, where thin market conditions may apply, thus providing possibly favourable conditions in the market for such an operation.

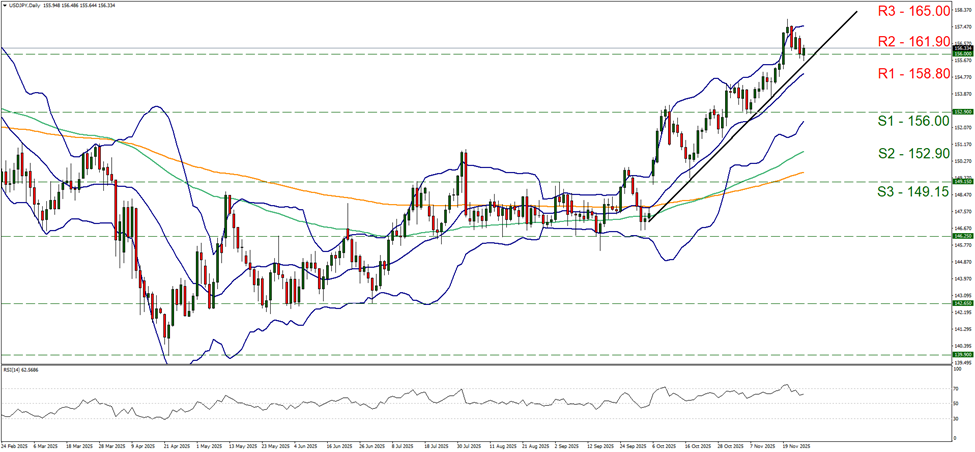

USD/JPY continued to edge lower yesterday teasing the 156.00 (S1) support line yet corrected higher in today’s Asian session. It should be noted that the pair’s price action has put the upward trendline active since the 2nd of October to the test yet failed to break it, thus our bullish outlook remains. Yet we note that the RSI indicator remains between the reading of 50 and 70, implying a bullish sentiment among market participants for pair, yet the indicators reading seems to be dropping, implying a possible easing of the bullish market sentiment since last Thursday. Should the bulls maintain control over the pair we may see the pair aiming if not breaching the 158.80 (R1) resistance line. Should the bears be in charge, we may see the pair reversing course, breaking the 156.00 (S1) line and continue lower to break the prementioned upward trendline, signaling an interruption of the upward trendline and continue to reach if not breach the 152.90 (S2) level.

In Europe, the common currency edged higher against the USD, getting some support, possibly also from the intensification of the efforts for a peace plan in Ukraine. Across the Channel, as mentioned in yesterday’s report, UK Finance Minister Rachel Reeves, later in the day, is to deliver the Autumn budget and the announcement of increased taxation is expected. Should the announcement exceed market expectations, we may see the event weighing on sterling and vice versa.

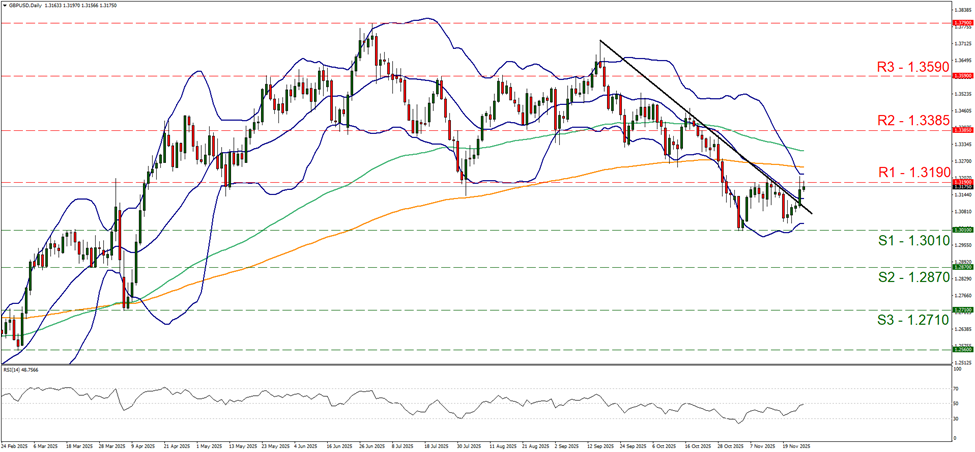

Cable was on the rise yesterday testing the 1.3190 (R1) resistance line. As the pair’s price action has broken the downward trendline guiding the pair since the 17th of September we currently switch our bearish outlook in favour of a sideways motion bias, possibly between the 1.3190 (R1) resistance line and the 1.3010 (S2) support level. For a bullish outlook to emerge we would require the pair to break clearly the 1.3190 (R1) resistance line and start aiming for the 1.3385 (R2) resistance level. For a bearish outlook to re-emerge we would require the pair to reverse the gains of the past few days and break the 1.3010 (S1) support line and continue lower aiming for the 1.2870 (S2) support level.

Autres faits marquants de la journée :

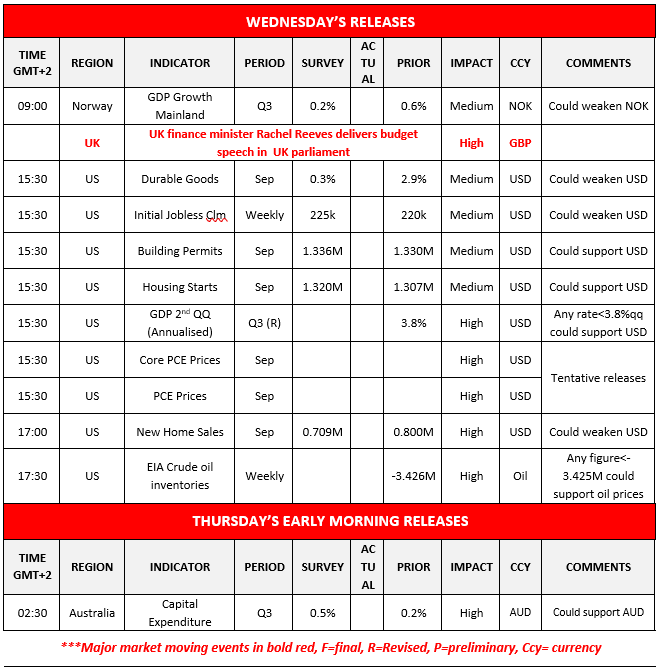

Today, we get Norway’s GDP rates for Q3, and from the US we get the durable goods orders for September, the weekly initial jobless claims figure, the building permits, house starts and new home sales figures all being for September, while oil traders may be more interested in the release of the weekly EIA crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s CapEx rate for Q3.

USD/JPY Daily Chart

- Support: 156.00 (S1), 152.90 (S2), 149.15 (S3)

- Resistance: 158.80 (R1), 161.90 (R2), 165.00 (R3)

GBP/USD Daily Chart

- Support: 1.3010 (S1), 1.2870 (S2), 1.2710 (S3)

- Resistance: 1.3190 (R1), 1.3385 (R2), 1.3590 (R3)

Si vous avez des questions d'ordre général ou des commentaires concernant cet article, veuillez envoyer un email directement à notre équipe de recherche à l'adresse research_team@ironfx.com

Avertissement :

Ces informations ne doivent pas être considérées comme un conseil ou une recommandation d'investissement, mais uniquement comme une communication marketing. IronFX n'est pas responsable des données ou informations fournies par des tiers référencés, ou en lien hypertexte, dans cette communication.