According to a statement by the Fed “Lisa Cook has indicated through her personal attorney that she will promptly challenge this action in court and seek a judicial decision that would confirm her ability to continue to fulfill her responsibilities as a Senate-confirmed member of the Board of Governors of the Federal Reserve System,” referring to the notice provided by President Trump that she is removed from her position. In turn, the continued battle between the US Government and its perceived attacks on the independence of the Federal Reserve could potentially influence gold prices as it unfolds, given gold’s safe haven asset status. In particular, with the Fed’s decision approaching in a few weeks, should the situation fail to be resolved it may lead to heightened volatility in the markets.In the US Equities markets the main event of the day is set to be Nvidia’s (#NVIDIA) earnings report for the quarter which are set to be released after the markets close today. Hence all eyes will be on the company and whether it will able to beat their revenue and earnings per share estimates provided by analysts. Such a scenario could aid the company’s stock price and the overall markets given Nvidia’s heavyweight status and market significance. However, should they fail to meet analyst’s expectations it could have the opposite effect.In the European Equities market Commerzbank and Deutsche Bank have been downgraded by GoldmanSachs (#GS) and could thus face downwards pressures on their stock prices. Should further downgrades occur it may weigh on their stock prices and considering the ongoing political turmoil in France, the overall European Equities markets could continue to ‘suffer’. Yet following the market’s open today the Euro Stoxx 600 has opened in the green’s.Across the globe, the US’s 50% tariff on India has kicked in and as such may warrant closer attention.

XAU/USD appears to be moving in a sideways fashion, with the commodity having remained within our sideways moving channel which was incepted on the 30th of April, despite some breakouts. Yet the commodity’s price is currently at our 3385 (R1) resistance level.Nonetheless, we opt for a sideways bias for gold’s price as long as it remains below our R1 resistance level. For our sideways bias to be maintained we would require gold’s price to remain confined between the 3240 (S1) support level and our 3385 (R1) resistance line. On the other hand for a bullish outlook we would require a clear break above our 3385 (R1) resistance line with the next possible target for the bulls being the 3500 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 3240 (S1) support level with the next possible target for the bears being the 3115 (S2) support line,

WTICash appears to downwards fashion, after re-emerging back below our 63.70 (R1) resistance line. We opt for a bearish outlook for the commodity’s price and supporting our case is the commodity’s price failure to remain above our 63.70 (R1) resistance line. For our bearish outlook to continue we would require a break below our 59.45 (S1) support level with the next possible target for the bears being the 55.20 (S2) support line.On the other hand for a bullish outlook we would require a clear break above our 63.70 (R1) resistance line with the next possible target for the bulls being the 67.60 (R2) resistance level. Lastly, for a sideways bias we would require the commodity’s price to remain confined between the 59.45 (S1) support level and the 63.70 (R1) resistance line.

دیگر نکات مهم امروز:

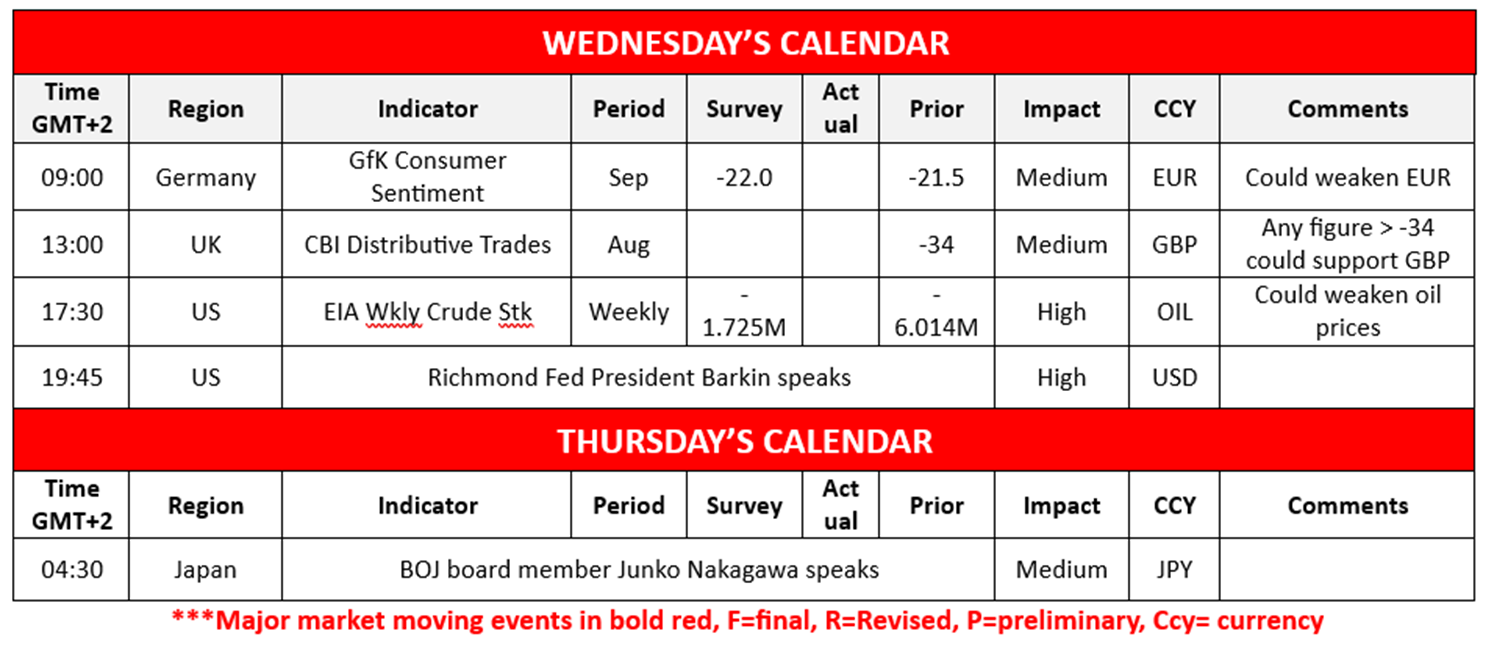

Today we get Germany’s Gfk consumer sentiment figure for September, the UK’s CBI distributive trades for August and the EIA weekly crude oil inventories figure. On a monetary level, we note the speech by Richmond Fed President Barkin today and BOJ member Nakagawa in tomorrow’s Asian session

XAU/USD Daily Chart

- Support: 3240 (S1), 3115 (S2), 2980 (S3)

- Resistance: 3385 (R1), 3500 (R2), 3645 (R3)

WTICash Daily Chart

- Support: 59.45 (S1), 55.20 (S2), 51.80 (S3)

- Resistance: 63.70 (R1), 67.60 (R2), 71.15 (R3)

اگر در مورد این مقاله سوال یا نظر ی کلی دارید، لطفاً ایمیل خود را مستقیماً به تیم تحقیقاتی ما بفرستیدresearch_team@ironfx.com

سلب مسئولیت:

این اطلاعات به عنوان مشاوره سرمایه گذاری یا توصیه سرمایه گذاری در نظر گرفته نمی شود ، بلکه در عوض یک ارتباط بازاریابی است. IronFX هیچ گونه مسئولیتی در قبال داده ها یا اطلاعاتی که توسط اشخاص ثالث در این ارتباطات ارجاع و یا پیوند داده شده اند ندارد.