We are nearing the end of the week and we have a look at next week’s calendar. On Monday we get Germany’s Ifo indicators for October and the release of the weekly US initial jobless claims figure while on Tuesday we get Germany’s GfK Consumer Sentiment for November and the US consumer confidence for October. On Wednesday we get Australia’s CPI rates for September, Sweden’s preliminary GDP rate for Q3, and on a monetary level, we note the release from Canada, BoC’s interest rate decision, while from the US we highlight the release of the Fed’s interest rate decision. On Thursday, on a monetary level, we note the release from Japan of BoJ’s interest rate decision while from the Euro Zone ECB’s interest rate decision, while we also note the release of the preliminary GDP rates for Q3 of France, the Czech Republic, Germany, the Euro Zone as a whole and the US, while we also get Switzerland’s KOF indicator for October and the Germany’s preliminary HICP rate for October. On Friday we get Japan’s Tokyo CPI rates for October and preliminary industrial output for September while from China we get October’s NBS manufacturing PMI figure, from France and the Euro Zone we get October’s preliminary HICP rates, while we also note the release of the US PCE rates for September and Canada’s GDP rates for August.

USD – Fed’s interest rate decision in focus

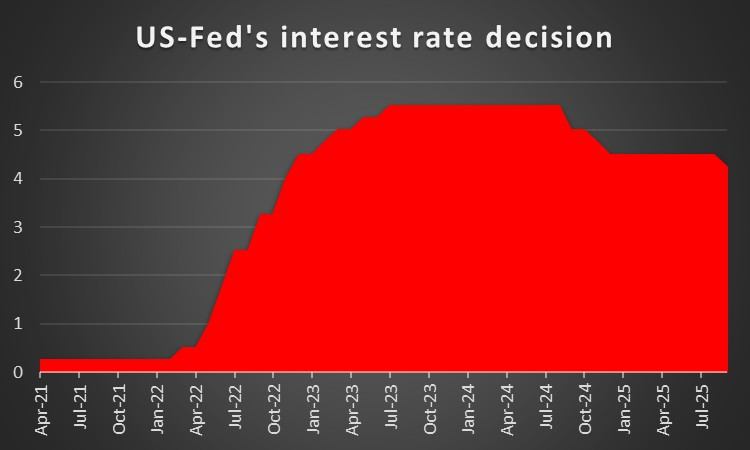

As we start the paragraph for the USD, we note that the US CPI rates for September are to be released later today, and could shake the greenback. In the coming week, on a fundamental level, we note that negotiations between the US and China, which are to begin today, could deliver results that could affect the USD and should the negotiations result in easing the tensions we may see the USD getting some support and vice versa. Furthermore we note that the US Government shutdown is still ongoing and tends to maintain uncertainty in the markets also weighing somewhat on the USD, albeit allready largely priced in by the markets. In the coming week we highlight the release of the Fed’s interest rate decision, which is largely in the dark, concerning the latest financial data, given the US Government shutdown. The bank is widely expected to cut rates by 25 basis points and currently Fed Funds Futures (FFF) imply a probability of 96.7% for such a scenario to materialise. FFF also imply that the market expects the bank to proceed with further rate cuts in December 25 and January 26, implying a clear dovish inclination on the market’s behalf. Should the bank proceed with a rate cut as expected, a scenario that we currently also share, market attention is expected to be on the bank’s forward guidance and should the bank imply that it intends to proceed with further rate cuts we may see the USD retreating somewhat as the market’s dovish expectations for the Fed’s intentions could intensify. On the flip side, should the bank in its forward guidance express doubts for the necessity of extensive further easing it may force the market to readjust its expectations and in that way support the greenback. On a macro level, we highlight the release of the GDP advance rate for Q3 and a possible slowdown of the rate could weigh on the USD as it would imply that the US economy grew at a slower pace.

Analyst’s opinion (USD)

“US Fundamentals are expected to continue tantalising the greenback, with a prolonged US Government shutdown and an escalation of tensions in the US-Sino relationships possibly weighing on the USD. On a monetary level we highlight the Fed’s interest rate decision, which is expected to deliver a rate cut and attention falls on the forward guidance. On a macro level, we note the release of the US GDP advance rate for Q3, and a possible slowdown could weigh on the USD should it exceed market expectations.”

GBP – Fundamentals to lead the pound

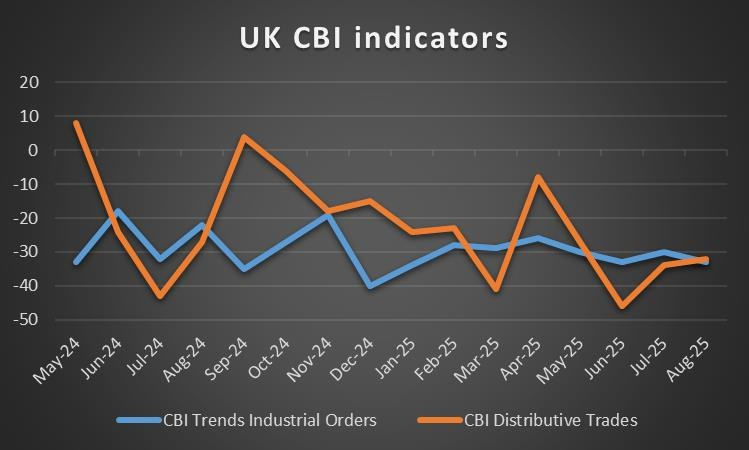

Cable seems ready το end the week lower against the USD, relenting the gains made in the past week, possibly driven lower by the failure of the CPI rates for September to accelerate as expected. As for financial releases we find next week’s calendar for GBP traders rather empty with one exception being possibly the CBI indicator for distributive trades for October. Hence we turn our attention towards fundamentals. We note that the market’s worries for the UK economic outlook still being present and weighing somewhat on the pound. On a positive note UK borrowing casts seem to be falling making UK Chancellor of EX Chequers a favour. Yet the possibility of a tax hike being announced is present and could weigh on the GBP. On a monetary level, we note that the market expects the bank to cut rates in the December meeting and remain on hold after that for some months, according to GBP OIS. The prospect of a rate cut may weigh a bit on the pound, yet the prospect of a stabilisation of the bank rate may counter it. Our worries revolve more around BoE rate setter Dhingra’s comments that the US tariffs on UK products entering the US are a drag for the UK economy, yet at the same time may add some downward pressure on the CPI rates in the medium term. The comment tended to lean more on the dovish side, yet produced little market reaction.

Analyst’s opinion (GBP)

“Given that for pound traders the calendar is rather empty of high impact financial releases we turn our attention towards the fundamentals surrounding the pound. Any enhancement of the market’s dovish expectations for BoE could weigh on the pound as could also any intensification of the market’s worries for the UK economic outlook.”

JPY – BoJ expected to remain on hold

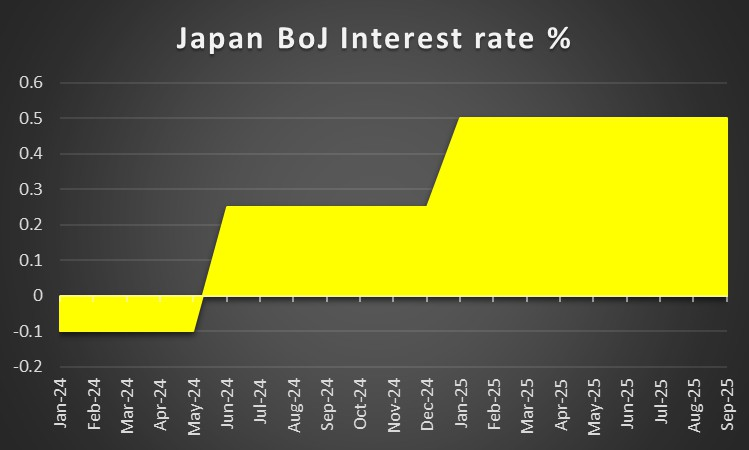

JPY is about to end the week in the reds against the USD, EUR and GBP, in a sign of wider weakness for the Japanese currency. On a fundamental level, we note that Ms. Takaichi was elected as the new PM of Japan, despite some wobbling. The election of Ms. Takaichi is considered as a turn to the right of the Japanese political scene as she is considered as ultraconservative. Yet we focus on Ms. Takaichi’s criticism for BoJ’s intentions to raise interest rates further. It should be noted that BoJ’s hawkish intentions and narrative of inflationary pressures in the Japanese economy, may have gotten some support as the CPI rates for September accelerated both on a core and headline level. In the coming week, we note the release of BoJ’s interest rate decision as the key event for JPY traders. The bank is widely expected to remain on hold and the market is also expecting the bank to hike rates in the January 26 meeting. We also expect the bank to remain on hold and turn our attention to the bank’s forward guidance. BoJ policymakers are expected to debate the timing of a possible rate hike and we expect the bank’s forward guidance to be leaning more on the hawkish side. Yet for the time being, given the recent election of Ms. Takaichi, the bank’s hands are somewhat tied. Should the bank enhance the market’s expectations for BoJ to hike rates we may see JPY getting some support and vice versa a possibly less than expected hawkish forward guidance, could weigh on the Yen. Also we continue to monitor JPY under a safe haven lens for international finance markets and the uncertainty on a global geopolitical level.

Analyst’s opinion (JPY)

“In the coming week, we highlight BoJ’s interest rate decision as the key event for JPY traders. The bank is expected to remain on hold and should the bank issue a forward guidance with a hawkish tone we may see the Yen getting some support.”

EUR – ECB to keep rates unchanged.

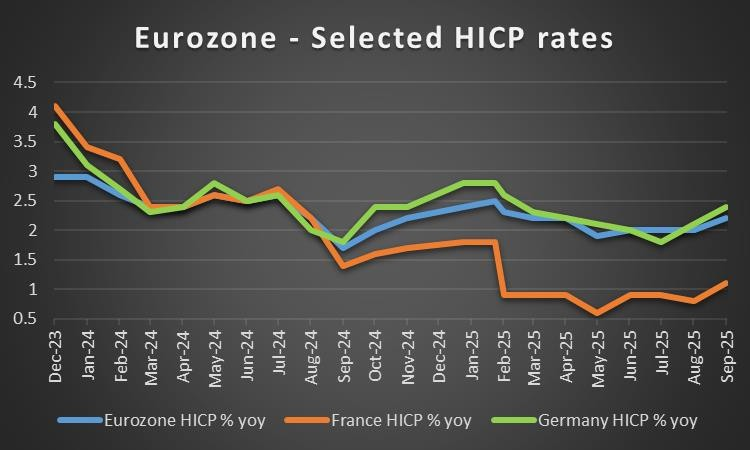

We start the EUR paragraph fundamentals including the war in Ukraine. The Ukrainians for the time being are making some daring attacks yet the Russians are holding their ground. It’s an attrition war and our worries tend to revolve around a possible escalation in the intensity of the fighting. It should be noted that a possible Trump-Putin meeting in Budapest has been cancelled indicative of a lack of progress in the improvement of the relationship of the two countries. On the contrary US President Trump has imposed new sanctions on Russian oil companies. A possible escalation of the war in Ukraine could weigh on the EUR as uncertainty on its east flank could be magnified. On a monetary level, we highlight the release of ECB’s interest rate decision next Thursday. The bank is widely expected to remain on hold, EUR OIS imply that the market has almost fully priced in such a scenario to materialise and its characteristic that the market currently expects the bank to remain on hold until the end of 2026. We expect a very careful forward guidance to be issued in the bank’s accompanying statement and ECB President Lagarde’s press conference, providing little about the bank’s intentions. Possibly we may see the bank indirectly reiterating that the bank’s monetary policy is in a “good place”, which could be considered as supportive for the common currency as it resists any ideas for an easing of the bank’s monetary policy. Should the bank unexpectedly include dovish innuendos in its forward guidance we may see the single currency, losing ground and the contrary should there be any hawkish elements present in ECB’s forward guidance. On a macroeconomic level, we note the notable improvement of economic activity in the Euro Zone, a positive for the common currency. We also note in the coming week the release of the preliminary HICP rates for October and GDP rates for Q3. Should the rates accelerate we may see the EUR getting some support as it could imply some slight inflationary pressures and a positive growth for the Euro Zone. Our main focus is to be on Germany’s preliminary GDP rate for Q3, as should the rate on a quarter on quarter level remain in the negatives, it would imply that the largest economy in the Euro Zone is in recession which in turn may enhance market worries for the macroeconomic outlook of the Zone as a whole.

Analyst’s opinion (EUR)

“In the coming week we may see some interest revolving around ECB’s interest rate decision which could under certain circumstances provide some support for the EUR, while the release of the preliminary HICP rates for October and preliminary GDP rates for Q3, also gathering some interest among EUR traders.”

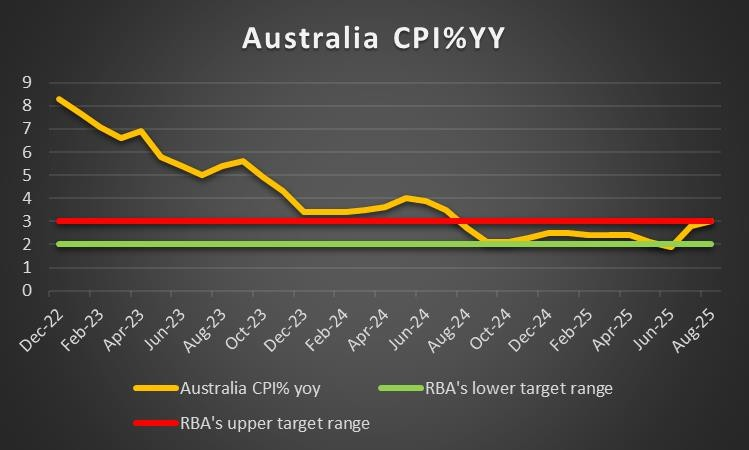

AUD – September’s CPI rates and US-Sino trade relationships to shake the Aussie

In the coming week we highlight on a macro level for Aussie traders the release of Australia’s CPI rates for September and Q3. A possible acceleration of the rates implying some persistence of the inflationary pressures in the Australian economy could provide some support for the Aussie as it would add more pressure on RBA to maintain rates unchanged. The bank is expected to cut rates by 25 basis points early next month and continue easing its monetary policy in Spring next year. The bank seems to remain open to both scenarios namely cutting rates and remaining on hold. We note RBA Governor Michele Bullock’s speech next Monday as a point of interest for the bank’s monetary policy and a possible innuendos could move the Aussie to either direction, depending on the content. On a fundamental level, we highlight the tensions in the US- Sino trade relationships as the key issue for the Aussie. Should we see an improvement of the US-Chinese relationships given the planned Trump-Xi meeting next week, Aussie traders may get more confidence and buy the Aussie given also the close Chinese-Australian economic ties. Also an improvement of the general market sentiment could provide some support for AUD, given that the Aussie is considered as a riskier asset in the FX market.

Analyst’s opinion (AUD)

“In the coming week, we expect the course of the US-Sino trade relationships to remain the dominant issue for Aussie traders and a possible improvement could provide some support for AUD. Also a possible acceleration of the Australian CPI rates could provide some support for AUD.”

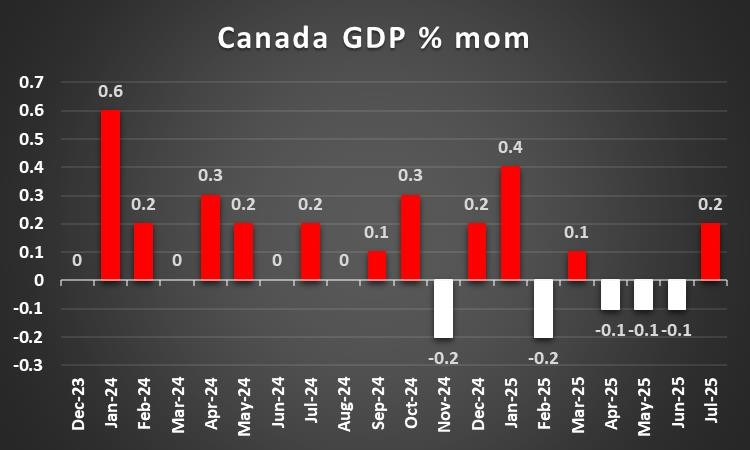

CAD – BoC expected to cut rates

The CAD seems to have stabilised against the USD in the past few days after the losses of the past three weeks. In the coming week, we expect the release of BoC’s interest rate decision next Wednesday, as the key issue for Loonie traders. The bank is expected to cut rates by 25 basis points and currently CAD OIS imply a probability of 87.9% for such a scenario to materialise, while the market seems to have some mixed expectations for the bank’s intentions after that. Should the bank cut rates as expected and signal in its forward guidance that it intends to proceed with further easing we may see the CAD losing ground, while should the bank express some cautiousness for the necessity to ease its monetary policy further at the current stage, we may see the Loonie getting some support. On a macro level the recent acceleration of the CPI rates for the past month tends to suggest that some caution in further easing of BoC’s monetary policy. In the coming week, we note the release of the GDP rate for August and a possible acceleration of the rate could provide some support for the CAD. On a fundamental level, we note that US President Trump has cancelled the trade negotiations with Canada as an advert against the US tariffs by the Ontario Government seems to have angered the US President. Should the tensions on the US-Canadian trade relationships escalate further, we may see the Loonie losing some ground. Also the recent rise of oil prices, given the US sanctions on Russian oil companies, the Ukrainian hit on Russian oil facilities and the announcement of large Chinese refineries that they will refrain from buying Russian sea- borne oil, have erased at least temporarily the market worries for a an oversupply of the oil market by OPEC. Should oil prices continue to rise we may see the Loonie getting some support as Canada is considered a major oil producing economy.

Analyst’s opinion (CAD)

“In the coming week we expect the release of BoC’s interest rate decision to shake Loonie traders, while on a fundamental level the ending of the US-Canadian trade negotiations by US President Trump is a negative signal for the Loonie.”

General Comment

As an epilogue, in the FX market we expect the USD to maintain the initiative over its counterparts, yet at the same time given that we get high impact releases on a monetary and macroeconomic level, from other economies, we may see the interest of FX traders splitting somewhat allowing for a more balanced trading mix to emerge. In the US equities market, we continue to view the optimism generated by the prospects of AI supporting the price of shares, yet also the earnings period is in full swing with a number of high profile companies expected to release their reports in the coming week. The main event of the markets over the past week in our opinion was the wide drop of gold’s price, ending a nine week winning streak. A change of trend seems to be emerging with the upward direction being interrupted and being replaced by a relative stabilisation of gold’s price, at least for the time being.

اگر در مورد این مقاله سوال یا نظر ی کلی دارید، لطفاً ایمیل خود را مستقیماً به تیم تحقیقاتی ما بفرستیدresearch_team@ironfx.com

سلب مسئولیت:

این اطلاعات به عنوان مشاوره سرمایه گذاری یا توصیه سرمایه گذاری در نظر گرفته نمی شود ، بلکه در عوض یک ارتباط بازاریابی است. IronFX هیچ گونه مسئولیتی در قبال داده ها یا اطلاعاتی که توسط اشخاص ثالث در این ارتباطات ارجاع و یا پیوند داده شده اند ندارد.