The UK’s annual budget is set to be released tomorrow. The upcoming announcement has faced heavy scrutiny from across the board, as it appeared that the Labour Government was on track to break a manifesto pledge. In our view the greatest concern is the way the Government is planning on raising revenue in order to fill the gaping budget hole that has strained the UK economy. Thus, we would not be surprised to see the government announcing an increase in income tax amongst other measures which in turn could weigh on the sterling. However, the way the pound may react depends on the market’s interpretation of the government’s budget announcement.On a geopolitical level, the stage is set between the US and Venezuela with the Trump administration designating President Maduro as a member of a foreign terrorist organization. In turn the designation of a foreign leader as a member of a terrorist organization could give the US the casus belli they have been looking for in order to intervene militarily in Venezuela. Hence in the event of a war breaking out between the two nations, oil and gold prices may gain newfound support. In the US Equities markets, a variety of media outlets have reported that Meta is in talks to spend billions on Google’s AI chips which could imply that Google (#GOOG) is making significant headway in their endeavours to challenge Nvidia’s current dominance in the market. Therefore, any further information which may showcase progress made by Google, could aid their stock price whilst simultaneously weighing on Nvidia’s stock price.In tomorrow’s Asian session, Australia’s CPI rates are set to be released which could influence the Aussie.

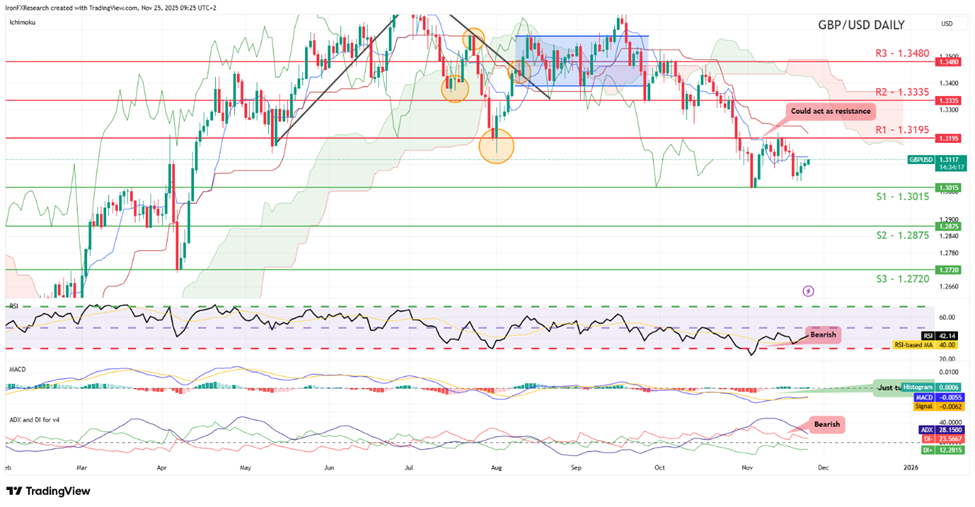

GBP/USD appears to be moving in a sideways fashion after failing to clear our 1.3015 (S1) support level. We opt for a sideways bias for the pair and supporting our case is the mixed signals from our indicators below our chart. For our sideways bias to be maintained, we would require the pair to remain confined between our 1.3015 (S1) support level and our 1.3195 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 1.3015 (S1) support level with the next possible target for the bears being our 1.2875 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 1.3195 (R1) resistance line with the next possible target for the bulls being our 1.3335 (R2) resistance level.

XAU/USD appears to be moving in an upwards fashion after reaching our 4150 (R1) resistance level. We opt for a bullish outlook for gold’s price and supporting our case are all three indicators below our chart, which tend to point towards a bullish market sentiment. For our bullish outlook to continue we would require a clear break above our 4150 (R1) resistance level with the next possible target for the bulls being our 4240 (R2) resistance line. On the other hand, for a sideways bias we would require gold’s price to remain confined between our 4045 (S1) support level and our 4150 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 4045 (S1) support level with the next possible target for the bears being our 3980 (S2) support line.

دیگر نکات مهم امروز:

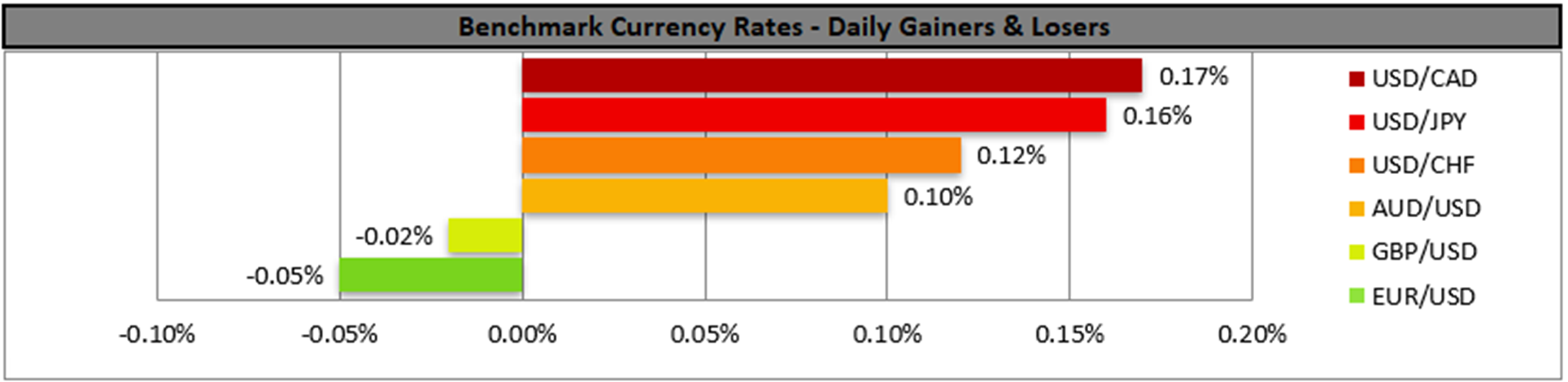

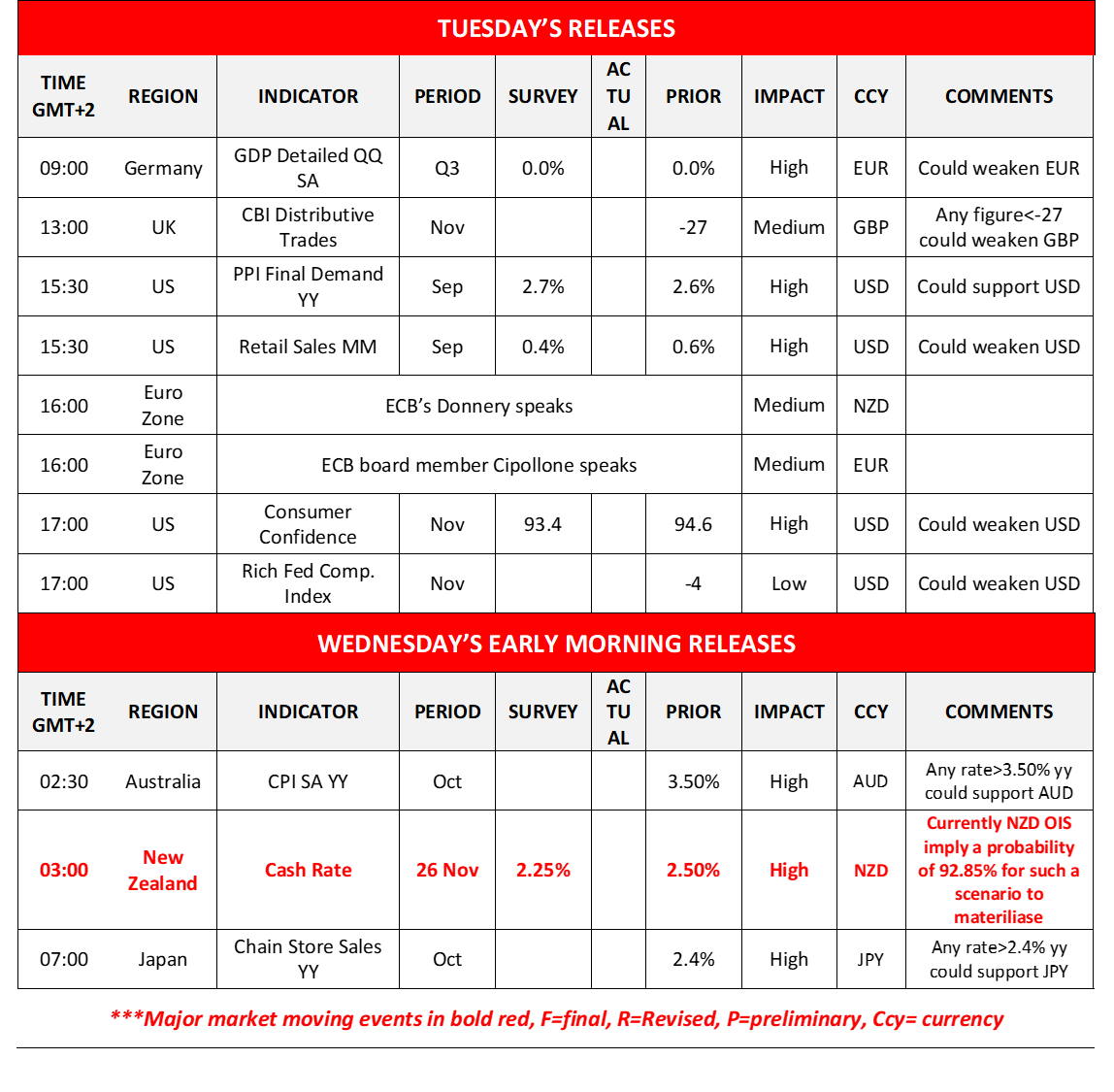

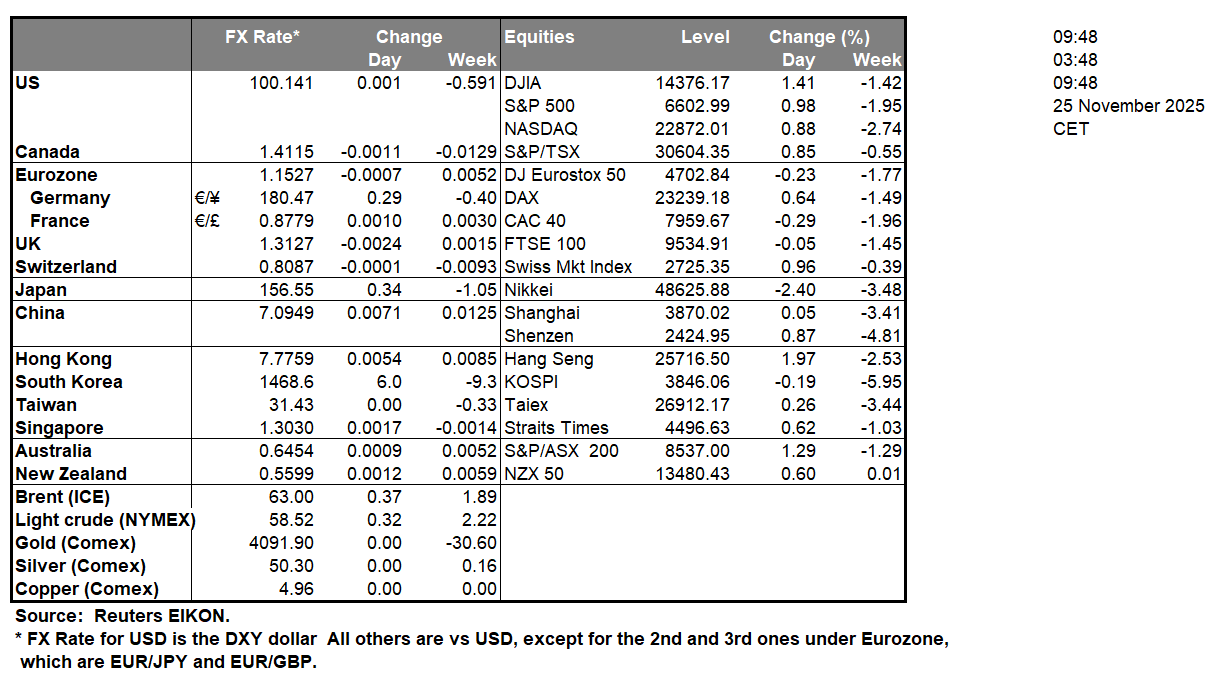

Today we get Germany’s detailed GDP rate for Q3, UK’s distributive trades for November and from the US the PPI rates for September, the retail sales for the same month, November’s consumer confidence and November’s Richmond Fed Composite Index. On a monetary level we note that ECB’s Donnery and Cipollone speak. In tomorrow’s Asian session, we note the release of Australia’s CPI rates for October, from New Zealand, we get RBNZ’s interest rate decision, while from Japan we note the release of October chain store sales.

GBP/USD Daily Chart

- Support: 1.3015 (S1), 1.2875 (S2), 1.2720 (S3)

- Resistance: 1.3195 (R1), 1.3335 (R2), 1.3480 (R3)

نمودار چهار ساعته طلا / دلار آمریکا

- Support: 4045 (S1), 3980 (S2), 3902 (S3)

- Resistance: 4150 (R1), 4240 (R2), 4340 (R3)

اگر در مورد این مقاله سوال یا نظر ی کلی دارید، لطفاً ایمیل خود را مستقیماً به تیم تحقیقاتی ما بفرستیدresearch_team@ironfx.com

سلب مسئولیت:

این اطلاعات به عنوان مشاوره سرمایه گذاری یا توصیه سرمایه گذاری در نظر گرفته نمی شود ، بلکه در عوض یک ارتباط بازاریابی است. IronFX هیچ گونه مسئولیتی در قبال داده ها یا اطلاعاتی که توسط اشخاص ثالث در این ارتباطات ارجاع و یا پیوند داده شده اند ندارد.