JPY tumbled against the USD, the EUR and the GBP yesterday in a wider sign of weakness for the Japanese currency. Market worries for political pressure being exercised by the new Japanese Government on BoJ to ease its rate hiking plans, tend to weigh on JPY. We have to note that BoJ kept rates steady as was widely expected yesterday, yet there was a split of 7-2 with the dissenting parties Mr. Takata and Mr. Tamura, favouring a 25 basis points rate hike. It’s characteristic that BoJ Governor Kazuo Ueda after the release of BoJ’s interest rate decision, pledged to continue hiking rates should the economy move in line with the bank’s expectations. The comments were considered as unusually strong, considering the otherwise soft-spoken BoJ Governor. Also, Reuters reports that trade unions in Japan are to seek 5% wage increases or even more and given that the path of wage increases tended to be a key driver behind BoJ’s monetary policy, it adds more pressure on the bank to hike rates in December. Furthermore, given the weakening of JPY, for the USD/JPY carry trade to be halted, a decisive stance on behalf of the BoJ may be required. For the time being, the markets are pricing in a scenario for the bank to remain on hold in December and delay any rate hikes until early Spring next year. On a fiscal level, we note the Japanese Minister of Finance Satsuki Katayama stated in today’s Asian session that the government has been monitoring the weakening of Yen “with a high sense of urgency“, highlighting the one-sided movement of the Japanese currency in the FX market. The comments could be perceived as verbal market intervention, yet the continuing weakening of JPY tends to imply that the market does not pay attention, believing that the Japanese Government may not have the ammunition to defend its currency on a continuous basis. Nevertheless, the scenario of Japan starting to buy Yen in the international markets should not be underestimated.

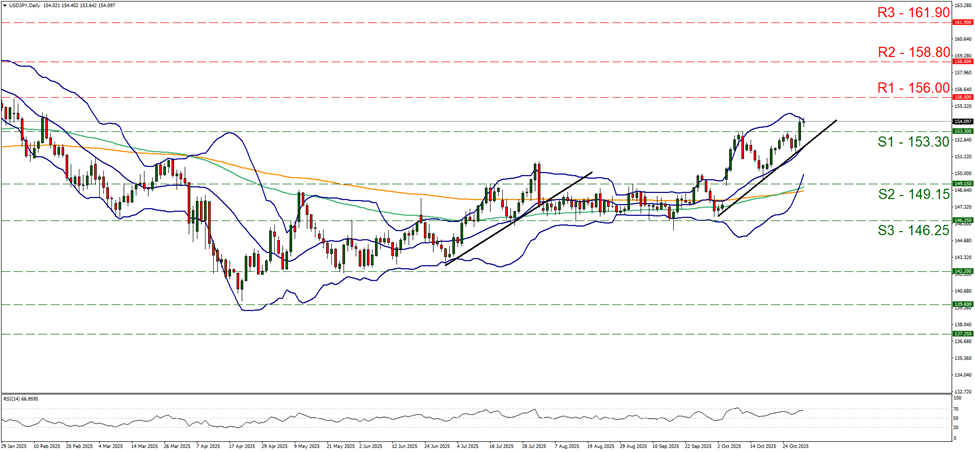

USD/JPY renewed its bullish tendencies yesterday breaking the 153.30 (S1) resistance line now turned to support. On a technical level, we maintain a bullish outlook for the pair, and the pair’s upward movement yesterday allowed us to draw an upward trendline starting from the 2nd of October and showing the limitations of the pair’s upward movement. The RSI indicator has neared the reading of 70, implying a strong bullish market sentiment for the pair, yet the fact that USD/JPY’s price action has reached the upper Bollinger band may slow down the bulls somewhat. Should the bulls maintain control over the pair’s direction we may see it breaking the 156.00 (R1) resistance line with the next possible target for the bulls being set at the 158.80 (R2) resistance level. Yet the pair has reached levels not seen for the past eight months or so and the heights may be giving the bulls vertigo. Should the bears take over, we may see the pair breaking the prementioned upward trendline in a first signal of an interruption of the upward movement and continuing lower to break the 153.30 (S1) support line clearly, thus paving the way for the 149.15 (S2) support base.

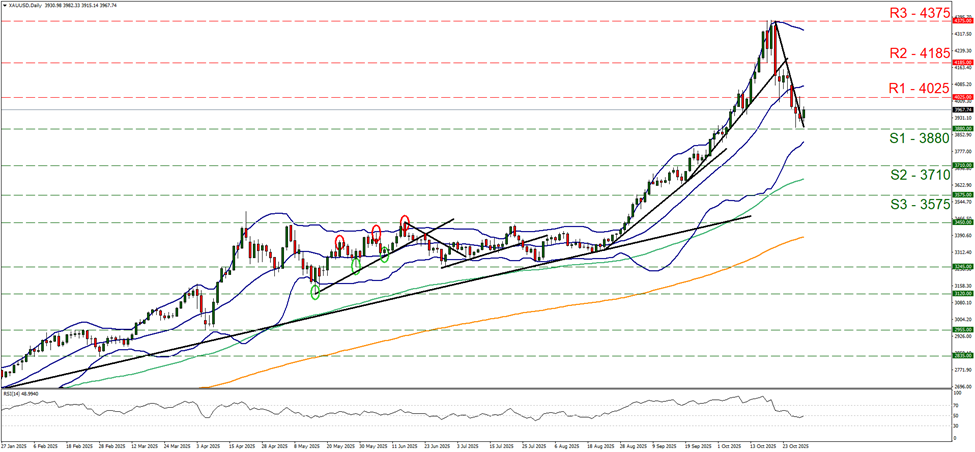

Since yesterday’s report, Gold’s price moved higher yesterday testing but not breaking the 4025 (R1) resistance line. We maintain currently a bias for a sideways motion of the precious metal’s price given also that the RSI indicator has landed on the reading of 50, implying a rather indecisive market, which could allow the stabilisation to be maintained. Should the bears take over, gold’s price may break the 3880 (S1) support line and start aiming for the 3710 (S2) level. Should the bulls take over, gold’s price may break the 4025 (R1) resistance line and start aiming for the 4185 (R2) level.

Otros puntos destacados del día:

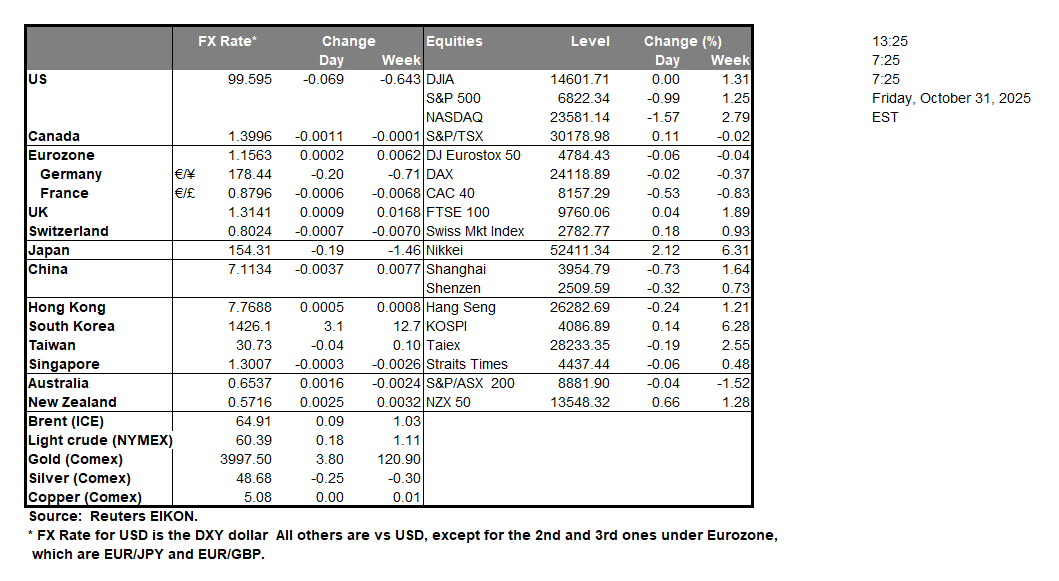

Today we get Canada’s GDP rate for August and from the US we may get September’s PCE rates. On a monetary level, we note the speeches of Dallas Fed President Logan and Atlanta Fed President Bostic. On Monday’s Asian session, we get Australia’s Building approvals for September and China’s manufacturing PMI figure for October.

USD/JPY Daily Chart

- Support: 153.30 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 156.00 (R1), 158.80 (R2), 161.90 (R3)

XAU/USD Gráfico Diario

- Support: 3880 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4025 (R1), 4185 (R2), 4375 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.