The trade relationship between China and the b continues to sour, with the US and China set to begin charging additional port fees on ocean shipping firms from each other’s respective nation, that ship anything from toys to crude oil. However, China will not be charging those additional fees on Chinese-built ships even if they are operated by a U.S company. The tit-for-tat fees and threats of tariffs could possibly upend the global trade economy and may result in heightened volatility in the markets, as the two world’s economic superpowers appear to be on track for a trade war starting on the 1st of November. Although we should note that President Trump has since taken a softer tone on China with the FT quoting the President as having said that the US “wants to help China, not hurt it!!!”. The President’s softer tone may offer some reprieve to the markets, yet the issue still remains as to whether the two nations will be able to strike a trade deal. In our view, we wouldn’t be surprised to see some form of trade “ceasefire” emerging, yet anything short of a full trade deal could raise concerns that another dispute may rise in the future and may lead to heightened volatility in the markets. In France, the political drama continues, which in our view is similar to that of a reality TV show. Nonetheless, the French President stated yesterday that “At this moment, France is being watched. The message it must give is a message of stability and strength” in an attempt to garner public support for yet another Government, in hopes that this one lasts for more than a couple of months. Moreover, we wouldn’t be surprised to see another no-confidence motion being introduced which in turn could weigh on the French Equities markets.

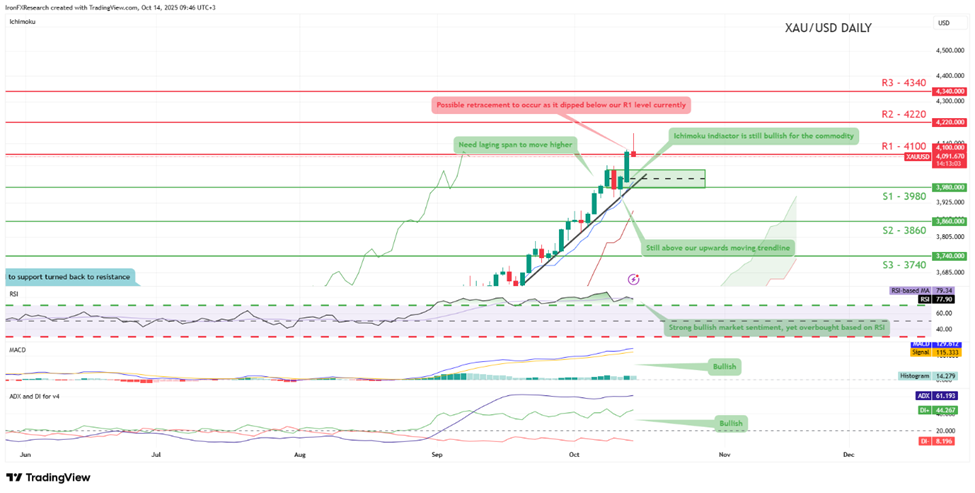

On a technical level, looking at XAU/USD we would maintain a predominantly bullish outlook for the precious metal’s price, yet we would also not be surprised to see a market correction to lower ground. Regardless we would opt for our predominantly bullish outlook and supporting our case is our upwards moving trendline as indicated on the chart, in addition to our ADX, RSI and MACD indicators located at the bottom of the chart. For our bullish outlook to be maintained, we would require gold’s price to remain above our upwards moving trendline if not also clearing and remaining above our 4100 (R1) resistance level with the next possible target for the bulls being the hypothetical 4220 (R2) resistance line.On the other hand for a bearish outlook we would require a clear break below our 3980 (S1) support line with the next possible target for the bears being our 3860 (S2) support level. Lastly, for a sideways bias we would require gold’s price to remain confined between our 3980 (S1) support level and our 4100 (R1) resistance line.

EUR/USD appears to be moving in a downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the downwards moving trendline which was incepted on the 17th of September, in addition to our MACD,RSI and ADX indicators below our chart. For our bearish outlook to continue we would require a clear break below our 1.1480 (S1) support level with the next possible target for the bears being our 1.1330 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1480 (S1) support level and our 1.1650 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above our 1.1650 (R1) resistance line with the next possible target for the bulls being our 1.1800 (R2) resistance level.

Otros puntos destacados del día:

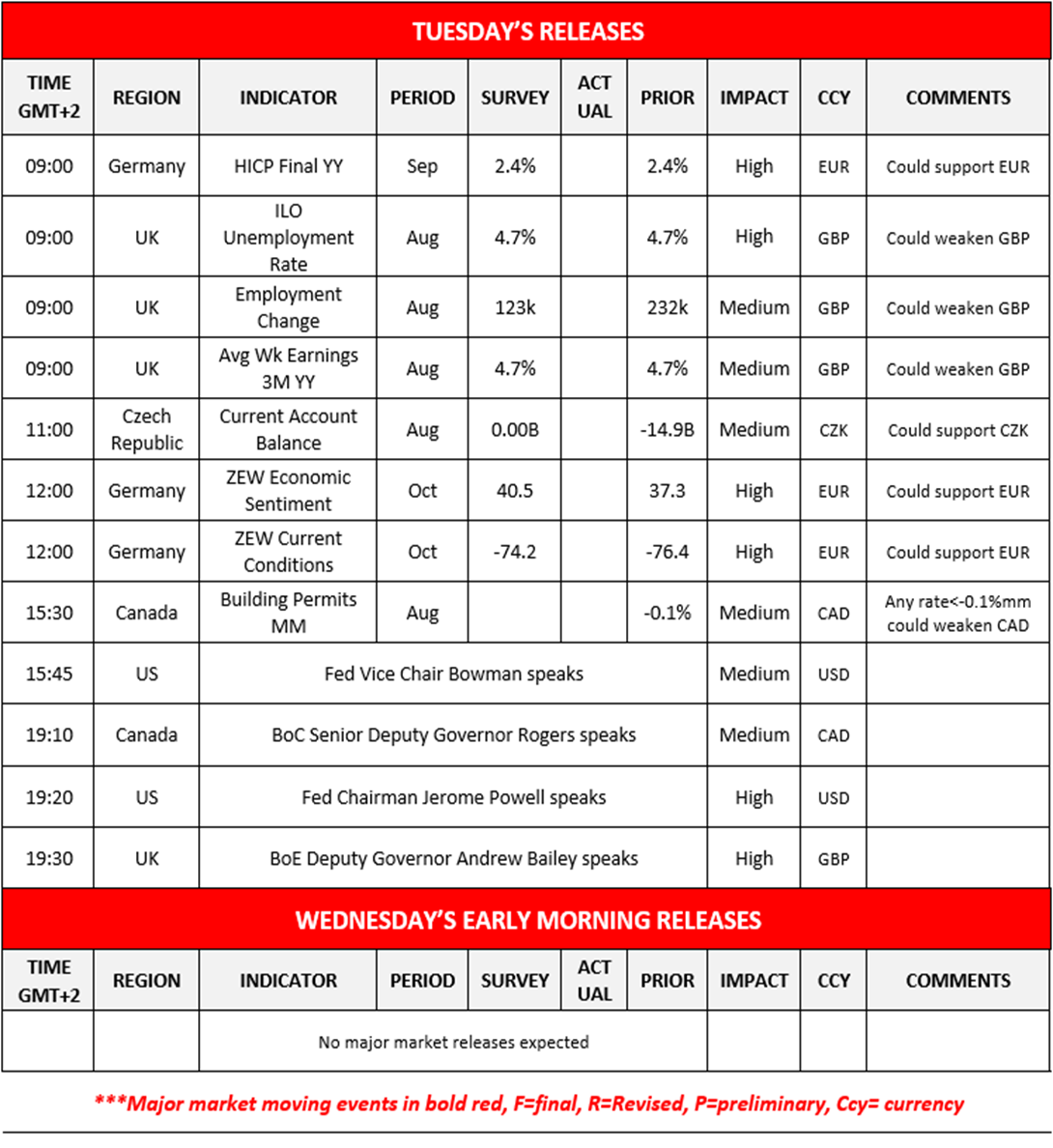

Today we note the release of Germany’s final HICP rates for September, UK’s employment data for August, the Czech Republic’s Current account balance for August, Germany’s ZEW indicators for October and Canada’s building permits for August. On a monetary level a number of policymakers from a number of central banks are scheduled to speak yet we highlight Fed Chairman Powell and BoE Governor Bailey as the two key speeches today.

EUR/USD Daily Chart

- Support: 1.1480 (S1), 1.1330 (S2), 1.1085 (S3)

- Resistance: 1.1650 (R1), 1.1800 (R2), 1.1980 (R3)

XAU/USD Daily Chart

- Support: 3980 (S1), 3860 (S2), 3740 (S3)

- Resistance: 4100 (R1), 4220 (R2), 4340 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.