According to various media outlets, ECB Chief Economist Lane stated in an interview that was released earlier on today, he stated that the bank can move downwards “within the zone of restrictiveness”, when referring to interest rates. The comments made by ECB Chief Economist Lane , could imply that the bank may soon begin to ease its monetary policy.

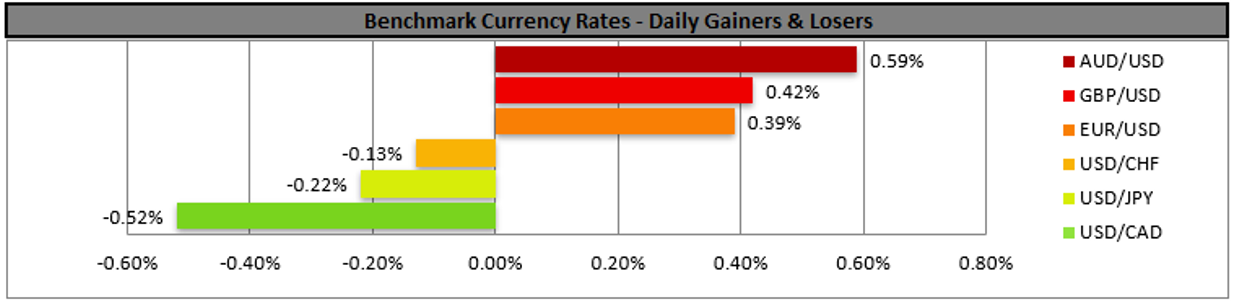

Hence, should more ECB policymakers imply that the bank may be preparing to cut interest rates sooner rather than later, we may see the EUR weakening.Tensions in the Middle East appear to be on the rise again, following Israel’s strike at an area of tents used by displaced people. An increase in regional tensions could provide safe haven inflows into gold.

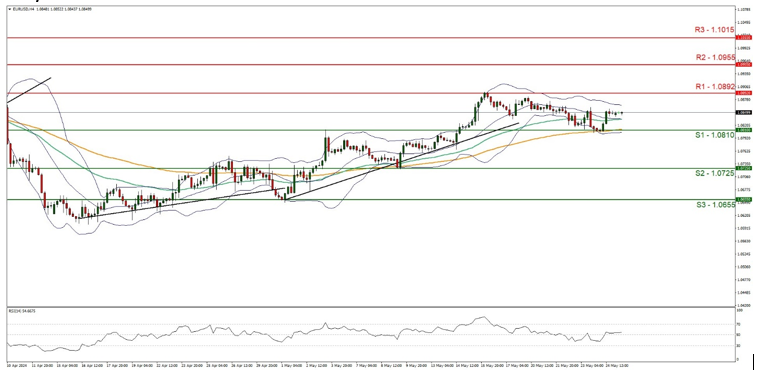

On a technical level EUR/USD appears to be moving in a sideways fashion. We maintain a sideways bias for the pair and supporting our case is the flattening of the 50MA and 100 MA lines, in addition to the Bollinger bands also narrowing which imply low market volatility.

Furthermore, the RSI Indicator below our chart currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the pair to remain confined within the 1.0810 (S1) support line and the 1.0982 (R1) resistance level.

On the flip side, for a bearish outlook, we would require a clear break below the 1.0810 (S1) support line, with the next possible target for the bears being the 1.0725 (S2) support level. Lastly, for a bullish outlook, we would require a clear break above the 1.0982 (R1) resistance line, with the next possible target for the bulls being the 1.0955 (R2) resistance line.

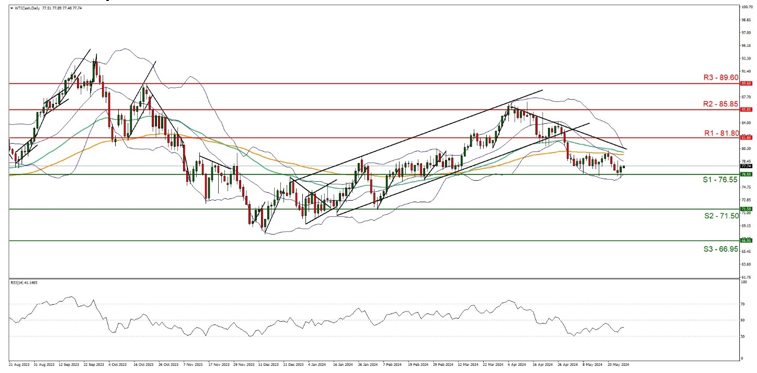

WTICash appears to be moving in a downwards fashion. We maintain a bearish outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure near 40, implying bearish market tendencies, in addition to the downwards moving trendline which has been guiding the commodity since the 5th of May.

For our bearish outlook to continue, we would require a clear break below the 76.55 (S1) support line, with the next possible target for the bears being the 71.50 (S2) support level.

On the flip side for a sideways bias, we would like to see the commodity remain confined between the 76.55 (S1) support level and the 81.80 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 81.80 (R1) resistance line, with the next possible target for the bulls being the 85.85 (R2) resistance level

Otros puntos destacados del día.

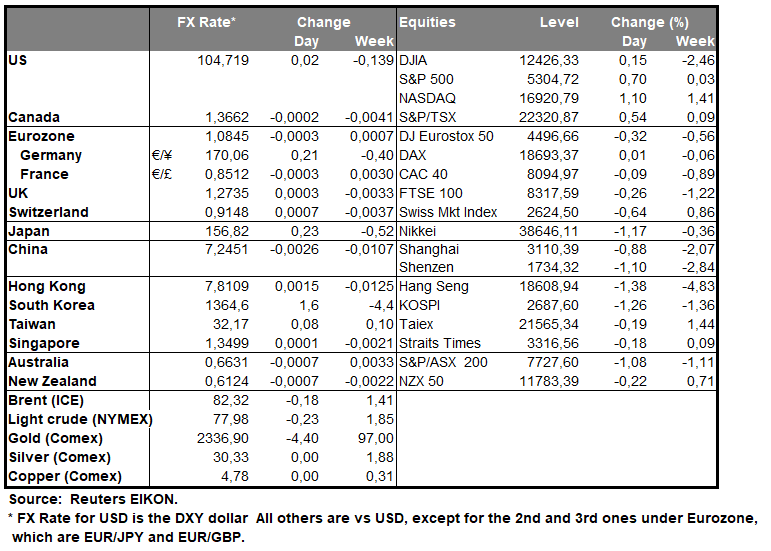

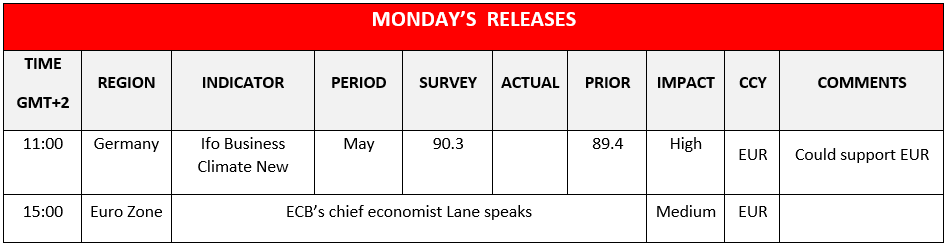

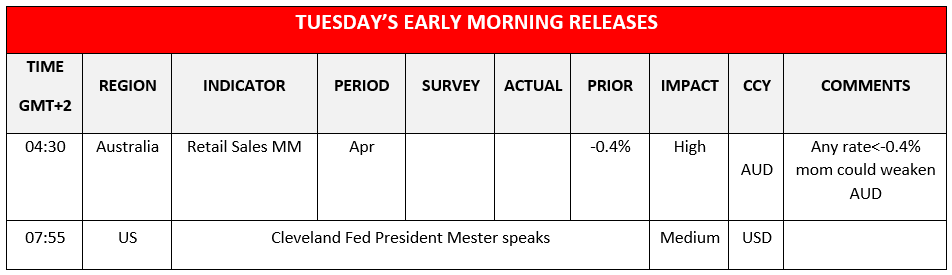

Today we note the release of Germany’s Ifo indicators for May, while ECB’s chief economist is scheduled to make statements. During tomorrow’s Asian session, we get Australia’s retail sales for April while later on Cleveland Fed President Mester is scheduled to speak.

On Tuesday we get the US Consumer confidence figure for May. On Wednesday, we get Australia’s CPI rate for April, Germany’s Gfk consumer sentiment figure for June and Germany’s Preliminary HICP rates for May.

On Thursday, SNB Chairman Jordan speaks and we get Australia’s building approvals rate for April, Sweden’s and Switzerland’s GDP rates both for Q1, Switzerland’s Kof indicator for May, Canada’s business barometer figure for May, the US 2nd GDP estimate rate for Q1 and the US weekly initial jobless claims figure.

On Friday we begin some comments from RBNZ’s Governor Orr and continue with Japan’s Tokyo CPI rates for May and Preliminary Industrial output rate for April, China’s NBS Manufacturing PMI figure for May, the UK’s Nationwide house price rate for May, France’s Final GDP rate for Q1 and France’s preliminary HICP rates for May, followed by Turkey’s quarterly GDP rate for Q1, the Eurozone’s Preliminary HICP rate for May, the US PCE rates for April and ending of the week is Canada’s annualized GDP rates for Q1 and March.

EUR/USD Gráfico 4H

- Support: 1.0810 (S1), 1.0725 (S2), 1.0655 (S3)

- Resistance: 1.0892 (R1), 1.0955 (R2), 1.1015 (R3)

WTICash Daily Chart

- Support: 76.55 (S1), 71.50 (S2), 66.95 (S3)

- Resistance: 81.80 (R1), 85.80 (R2), 89.60 (R3)

Si tiene preguntas generales o comentarios relacionados con este artículo, envíe un correo electrónico directamente a nuestro equipo de investigación a research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.