We are nearing the end of the week and have a look at next week’s calendar .On Monday we get China’s trade balance figure for November, Japan’s revised GDP rate for Q3, Germany’s industrial output rate for October, the Czech Republic’s unemployment rate for November and the Zone’s Sentix index figure for December. On Tuesday, we get the RBA’s interest rate decision and the US JOLT’s job openings figure for September. On Wednesday we get China’s PPI and CPI rates for November, Sweden’s GDP rate for October, Norway’s inflation rate for November, speeches by BoE Governor Bailey and ECB President Lagarde and the highlights of the week which are the Bank of Canada’s and the Federal Reserve’s interest rate decisions. On Thursday we get Australia’s employment data and Sweden’s CPI rates both for November, the SNB’s and CBT’s interest rate decisions. On Friday we get Germany’s final HICP rate for November, the UK’s GDP rates and manufacturing output rate all for October, Sweden’s unemployment rate for November, Franc e’s final HICP rate for November and the speeches by Philadelphia Fed President Paulson and Chicago Fed President Goolsbee.

USD – FED Decision next week

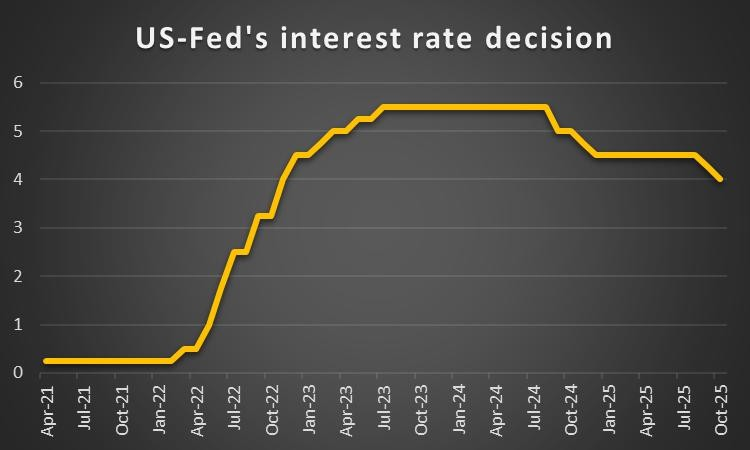

Our comment for the USD starts with monetary policy, considering that the Fed’s last interest rate decision for the year is set to occur next week. As things stand, the majority of market participants currently anticipate the Fed to cut rates by 25 basis points, with FFF currently implying an 89.73% probability for such a scenario to materialize. Hence, we will focus on the upcoming interest rate decision, where we wouldn’t be surprised to see what we would call a “hawkish cut” where the bank may cut rates by 25 basis points, but in it’s accompanying statement showcases a willingness to remain on hold for a prolonged period of time. Thus, although the initial reaction may weigh on the dollar as a result of the assumed rate cut, the secondary shockwave may be hawkish in nature and could thus provide support for the dollar. However, from a macroeconomic standpoint the US PCE rates for September are set to be released today and could either invalidate our hypothesis or further amplify the dovish expectations from market participants for the Fed in the coming week. In our first scenario, an acceleration of inflationary pressures could lead to the Fed adopting a hawkish stance in their accompanying statement which is our current hypothesis and considering that the headline PCE rate is anticipated to accelerate from 2.8% to 2.9%, that may be the case which could aid the greenback. Whereas should inflation appear to be under control or even showcase signs of easing, it may allow for a more dovish tone to emerge from policymakers which could weigh on the USD. Lastly, from a political standpoint, President Donald Trump stated this week that he would be announcing the next Fed Chair early next year. Moreover, during his comments, the President teased reporters that the next Fed Chair may be in the room, “I guess a potential Fed chair is here too. Am I allowed to say that? Potential. He’s a respected person, that I can tell you. Thank you, Kevin”. ‘Kevin’ refers to Kevin Hasset the Director of the National Economic Council in the US, who was been touted as the current frontrunner for the Fed Chair position. Hence any signs which emerge which further confirm or change the markets perspective as to who the next Fed Chair may be, could also influence the dollar.

Analyst’s opinion (USD)

“Considering the anticipated uptick in the PCE rate for September, we wouldn’t be surprised to see a ‘hawkish’ cut from the Fed next week. Moreover, even if the PCE rates remain stable we would still maintain this view that the Fed may opt for ‘stronger’ language in their accompanying statement in order to ease the market’s expectations for the new year, in the event that an adjustment is required”

GBP – UK GDP rates next Friday

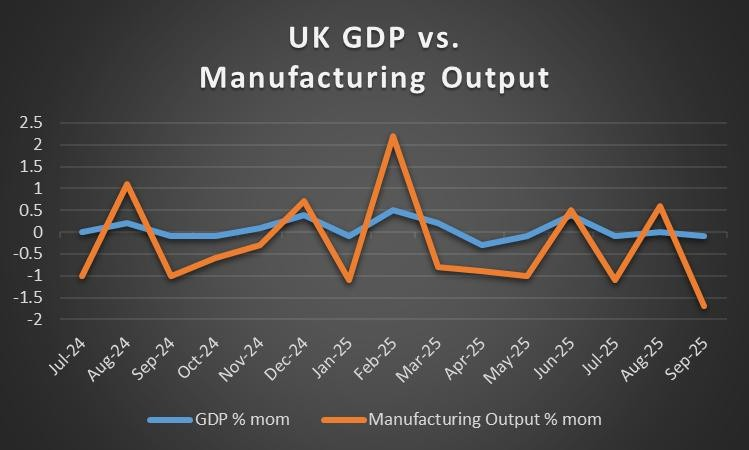

The main event for the this week may have been the release of the nation’s HPI rates for November which were released on Tuesday and exceeded the expectations by economists by coming in at 1.8% versus 1.4% on a year-on-year level and 0.3% versus 0.0% on a month-on-month basis, whilst on another positive note the composite PMI figure for November came in better than expected at 51.2 implying an overall expansion which may have provided support for the pound. In the coming week pound traders may be interested in the release of the nations GDP rates for October which are due out in the European trading session on Friday. The prior rates tended to showcase a bit of a concern for the economy when looking at the 3-month average which was at 0.1%. Nonetheless, should the GPD rates showcase economic growth in the UK economy, the sterling may find newfound support. Whereas, should they showcase a deterioration and even a contraction in growth, it may have the opposite effect on the sterling. From a monetary policy perspective traders may also be interested in the speech of BoE Governor Bailey on Wednesday where participants may be looking for clues as to how the bank may approach their next monetary policy meeting. Thus in the event of ‘hints’ being provided from the Governor the sterling could move in either direction depending on the narrative which emerges. Lastly, we would like to note the comments made by BoE policymaker Greene this week that “”I would need to see the labour market deteriorate more, and that would need to play out not just in the unemployment data, but also in the employment data”. The comments tend to paint a more restrictive narrative which is expected from Greene but nonetheless may have aided the pound.

Analyst’s opinion (GBP)

“We’re slightly surprised from the services and composite PMI figure from the UK which exceeded expectations. Our attention for the pound turns to the GDP rates next Friday which could influence the sterling, although even if they are received in a positive light, we must stress that the next reading may begin to reflect the economic impact as a result of the Government’s autumn budget.”

JPY – BOJ hike in the bank’s next meeting?

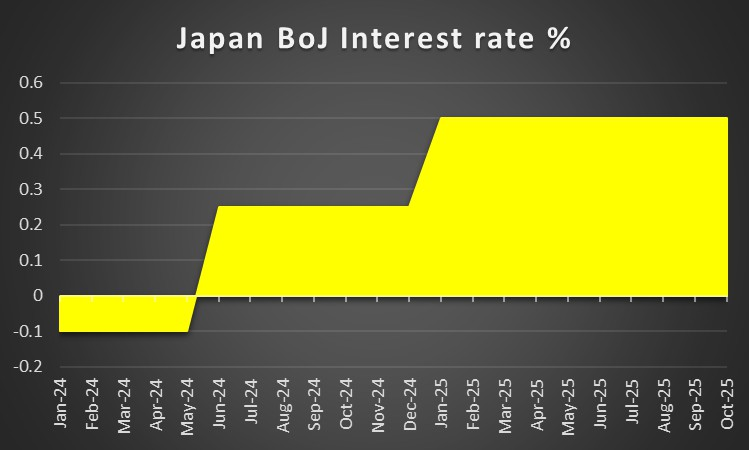

Sticking to our predominantly monetary policy theme in this week’s edition of our week ahead outlook, we start our paragraph on the BOJ from a monetary policy perspective as well. BOJ Governor Ueda earlier this week stated the following “will consider the pros and cons of raising the policy interest rate and make decisions as appropriate”, and that “We don’t know where it lies, but how much interest rates, nominal ones, will ultimately rise and how much will be appropriate will depend on that”. Considering the hawkish comments made by the Governor, we now opt for the view that the bank may hike in their final meeting of the year, an opinion which appears to be shared by other market participants as JPY OIS currently implies a 66.38% probability for a 25 basis point rate hike in their meeting on the 19th of December. Furthermore a Reuters source noted that the Government is prepared to tolerate a December hike, showcasing political tolerance for a rate hike. In turn as the bank’s meeting day approaches or even from next week, we wouldn’t be surprised to see the JPY gaining as a result of the anticipation of a rate hike from the bank. Moreover, should the bank’s accompanying statement in two weeks’ time also be hawkish in nature i.e, implying further rate hikes down the line, it may further provide support for the JPY. Lastly, for a macro perspective, we would like to note Japan’s revised GDP rate for Q3 which is due out on Monday, where an improvement from the unfavourable prior rate of -1.8% could provide support for the Yen and vice versa.

Analyst’s opinion (JPY)

“We now opt for the belief that the BOJ may hike in their meeting in two week’s time, following the comments made by BOJ Governor Ueda. Thus in the coming week, considering that the Fed is anticipated to cut rates whereas the BOJ is set to hike in two week’s time, we would not be surprised to see the JPY gaining against the dollar.”

EUR – Sentix index for the Euro next week

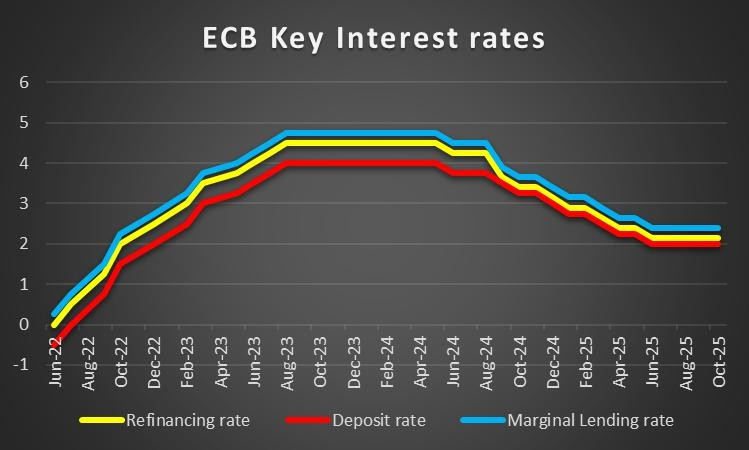

Making a start for the Eurozone on a macroeconomic level. On Monday we had Germany’s manufacturing PMI figure which tended to come in lower than expected at 48.2 implying a widening contraction in the manufacturing sector of Germany’s economy, which may have weighed on the EUR. However, looking at the Zone’s preliminary CPI rates for November on a year-on-year basis which came in hotter than expected, the common currency may have gained. Although if we’re being honest, the acceleration from 2.1% to 2.2% in our view is relatively immaterial as it is essentially at the bank’s 2% inflation target and thus may not lead to drastic changes in the bank’s monetary policy approach. A sentiment which ECB President Lagarde appears to agree with, considering her comments earlier on this week that “our assessment of the inflation outlook was broadly unchanged”, which may imply that the ECB could remain on a prolonged “holding pattern”. In turn the reduced possibility of further rate cuts by the ECB in the near term may have provided support for the EUR. For next week, the Eurozone’s Sentix figure for December is set to be released on Monday the 8th of December and could slightly influence the EUR’s direction. However, considering how many interest rate decisions we have occurring the release may be overshadowed.

Analyst’s opinion (EUR)

“The EUR may gain, considering the restrictive stance being taken by the ECB which tended to be affirmed by ECB President Lagarde. Thus in a world were the Fed may embark on a rate-cutting path, the EUR may gain as a result of the bank’s more restrictive stance. In our view, the ECB doesn’t need to cut or hike rates with inflation near its 2% target and thus commentary from policymakers may be finely balanced between dovish and hawkish elements if there are any.”

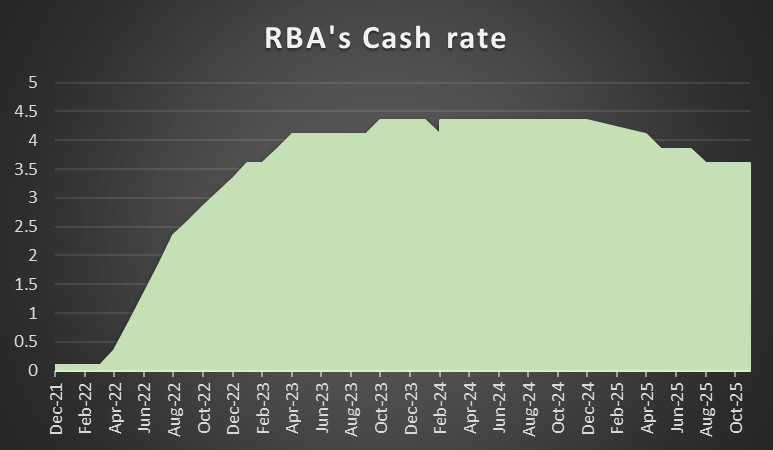

AUD – RBA decision week

The Aussie seems about to end the week deep in the greens against the USD for a second week in a row and having reached levels last seen at the end of October. Next week the main event for Aussie traders will be obviously the release of the RBA’s interest decision in the early morning of Tuesday the 9th of December. The current expectations by market participants are for the bank to remain on hold at 3.60% with AUD OIS currently implying a 97.52% probability for such a scenario to materialize. Considering how the CPI rate accelerated from 3.5% to 3.8% in the inflation print which was release of the 26th of November, we are not surprised that the market is expecting the bank to remain on hold, a view which we support as well. Hence attention turns to the bank’s accompanying statement where considering the inflation story in Australia, we would not be surprised at all to see a hawkish sentiment emerging from policymakers i.e implying that if inflation continues on its current path that the bank may need to remain on hold for a prolonged period of time. In turn this could be perceived as hawkish which may aid the AUD and vice versa. Although considering this week’s release of Australia’s GDP rate for Q3 which came in lower than expected, policymakers may be wary of being overly aggressive in their comments. Yet, despite the GDP rates, Governor Bullocks comments that if inflationary pressures were more permanent, it would “have implications for the future path of monetary policy”, tended to overshadow the ‘bad’ GDP release and may have aided the Aussie as the rate hike door appears to be opening slightly. Lastly, for next week from a macro perspective, Australia’s unemployment rate is due out on Thursday, which could influence the Aussie.

Analyst’s opinion (AUD)

“Considering the comments from Bullock and the issue of inflation in Australia, we aren’t surprised at tend to support the theory that the bank may remain on hold and in their accompanying statement may be hawkish in their commentary. In turn, we wouldn’t be surprised to see the Aussie gaining during the week against its counterparts .”

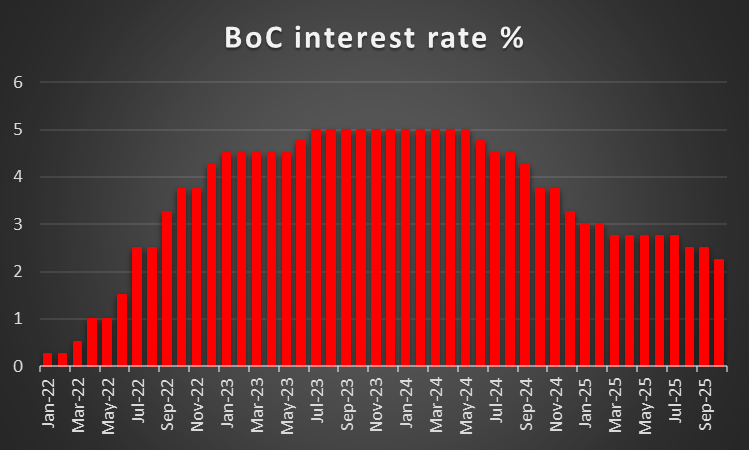

CAD –BoC decision week

Also the Loonie seems about to end the week in the greens against the USD. As has been the predominant theme for every other pair we’ve covered today, we are to look at the CAD from a monetary point of view considering the BoC’s decision next week as well. The Bank of Canada as we just mentioned is set to announce their interest rate decision next Wednesday, with the majority of market participants currently anticipating the bank to remain on hold at 2.25% with CAD OIS currently implying a 89.73% probability for such a scenario to materialize. We tend to agree with the market participants on this one , considering the release of Canada’s GDP rates for Q3 where on a qoq level, showcased an improvement thus providing leeway for the bank to remain on hold if they wished to do so. Therefore, attention turns to the bank’s accompanying statement which may offer clues as to how the bank may approach its monetary policy direction with the new year and could in turn, influence the Loonie. From a macro perspective, we should note that we haven’t received the Canadian employment data for November which is due out later on today. Yet, should the predictions by economists be materialize , with the Canadian labour market showcase signs of easing, the CAD may lose some ground and in next week’s accompanying statement, policymakers may opt for a softer tone which could weigh on the CAD. However, on the other hand should the data come in better than expected then we may see the Loonie gaining.

Analyst’s opinion (CAD)

“The BOC’s decision is next week and in our view the accompanying statement could be slightly dovish which may weigh on the CAD, assuming the employment data today showcases a loosening labour market. In such a scenario the CAD may face significant volatility as a secondary shock may emerge from the Fed’s decision later on in the day.”

General Comment

In the big picture, we expect the USD to maintain the initiative over other currencies, considering Fed’s interest rate decision, but with other central banks announcing their interest rate decisions, the spotlight may be shared between the SNB,FED,BOC and RBA during the week. We note that the US stock markets appear continued on their ascent this week. On a political level, we remain cautious to the US’s actions in Venezuela which could intensify over the weekend as the US has implied that ground strikes on Venezuelan soil may begin soon. Thus, any an attempt to overthrow the regime could influence the oil and gold markets.

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.