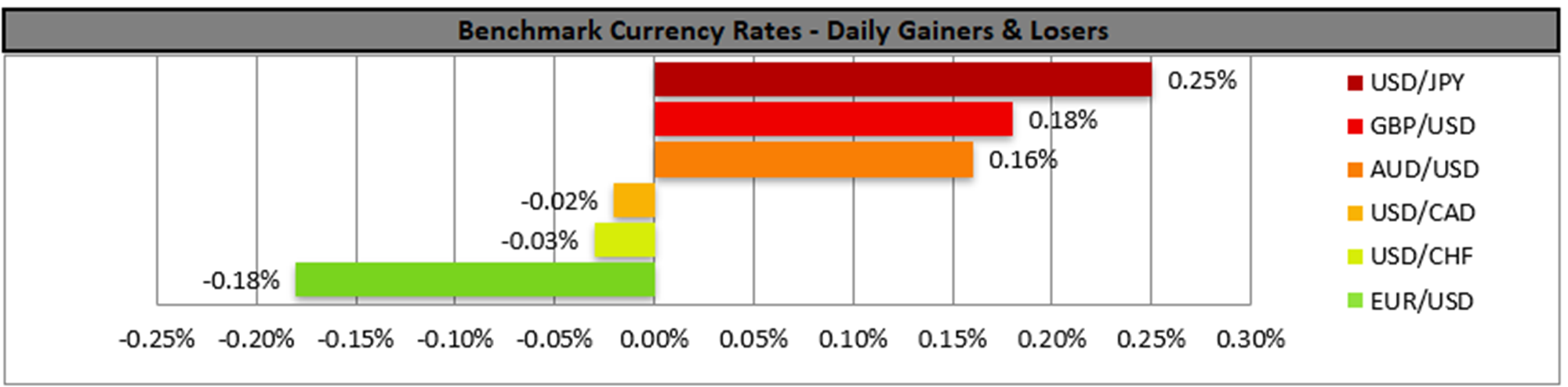

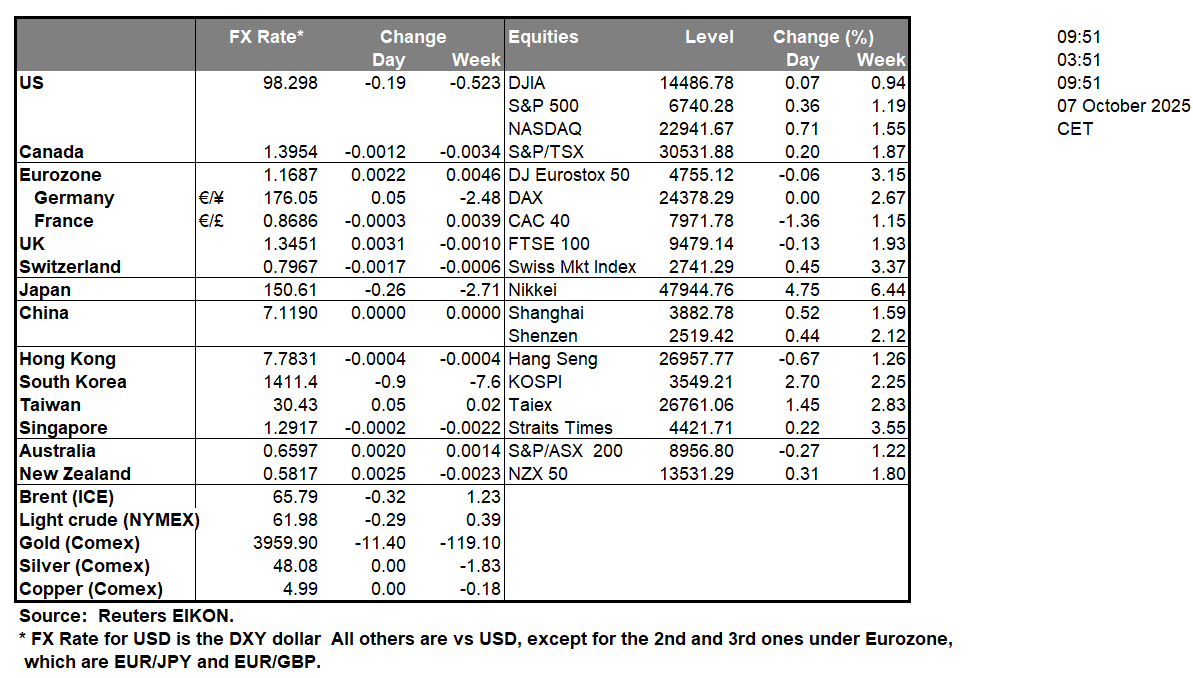

In the FX market JPY continued to weaken on worries for the election of Ms. Takaichi as leader of the LDP and possibly new Japanese PM. The Yen reached a two month low against the USD as market worries for the opposition of Ms. Takaichi to BoJ’s hiking plans intensify and rumors are spreading for a possible revival of carry trade that could weigh on JPY substantially, thus setting the basis for a self fulfilling prophecy. It’s characteristic that Japan’s finance minister Katsunobu Kato was reported stating that the Japanese government will be vigilant for any JPY volatility in the currency market, yet for the time being we see the case for a possible market intervention as remote but not impossible. In the US the US Government shutdown is still looming over the markets as the main fundamental issue for the markets with uncertainty being enhanced, while also the Fed’s intentions are puzzling the markets.

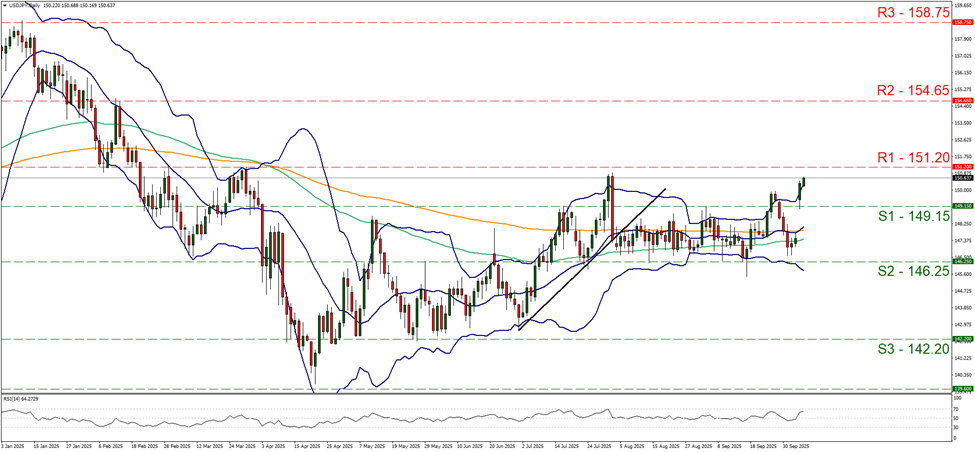

USD/JPY continued to rise in today’s Asian session, aiming for the 151.20 (R1) resistance line. We see the case for a bullish outlook to emerge given also that the RSI indicator has neared the reading of 70 implying a strengthening bullish market sentiment for the pair, yet on the flip side we also note that the pair’s price action has clearly breached the upper Bollinger band which may slow down the bulls if not cause a correction lower. Should the bullish momentum be maintained we may see the pair breaking the 151.20 (R1) resistance line and start aiming for the 154.65 (R2) resistance level. Should the bears find a chance and lead the pair lower we may see USD/JPY breaking the 149.15 (S1) line and start aiming for the 146.25 (S2) support level.

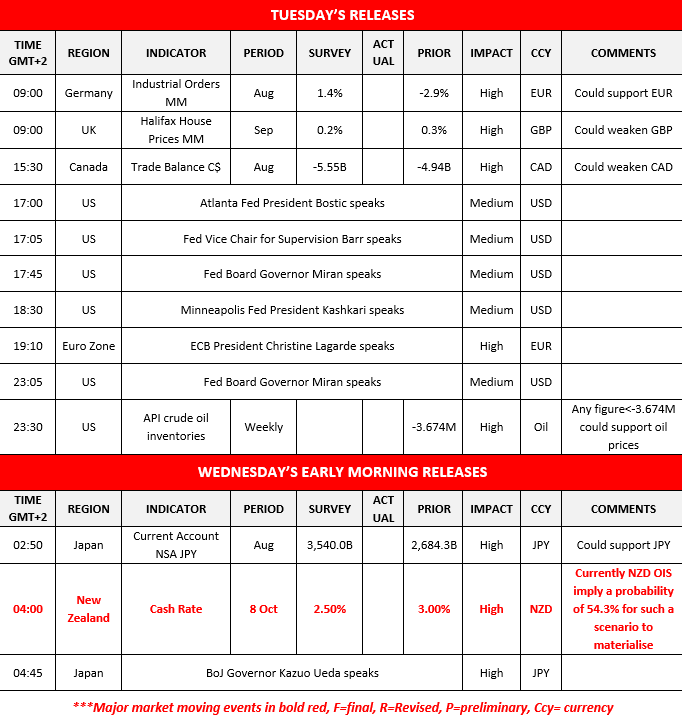

In tomorrow’s Asian session, we get from New Zealand RBNZ’s interest rate decision and the bank is marginally expected to proceed with a double rate cut. Currently NZD OIS imply a probability of 54% for the bank to deliver a 50 basis points (bp) rate cut with the rest implying that a 25 bp rate cut is also sufficient. NZD OIS also imply that the market expects the bank to deliver another rate cut in the November meeting, underscoring the market’s dovish expectations for the bank’s intentions. Should the bank cut rates by 50 basis points we may see the Kiwi slipping while a dovish forward guidance could enhance the bearish tendencies for NZD as it could reinforce the market’s expectations. On the flip side should the bank surprise the markets and adopt a more cautious approach in further easing its monetary policy by delivering a 25 bp and/or provide a more prudent forward guidance implying less rate cuts than what the market expects we may see the Kiwi getting some support.

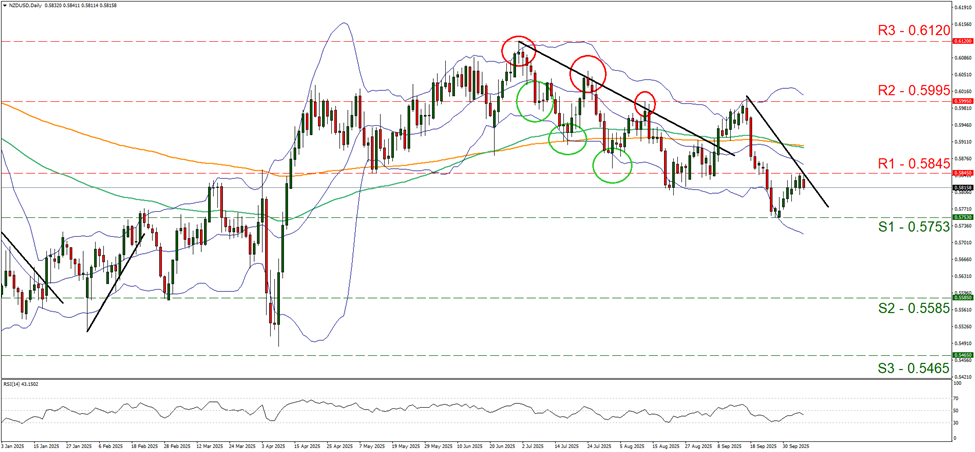

On a technical level, we note that NZD/USD corrected lower after hitting a ceiling on the 0.5845 (R1) resistance line. The RSI indicator turned southwards after nearing but failing to break above the reading of 50 which may signal that the bears have an advantage. The pair’s correction lower has allowed us to draw a downward trendline and we intend to maintain a bearish outlook for the pair as long as the downward trendline remains intact. Should the bears maintain control as expected a new lower trough should be formed and for that to happen the pair’s price action has to break the 0.5753 (S1) support line marking the latest trough and start aiming for the 0.5585 (S2) support level. Should the bulls take over, we may see the pair reversing course breaking the prementioned downward trendline in a first signal of an interruption of the downward motion and continue to break the 0.5845 (R1) line aiming for the 0.5995 (R2) resistance level.

Otros puntos destacados del día:

Today we get Germany’s industrial orders for August, UK’s Halifax House prices for September, Canada’s trade data for August and the US API weekly crude oil inventories figure. On a monetary level we note that Atlanta Fed President Bostic, Fed Vice Chair for Supervision Barr, Fed Board Governor Miran, Minneapolis Fed President Kashkari and ECB President Christine Lagarde. In tomorrow’s Asian session, we get Japan’s current account balance while BoJ Governor Ueda will be speaking.

USD/JPY Daily Chart

- Support: 149.15 (S1), 146.25 (S2), 142.20 (S3)

- Resistance: 151.20 (R1), 154.65 (R2), 158.75 (R3)

NZD/USD Daily Chart

- Support: 0.5753 (S1), 0.5585 (S2), 0.5465 (S3)

- Resistance: 0.5845 (R1), 0.5995 (R2), 0.6120 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.