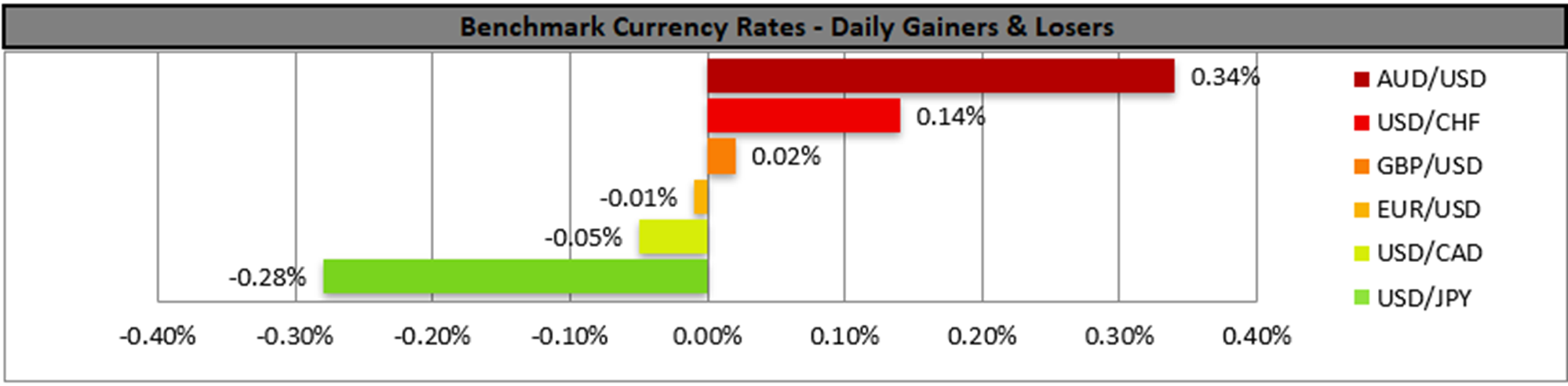

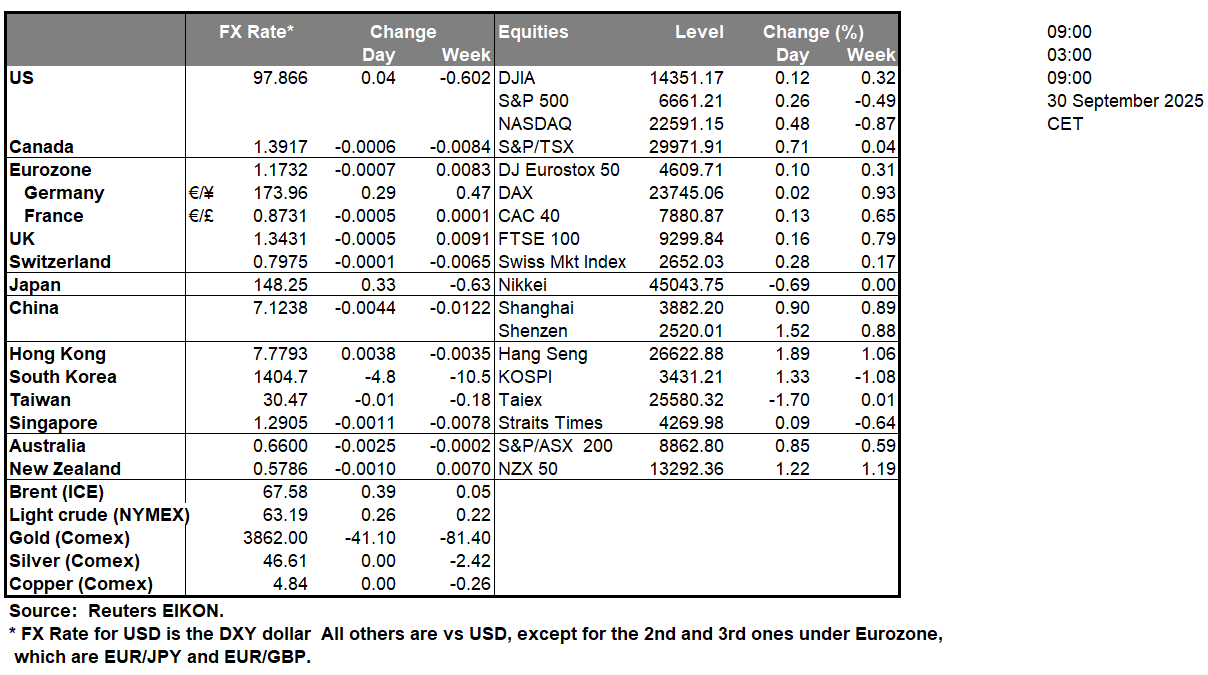

Market worries for a possible US Government shutdown are intensifying. The meeting between US President Trump, the Republicans and the Democrats in US Congress for a possible extension of funding for the US Government seems to have failed to provide a deal. Hence the possibility of a full or partial US Government shutdown tomorrow, Wednesday, seems to be high. Should the US Government shutdown be brief, its repercussions on the US economy may be limited and the issue may be ignored. Yet should the US Government shutdown be extended we may see negative side effects emerging for growth in the US economy, which in turn may intensify any dovish voices within the Fed. In another twist the US Labour and Commerce Departments announced that in the case of a partial US Government shutdown would delay the release of economic data, which would also include the much-awaited US employment report for September. Such a development could intensify the market’s uncertainty further as well as suspicions for a weak US employment market thus weighing possibly on the USD.

Across the world, Australia’s RBA remained on hold as was widely expected, keeping rates unchanged at 3.6%. In its accompanying statement the bank seemed to be leaning more towards the hawkish side by noting that financial conditions have eased and that the full effect of earlier rate cuts will take some time to be shown. Overall should this hawkish turn in RBA’s direction be intensified we may see the Aussie getting additional support.

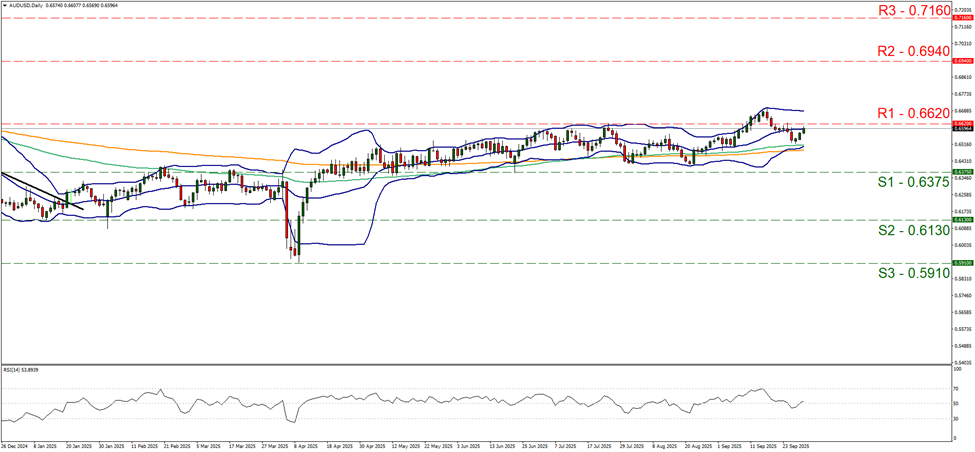

AUD/USD edged higher during today’s Asian session aiming for the 0.6620 (R1) resistance level. The RSI indicator edged higher, surpassing the reading of 50, implying that any bearish tendencies for the pair among the market participants have been erased, yet we still have to see some intensifying of a bullish sentiment. For the time being, we maintain a bias for the pair’s sideways motion to continue between the R1 and the S1. Should the bulls gain control we may see the pair rising, breaking the 0.6620 (R1) resistance line clearly and starting to aim for the 0.6940 (R2) resistance level. Should the bears be in charge, we may see AUD/USD breaking the 0.6375 (S1) support line and start aiming for the 0.6130 (S2) support level.

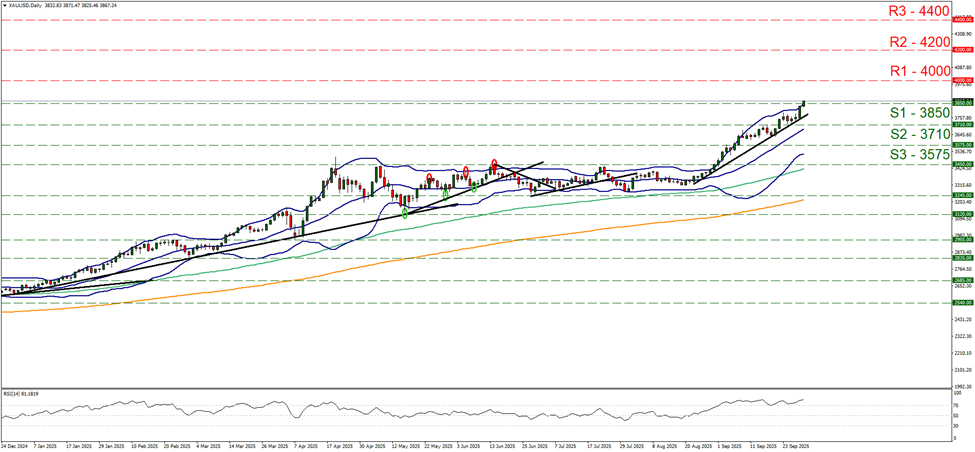

Gold’s price continued to rise and in today’s Asian session broke 3850 (S1) resistance line now turned to support, reaching new All Time High levels. The RSI indicator remains well above the reading of 70, implying a strong bullish market sentiment for gold, yet at the same time reminding traders that gold is at over bought levels and is ripe for a correction lower. Similar signals are being sent by the price action breaching the upper Bollinger band intensifying the possibility of a correction lower. We maintain our bullish outlook for gold’s price, as long as the upward trendline guiding it, yet at the same time we issue a warning for a possible correction lower. Should the bulls actually maintain control over the gold’s price we set as the next possible target for the bulls the 4000 (R1) resistance level. Should the bears take over, we may see gold’s price breaking the 3850 (S1) support line and continuing to break the prementioned upward trendline clearly and continuing even lower to break the 3710 (S2) support level.

Otros puntos destacados del día:

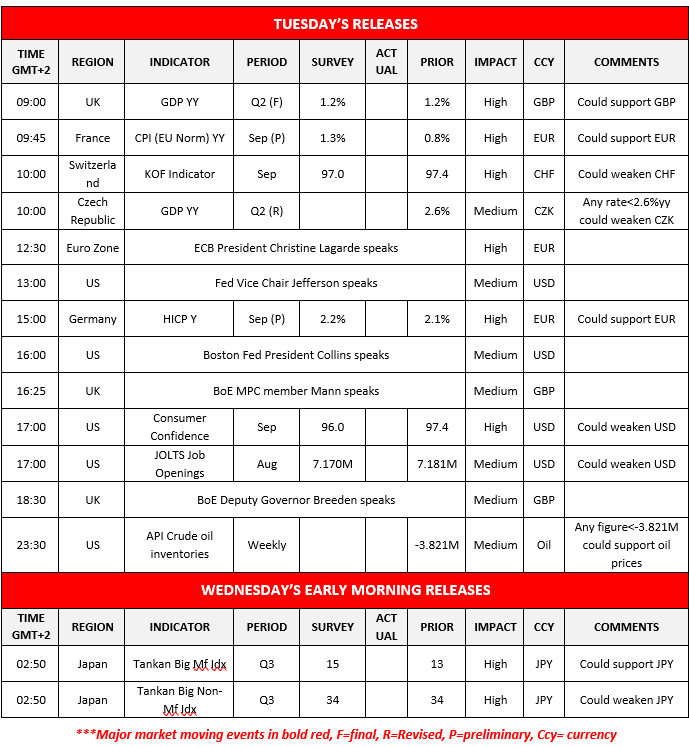

Today we get UK’s GDP rates for Q2, France’s and Germany’s preliminary HICP rates for September, Switzerland’s KOF indicator for the same month, the Czech Republic’s revised GDP rate and from the US, the September consumer confidence, August’s JOLTS job openings figure and the weekly API crude oil inventories figure. On a monetary level, we note that ECB President Christine Lagarde, Fed Vice Chair Jefferson, Boston Fed President Collins, BoE MPC member Mann, BoE Deputy Governor Breeden and Chicago Fed President Goolsbee are scheduled to speak. In tomorrow’s Asian session, we get Australia’s and Japan’s final manufacturing PMI figures for September, as well as Japan’s Tankan Indexes for Q3.

AUD/USD Gráfico diario

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

XAU/USD Gráfico Diario

- Support: 3850 (S1), 3710 (S2), 3575 (S3)

- Resistance: 4000 (R1), 4200 (R2), 4400 (R3)

Si tiene usted alguna pregunta o comentario sobre este artículo, escriba un correo directamente a nuestro equipo de investigación research_team@ironfx.com

Descargo de responsabilidad:

Esta información no debe considerarse asesoramiento o recomendación sobre inversiones, sino una comunicación de marketing. IronFX no se hace responsable de datos o información de terceros en esta comunicación, ya sea por referencia o enlace.