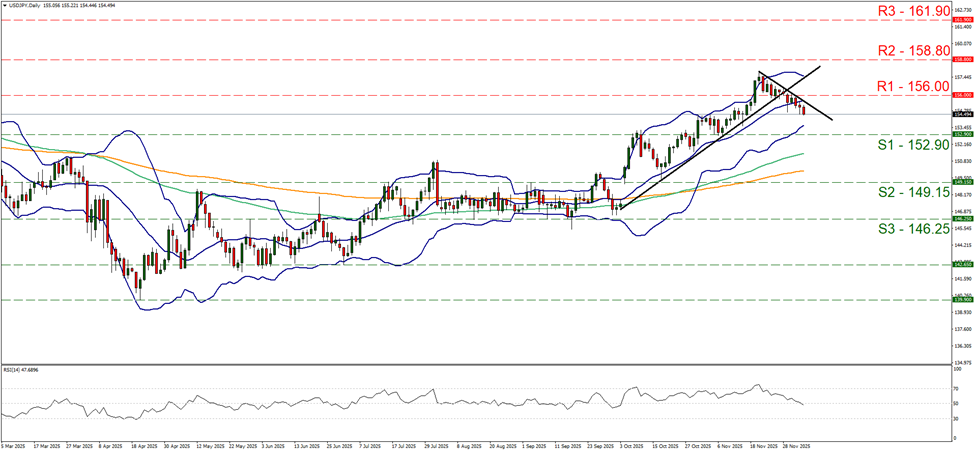

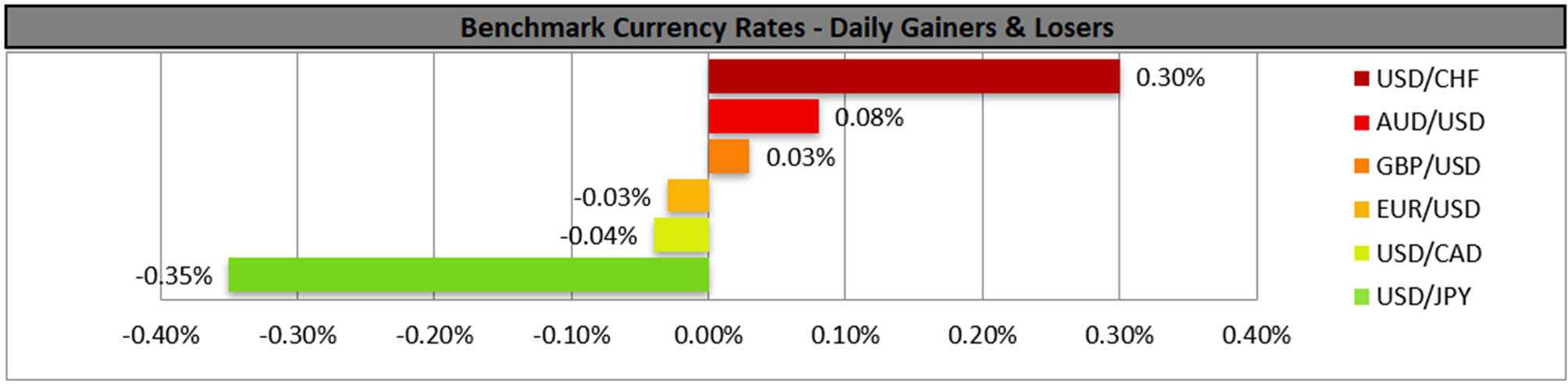

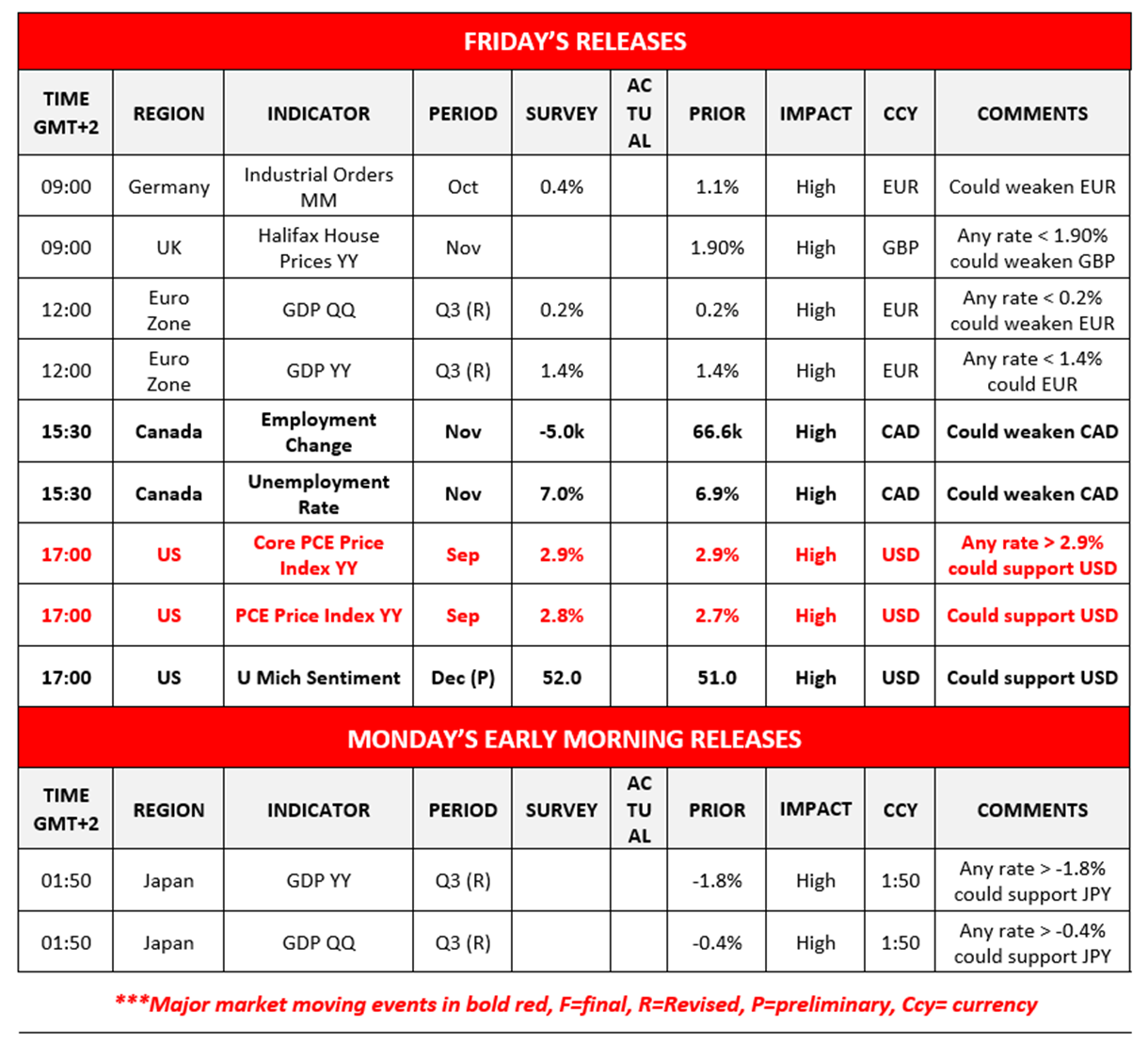

The greenback continued to weaken against its counterparts during today’s Asian session, as the market increasingly focuses on the release of the Fed’s interest rate decision next Wednesday. Maybe the biggest losses of the USD were against the Yen, as diverging monetary policy outlooks of the Fed with the BoJ seem to be favouring the Japanese currency. Fed Funds Futures imply a probability of 87% currently for the Fed to cut rates by 25 basis points next week. Please note that the market also expects the bank to deliver another three rate cuts in the first half of the coming year, underscoring its dovish expectations for the Fed. Please note that on Wednesday, the ADP national employment figure dropped into the negatives for November, intensifying the market worries for the private sector of the US employment market, while a reduction of the weekly initial jobless claims figure released yesterday failed to comfort the market’s worries, as Thanksgiving and Black Friday may have kept the figure temporarily low. Also, the USD continued to be under pressure for a deeper reason as the prospect of US President Trump appointing White House economic adviser Kevin Hassett as the next Fed Chairman, given that incumbent Fed Chairman Powell’s term ends in May next year, which may allow the bank to continue to ease its monetary policy after the 1st half of next year. Today, we highlight the release of the US PCE rates for September and a possible acceleration of the rates, beyond market expectations could imply resilience of inflationary pressures in the US economy, thus supporting the USD.

BOJ officials are ready to raise rates on December 19, in the absence of any major economic shocks, Bloomberg reported on Friday, a day after Reuters reported three sources as saying a hike this month was likely. Yet on Monday’s Asian session, we get Japan’s revised GDP rate for Q3. Should the rates fail to escape the negative territory, we may see the pressure on the BoJ to remain on hold increasing, which in turn may weigh on the Yen.

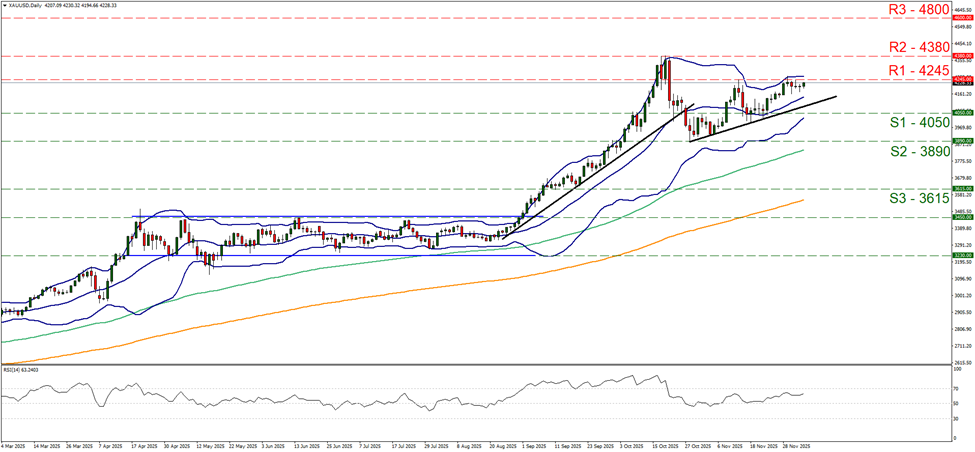

XAU/USD seems to have stabilised just below the 4245 (R1) resistance level. On the one hand we maintain our bullish outlook for the precious metal’s price given that the upward trendline initiated since the 28th of October remains intact. Also the RSI indicator remains between the readings of 50 and 70, implying a bullish predisposition of the market. On the other hand, the failure of gold’s price action to form higher peaks, tends top suggest a relative stabilisation. Should the bulls regain the initiative we may see gold’s price breaking the 4245 (R1) line and start aiming for the 4380 (R2) level. Should the bears take over ,we may see gold’s price breaking the prementioned upward trendline, the 4050 (S1) line and start aiming for the 3890 (S2) level.

Other highlights for the day:

Today we get Germany’s industrial orders rate for October, the UK’s Halifax house prices rate for November, the Eurozone’s revised GDP rates for Q3, Canada’s employment data for November, the US PCE rates for September and ending the week is the UoM preliminary consumer sentiment figure for December.

USD/JPY Daily Chart

- Support: 152.90 (S1), 149.15 (S2), 146.25 (S3)

- Resistance: 156.00 (R1), 158.80 (R2), 161.90 (R3)

XAU/USD Daily Chart

- Support: 4050 (S1), 3890 (S2), 3615 (S3)

- Resistance: 4245 (R1), 4380 (R2), 4800 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.