The week is nearing its end as we open a window at what next week has in store for the markets. On Monday, we get China’s trade balance figure for October, on Tuesday we get Australia’s NAB figures for September, the RBA’s September meeting minutes, the UK’s unemployment rate for August and Germany’s ZEW economic sentiment figure for October. On Wednesday, we get China’s PPI rates , Sweden’s CPI rate and the US CPI rates all for September. On Thursday, we get Japan’s machinery orders rate for August, Australia’s employment data for September, the UK’s GDP rates for August and manufacturing output rate for the same month, followed by Canada’s business barometer for October, the US Philly Fed Business index figure for October, the US final PPI demand rate and US retail sales rate both for September, the US weekly initial jobless claims figure. On Friday, we get the US industrial production rate for September.

USD – US CPI rates next week

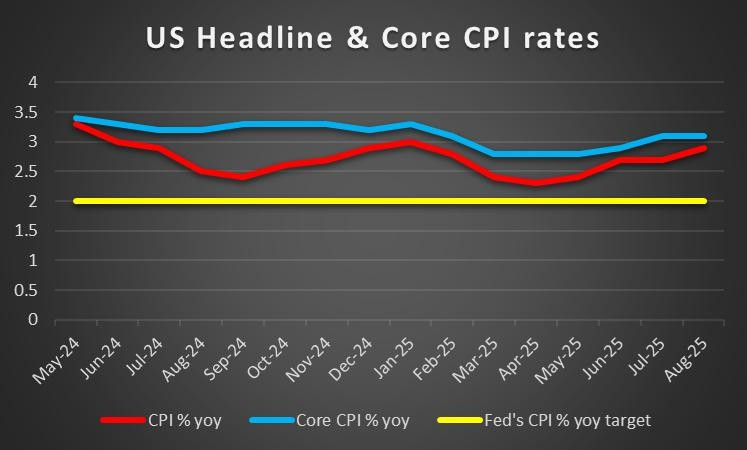

We would start the USD paragraph .On a monetary level, we would like to note the release of the Fed’s last meeting minutes earlier on this week which tended to showcase that concern over the state of the US employment has risen since their last meeting. Hence, should the state of the US labour market continue to weaken it may justify a continued dovish narrative from Fed policymakers which could in turn weigh on the dollar. However, we should note that in the minutes, Fed policymakers appeared to be slightly cautious in regards for an extensive monetary policy easing period from the bank. Nonetheless, the confirmation of a dovish pivot by the bank could pave the way forward for the bank to cut rates again this year. On a political level, we note that the US Government shutdown could be extended to next week as well, as repeated attempts by Republicans to re- open the Government have failed to garner enough support in the chambers of the Senate, where the Democratic opposition remains steadfast. In turn, the longer the US Government continues the higher the risk to the US economy could begin to cause some waves in the markets, which have largely ignored in our view, the ongoing US government shutdown. On a macroeconomic level, we must note the release of the US CPI rates for September next Wednesday the 15th of October, which could influence the dollar’s direction. Looking back the prior release the Core CPI rate came in at 3.1% and the headline rate at 2.9% which may appear relatively ‘fine’ but in reality is still not exactly close to the bank’s 2% inflation target. Hence, should this upcoming release showcase that inflation is accelerating and moving away from the bank’s 2% target it may dampen hopes from the doves that the bank may cut rates in their next meeting, and thus could provide support for the dollar. Whereas, should the rates show that they are ‘moving’ closer to the banks 2% target, calls for another rate cut may be amplified and could weigh on the greenback.

Analyst’s opinion (USD)

“Overall, the US has a lot going on a political, macroeconomic and monetary level which may lead to unnecessary ‘noise’ in the market. In our view, we would focus on the CPI rates given their importance to the inflation narrative. As this author is an economist by nature, my focus is on the Core CPI rate and a rate higher than 3% may continue to be a thorn for the Fed’s dual mandate, as the labour market data is concerning, whilst simultaneously inflation is still relatively elevated.”

GBP – UK GDP rate in sight

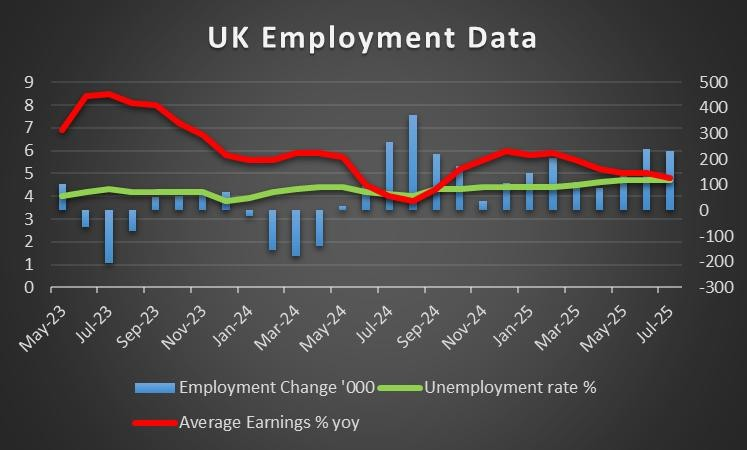

Generally speaking, for the UK, no major fundamental issues have emerged in the UK over the last week and on a political level, it appears to have been an easy-going week for pound traders. Regardless we should note that interest in the UK economy will pick up once November comes around, as the nation’s autumn budget is set to be released on the 26th of November. On a macroeconomic level we note that the UK’s construction PMI figure for September was released this Monday and showcased an improvement compared to last month as well as exceeding the expectations by economists. In turn this may have provided some support for the sterling during the week, yet the Halifax House prices rate for September came in lower than expected and thus the support the sterling may have possibly received may have been short- lived. Next week however, interest may pick up in the pound with the UK’s unemployment rate for August set to be released on Tuesday. Given our ongoing concerns for the UK economy, we would not be surprised to see the unemployment rate increasing slightly or failing to significantly improve and thus could weigh on the pound. Yet, should it showcase a resilient labour market, it may provide support for the pound. Moreover, on Thursday, the UK’s GDP rate for August is due to be released and could heavily influence the pound considering the prior was at 0%, essentially on a seesaw of economic growth or contraction and thus may be worth keeping an eye out for.

Analyst’s opinion (GBP)

“The sterling does not provide significant interest for this author in the coming week. Granted we do have some interesting releases from the UK, yet in our opinion the pound’s direction may be dictated from other currencies, unless Chancellor Reeves makes an announcement in regards to the upcoming budget.”

JPY – BOJ policy at odds with the Government?

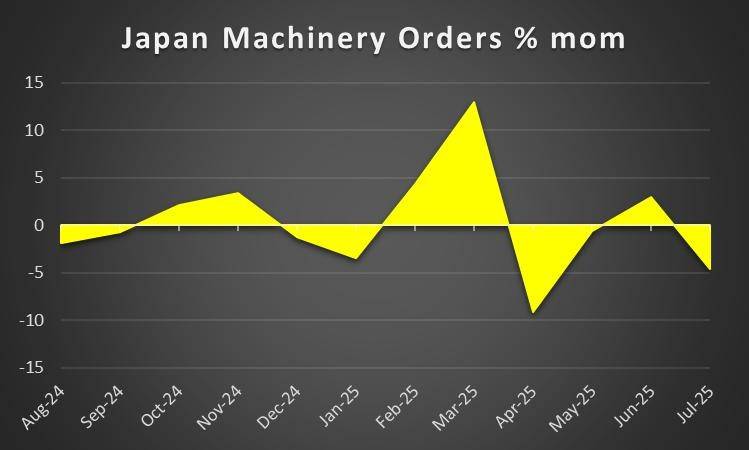

JPY seems about to end the week weaker against the USD. The LDP internal elections were concluded since our last report, with Takaichi Sanae being chosen as the new leader of the Liberal Democratic Party on the 4th of October, after defeating Koizumi Shinjiro in the run-off election. Takaichi is expected to become the country’s next Prime Minister later on this month, which would mark the first time that a female has been elected to the office of Prime Minister in Japan. However, her policies are slightly concerning for Yen traders as her approach to the BOJ appears to be taking a page from Trump’s playbook as concerns over the BOJ’s independence have risen slightly. The concern first appeared after her comments on Saturday that the “The government and BOJ must move in lockstep and cooperate with each other in guiding economic policy” and that they “ would look into whether the government should revise a joint statement with the BOJ, first agreed upon in 2013, that focuses on measures to beat deflation” per Reuters. Nonetheless, we wouldn’t be surprised to see the bank continuing on its current monetary policy path, as the BOJ has signalled their willingness to continue hiking rates in the near future. Albeit some caution is warranted as the expected new Premier sets out her agenda moving forward. On a macroeconomic level, it was a relatively easy going week for Yen traders but the increase in Household spending rate for the month of August was well received as it came in higher than the expectations by economists and even higher than the prior financial release both on a year-on-year and on a month-on-month basis. Looking at next week, it’s a relatively quiet week for Yen traders with no major financial releases expected from the nation and thus focus for market participants may be mostly on a political level.

Analyst’s opinion (JPY)

“The political situation in Japan peaks our interest with the anticipated new Premier. In our view, we wouldn’t be surprised to see the presumed Government attempting to influence the BOJ’s monetary policy decisions moving forward, yet given the stance by the BOJ and their general comments for a possible rate hike we do not anticipate a material change in the banks path. ”

EUR – ECB minutes tend to confirm the bank’s prolonged “pause”

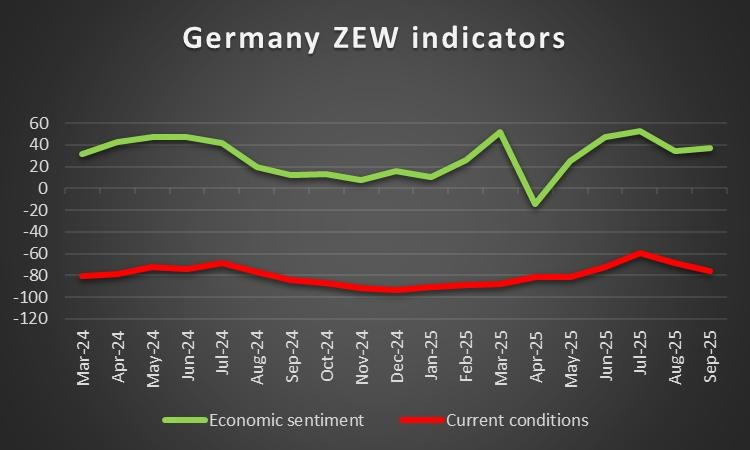

Starting with our EUR paragraph, the bank’s last meeting minutes where released earlier on this week and tended to support our continued view that the bank may remain on hold. In particular, in the banks last meeting minutes it was stated that “Subsequent data releases had confirmed and reinforced this new baseline path” in addition to the comments made by ECB Chief Economist Lane that “In particular, the incoming data since the July meeting had confirmed that the inflation outlook continued to be in a good place”. Overall, the comments appear to be reinforcing the hypothesis that the ECB may be done with cutting interest rates and that they may remain on a prolonged holding pattern. Furthermore, the “good place” phrase when used to refer to the bank’s monetary policy appears to be echoed by other ECB policymakers and we would not be surprised to see that characterization being used frequently in statements by policymakers. In turn, the implications and the apparent reinforcement of the idea that the bank is done cutting interest rates, may have provided some support for the EUR during the week. On a macroeconomic level, we would like to note the Eurozone’s Sentix index figure for October which was released on Monday and showcased an improvement from -9.2 to -5.4 and beat the market’s expectations of a -7.5 figure. The improvement may have been perceived as a positive for the EUR, although Germany’s factory orders rate and industrial production rate both for August, came in lower than expected and may have damped the economic outlook surrounding Germany’s economy, thus potentially weighing on the EUR. For next week, in terms of financial releases, Germany’s ZEW economic sentiment figure for October is set to be released and could garner some attention from EUR traders. On a political level, we expect a new Prime Minister for France to be announced today following another collapse of the French Government. The office of Prime Minister in France is ever-changing and their continued failure raises questions over the state of the French economy. Nonetheless, some attention may be warranted following the announcement of the new Prime Minister in order to gauge if they will be able to form a Government that can survive a few months.

Analyst’s opinion (EUR)

“The ECB in our view may remain on hold for a prolonged period of time. Moreover continued that the rhetoric now is that the ECB is in a “good place”, we don’t see the case for further rate cuts this year. Our main concern for the EUR is the state of the French economy, considering they have been unable to form a stable government, in addition to their continued issues with their public finances.”

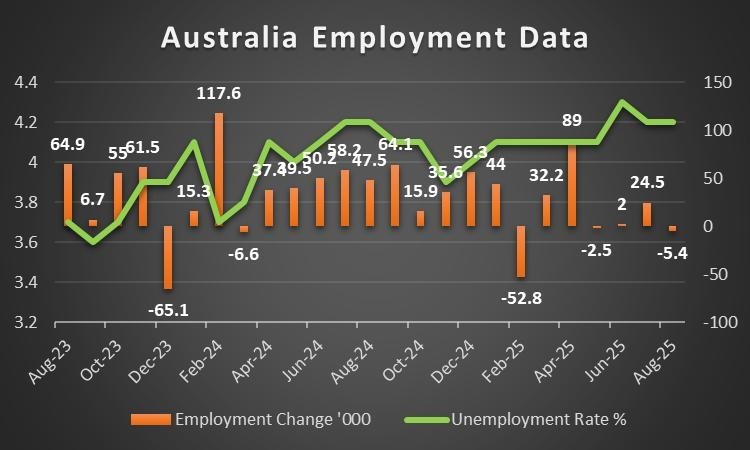

AUD – RBA minutes due out next week

The Aussie on a monetary level may experience some volatility with the release of the bank’s September meeting minutes which are set to be released on Tuesday. Considering the bank’s accompanying statement, where we noted last week that the bank seemed to be leaning more towards the hawkish side, we wouldn’t be surprised to see the minutes reflecting this sentiment. Moreover, sticking to our monetary policy theme , we would like to note the comments made by RBA Governor Bullock earlier on today that “Australia’s economy is in a “pretty good spot” with inflation inside the central bank’s 2-3% target band and the labor market still tight” which may imply that the bank has options as to whether they opt for a rate cut or to remain on hold. Thus, it appears that this may be a ‘goldilocks’ situation for the bank and could provide some support for the Aussie should the bank opt to remain on hold in their next meeting. On a macroeconomic level, Aussie traders may be interested in the release of the nation’s employment data for September, which is due out on Thursday. Should the employment data showcase a resilient labour market it may provide support for the Aussie and vice versa.

Analyst’s opinion (AUD)

“In our view the minutes may reflect the sentiment echoed by the RBA Governor in which the RBA appears to be in a good place and could opt to remain on hold, thus tilting towards a more relative ‘hawkish stance’. Moreover, of interest for us will be the release of the employment data where we wouldn’t be surprised to see indications of a resilient labour market which could aid the AUD.”

CAD – Canada’s Business barometer due out next week

On a macroeconomic level we must highlight the release of Canada’s September employment data today.As we mentioned in last week, should the actual data imply a tightening Canadian employment market we may see the Loonie getting some support and vice versa. Yet, with economists expecting the unemployment rate to increase to 7.2%, the scenario currently is for a loosening labour market which could weigh on the CAD. On another macro note, Canada’s Ivey PMI figure for September was released earlier on this week and showcased an improvement in the figure to 59.8, which also exceeded the market’s expectations of 51.2. In turn the financial release may have provided support for the Loonie as the economic outlook for the nation tended to improve. Although, depending on the release of the employment data today, that narrative could change or could be amplified and thus respectively could influence the Loonie’s diretion as the week comes to an end. Lastly, it’s a relatively light economic calendar for Canada next week, with only the Business Barometer figure for October being worthy of note. Hence an improvement in the figure could aid the CAD and vice versa.

Analyst’s opinion (CAD)

“The Ivey PMI figure showcased an improvement which may have aided the Loonie, yet the expected uptick in the unemployment rate is of some concern as it still remains high at above 7%. Hence an uptick in the unemployment rate could increase calls for further rate cuts by the BoC which may weigh on the CAD.”

General Comment

In the coming week we expect that USD’s dominance to increase given the release of the US CPI rates for September on Thursday. In the US equities markets we tend to maintain currently a bullish outlook although we are slightly concerned with the recent movements in the Down Jones 30 industrial index. Moreover, we must note that the US Government is heading for another week with no agreement being reached in the Senate to re-open the Government and thus could begin to result in some tailwinds for the bulls. In the commodity markets, gold continued to soar, although it appears to have experienced a retracement, possibly as a result of profit taking.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

Disclaimer:

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.