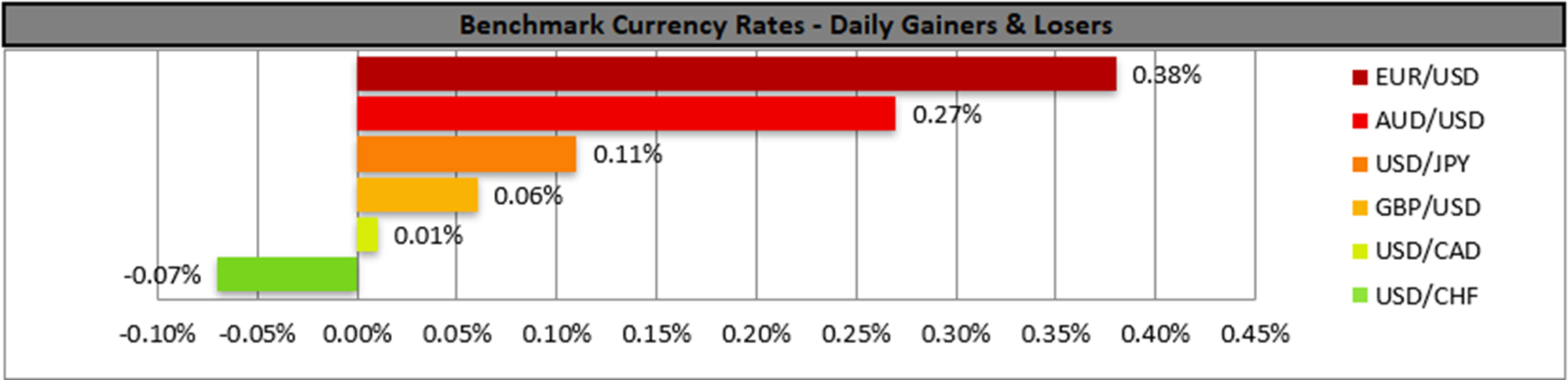

The USD edged higher against its counterparts on Friday, yet overall, the greenback’s movement tends to be characterised by stability as the markets maintain a wait-and-see position. In the coming week, given the low number of high-impact financial releases on the US calendar, we expect fundamentals to lead the markets. The Trump-Putin summit yielded few results over the weekend, and now the markets are turning their attention to the Trump-Zelensky meeting. It seems that the US President may try to persuade his Ukrainian counterpart of the necessity of a land swap for peace to be established in the country. Should we see the issue advancing further, we may see a more optimistic outlook emerging, which could provide some support for riskier assets. A deterioration of the US-Russian relationships may enhance uncertainty and thus provide inflows for safe-haven instruments. On a monetary level, we note that the release of the US PPI and retail sales growth rates for July practically landed market expectations for the Fed to cut rates in its next meeting in September. In the coming week, we note the release of the Fed’s last meeting minutes on Wednesday and the Jackson Hole summit over the weekend as possible market movers and a possible dovish tone by Fed policymakers could weigh on the USD and vice versa.

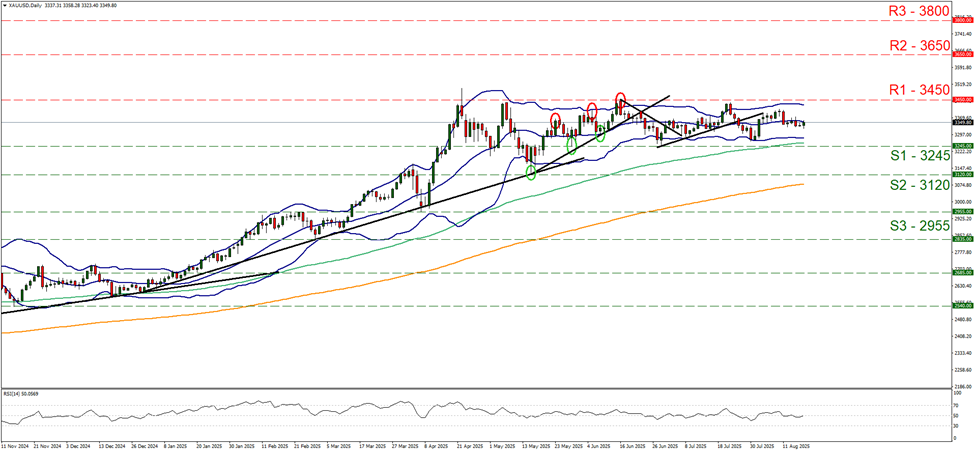

Gold’s price edged higher in today’s Asian session yet overall remains well between the 3245 (R1) support line and the 3450 (R1) resistance level. The RSI indicator continues to run along the reading of 50, implying a relative indecisiveness of the precious metal’s price. We also note that the Bollinger bands remain relatively tight, implying a possible continuation of the low volatility for gold’s price. Hence, we maintain a bias for the continuation of the sideways motion of gold’s price within the prementioned levels. Should the bulls take over, we may see gold’s price breaking the 3450 (R1) resistance line clearly and taking aim of the 3650 (R2) resistance level. Should the bears take over, we may see gold’s price diving to break the 3245 (S1) support line thus paving the way for the 3120 (S2) support level.

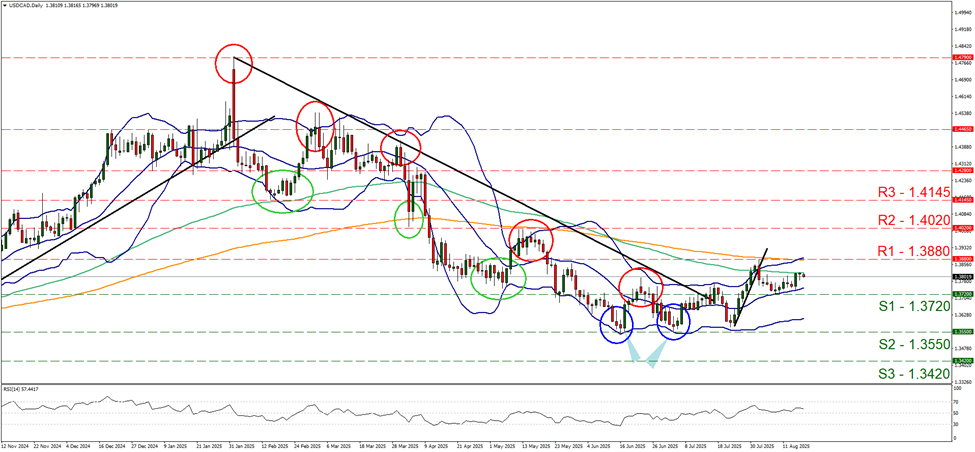

USD/CAD remained relatively stable on Friday and Thursday between the 1.3720 (S1) support line and the 1.3880 (R1) resistance level. We tend to maintain our bias for the pair’s sideways motion to continue at the current stage. Yet we note that the RSI indicator, is currently just above the reading of 50, implying some slight bullish tendencies which are currently unconvincing. Also the Bollinger bands seem to maintain a slight upward inclination, implying some bullish tendencies. Yet for a bullish outlook to emerge we would require the pair’s price action to break the 1.3880 (R1) resistance level and start aiming for the 1.4020 (R2) resistance barrier. For a bearish outlook to be adopted we would require USD/CAD breaking the 1.3720 (S1) support line and start aiming for the 1.3550 (R2) resistance level.

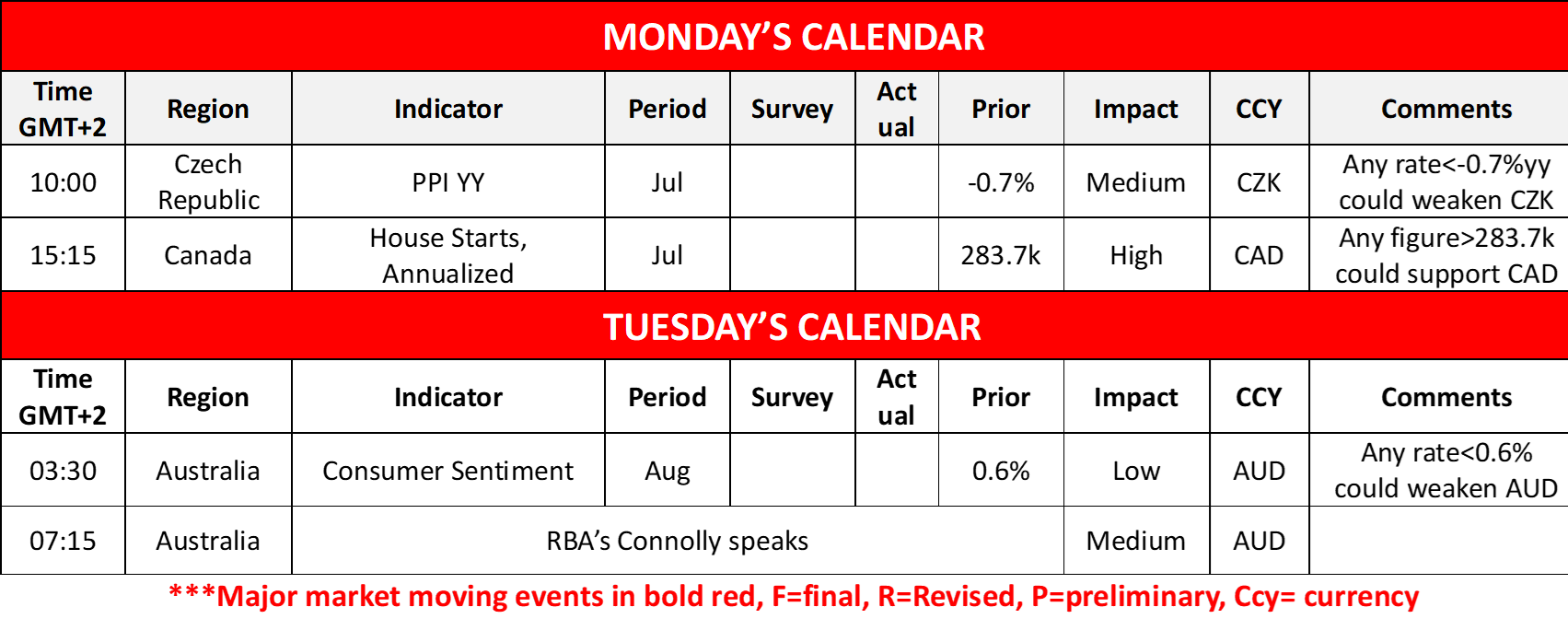

Other highlights for the day:

Today we get the Czech Republic’s CPI rates for July and Canada’s house starts for the same month. In tomorrow’s Asian session, we get Australia’s consumer confidence for August, while RBA’s Connolly speaks.

As for the rest of the week:

On Tuesday, we get Canada’s CPI rates for July, and on Wednesday, we get New Zealand RBNZ’s interest rate decision, UK’s CPI rates for July, Euro Zone’s final HICP rates for July, and the Fed releases the minutes of the July meeting. On a busy Thursday, we get New Zealand’s trade data, Australia’s, Japan’s, Germany’s, France’s, Euro Zone’s and the UK’s preliminary PMI figures for August, UK’s CBI trends for August, Canada’s business barometer for August and producer prices for July and from the US, the weekly initial jobless claims figure and Philly Fed business index for August. On Friday, we get Japan’s CPI rates for July and the UK retail sales also for July, and Canada’s retail sales for June.

XAU/USD Daily Chart

- Support: 3245 (S1), 3120 (S2), 2955 (S3)

- Resistance: 3450 (R1), 3650 (R2), 3800 (R3)

USD/CAD Daily Chart

- Support: 1.3720 (S1), 1.3550 (S2), 1.3420 (S3)

- Resistance: 1.3880 (R1), 1.4020 (R2), 1.4145 (R3)

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.