Since our last report, US equities have moved higher.On a fundamental level, we note the recent news surrounding Google and Nvidia, in addition to the ongoing selection process for the next Fed Chair. For a more complete picture, we are also to provide a technical analysis of the broad S&P 500’s daily chart.

Google to usurp Nvidia?

Google has been in the news recently in regards to its progress in the AI race. In particular, various news outlets such as the FT and Bloomberg have noted that Google appears to be gaining ground in the AI race with Gemini 3, the latest large language model which has allegedly leapfrogged OpenAI’s ChatGPT. Moreover, per Reuters Meta is in talks with Google for the possibility of spending billions of dollars on Alphabet’s owned company chips for use in its data centers starting from 2027, which showcases the rising threat of Google to Nvidia as they may be in direct competition with one another. As a result Google’s (#GOOG) stock price gained, whereas Nvidia’s moved lower due to the risks posed from Google contending for the Crown. In our opinion, the increased competition will be beneficial for the market as a whole and could lead to more healthy competition. However, considering how far Nvidia is in general, even if Google is making progress currently, it still has a long way to go before catching up with Nvidia.

Fed Chair draft day nears

According to media outlets, the race for the new Fed Chair may already be in progress, with US Treasury Secretary Bessent stating to CNBC that there was a good chance that President Trump could announce his decision for the next Fed Chair within the next month and prior to the 25th of December. Per Bloomberg, there are now five contenders for the position which are the following “Hassett, Warsh, Waller, Fed Vice Chair for Supervision Michelle Bowman and BlackRock Inc.’s Rick Rieder”. However, it now appears that the frontrunner for the coveted position of Fed Chair, appears to be Hassett who has closely aligned himself to President Trump’s ambitions for further rate cuts from the Federal Reserve. In turn, the speculation that Hasset may be appointed as the next Fed Chair may further validate that the bank’s direction next year may be steered towards a more dovish path. In turn this may have further increased market optimism for rate cuts next year, which may have provided support for the US Equities markets.

التحليل الفني

US500 Daily Chart

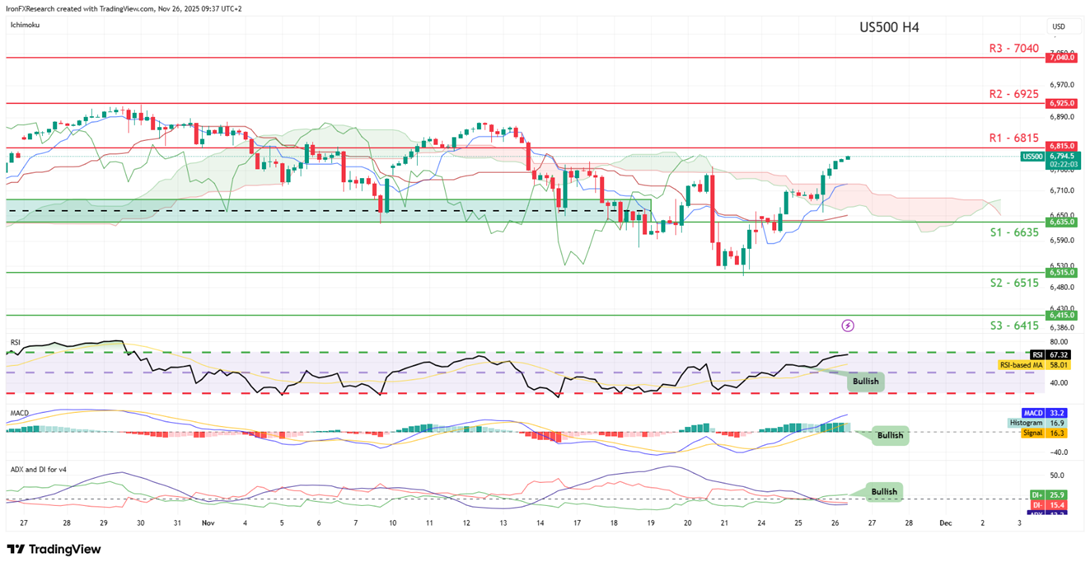

- Support: 6635 (S1), 6515 (S2), 6415 (S3)

- Resistance: 6815 (R1), 6925 (R2), 7040 (R3)

In the past week, the S&P500 appears to be moving in an upwards fashion. We opt for a bullish outlook for the index and supporting our case are all three indicators below our chart which tend to point towards a bullish market sentiment. For our bullish outlook to be maintained we would require a clear break above our 6815 (R1) resistance line with the next possible target for the bulls being our 6925 (R2) resistance level. On the other hand, for a sideways bias we would require the index to remain confined between our 6635 (S1) support level and our 6815 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 6635 (S1) support level with the next possible target for the bears being our 6515 (S2) support level.

If you have any general queries or comments relating to this article please send an email directly to our Research team at research_team@ironfx.com

إخلاء المسؤولية:

لا تُعد هذه المعلومات نصيحة استثمارية أو توصية بالاستثمار، وإنما تُعد تواصلاً تسويقيًا. لا تتحمل IronFX أي مسؤولية عن أي بيانات أو معلومات مقدمة من أطراف ثالثة تم الإشارة إليها أو الارتباط بها في هذا التواصل.